“It’s entirely unacceptable for digital banking to displace the customer/financial institution relationship… The goal is building customer loyalty and extending the trusted relationship from the physical realm of brick and mortar to the digital realm.” ….. Mark Kilpatrick.

I dedicate this article to all banks, finTechs and telcos who are making great strides to churn out innovative solutions for their customers and facilitate a seamless solution to challenges being faced in banking during this COVID 19 pandemic era.

While congratulating the innovators of banking solutions, I also wish to welcome all previously risk-averse customers who have never been comfortable using digital banking, but now emboldened to adopt digital banking to meet the demand of the times. The main theme of today’s article is to examine how all parties involved in digital banking space are creating solutions either as service providers, delivery vessels, or the final end-users to meet challenges of the pandemic. I want to start with a few questions for Readers about digital banking:

- Is it solving your financial needs?

- How customer friendly is the digital environment?

- Do you feel safe with the embedded controls?

- Is it a good substitute for traditional banking?

- Is it a win-win situation or winner takes all?

Collaboration between Banks and FinTechs.

Digital banking has been aided through a collaboration of banks, telcos and finTechs, and ably supported by GHIPPS, and the national digitization drive. A key driver of FinTech innovation in Ghana is the increasing general level of education in the Ghanaian populace. More people can read, or at least make sense of simple numbers, due to an increase in Generation Z and the millennial population. The demand by consumers, the growing number of smart phone users, penetration of internet services, the use of point of sales devices in shopping malls and supermarkets has driven the demand for cashless transactions. According to the Government of Ghana’s National Financial Inclusion and Development Strategy (NFIDS) 2018–2023, digital financial services hold a strong potential for increasing financial inclusion in Ghana. Leveraging financial technology (fintech) should be at the core of promoting financial inclusion in Ghana. The government has facilitated interoperability across payment instruments by establishing the first interoperable mobile money switch in Africa. The system has been the most patronized digital banking product and continues to remain so, especially due to its use of the USSD, where internet service is not required. The various banking apps are now following closely, except for their limitation to areas with internet coverage.

The Advantages of Digital Banking

COVID 19 has accelerated the demand for digital banking. The advantages of digital banking are endless:

- While incurring fewer overhead costs on the bank, it is fast and convenient for the customers, who can also protect themselves online as they monitor all transactions digitally.

- The relationship with the customer is still maintained, despite nil or minimum distance and with little or no direct personal interaction.

- There are no constraints of time, place and method.

- There is a positive effect from the consolidation of relations between banks and their customers, and the reliance on efficient communication is of utmost importance for a good reciprocal flow of information.

Concerns about Digital Banking

This digital era is however not a free lunch. It is also accompanied by newly emerging risks. In the interests of transparency and consumer protection, providers of online financial services are required to provide customers with comprehensive information prior to the contract being formed. Assuming a customer’s mandate cannot be executed due to a system lapse, the due processes should be activated to avoid losses to customers. The following concerns are real:

- It can be challenging for beginners due to trust and responsibility issues. Some are unable to handle complex transactions. Some financial jargons require some assistance as some customers are still not comfortable with virtual assistance, in this day of robots-enabled banking. Some customers still prefer to relate to humans at a point in time. For non-IT savvy customers, digital banking has created new vulnerabilities making such customers the weakest links in the chain. Their awareness of online security risks is often low and are easily coerced to divulge confidential data to criminal groups who use it for fraud. In some cases, the inability to get assistance, lack of personal relationships with bank personnel, unprofessional and ignorant bank officers, hidden/additional bank charges, and inadequate education on product features. Moreover, complaints of ‘exorbitant charges’ levied on mobile banking transfers are rampant.

The Service Quality Elements (The R-A-T-E-R model)

Whether traditional or digital banking, the principles behind the banker-customer relationship have not changed. The service quality elements of the (R-A-T-E-R) model is still applicable and therefore, customers’ expectations of banks’ service quality are the same. Here are a few questions/comments on the service delivery based on the RATER Model:

- RELIABILITY: Is there brand consistency in the system operations. Are bankers reliable and honouring their promises?

- ASSURANCE: Software should guide, support and solve customers’ problems. It must create a holistic impression for customers’ seamless transactions across all touchpoints. Are the bankers knowledgeable and exhibit confidence?

- TANGIBILITY: Is the system visually appealing, easy-to-use and can reduce errors and inconsistencies.

- EMPATHY: Is there fast responses from staff support and contact centers in assisting customers to solve their digital banking issues in good time, to create loyalty to the brand? Do the bankers put their feet into customers shoes when they have challenges?

- RESPONSIVENESS: The Omnichannel support software should track all interactions and tie them together across all channels (email, phone, social media, live chat etc.) and prevent the customer from having a fragmented digital customer experience?

Designing the Customers’ Digital Banking Journey/Experience

Going digital is now the competitive battleground for today’s banks, however just offering digital banking functionality is no longer a competitive differentiator. It is the application and mechanisms that accompany this service delivery which make a bank unique. Fin-techs and banks, in their collaboration must design customers’ digital banking experiences appropriately. A successful digital banking platform must be meaningful and available to all types of customers because it has the potential of enhancing the numbers, while driving brand loyalty.

The Relevance of Age and Literacy

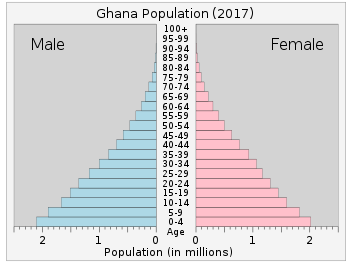

According to Ghana Statistical Service, the population of Ghana as at February, 2020 was 30,802,793. The chart below shows Ghana’s age structure in 2017 as fairly young, and such data should form part of the factors that guide the type of innovative services designed for the customers. On the other hand, age per se does not reflect literacy.

0-14 years: 37.83% (male 5,344,146 /female 5,286,383)

15-24 years: 18.61% (male 2,600,390 /female 2,629,660)

25-54 years: 34.21% (male 4,663,234 /female 4,950,888)

55-64 years: 5.05% (male 690,327 /female 727,957)

65 years and over: 4.3% (male 557,155 /female 652,331) (2018 est.)

Despite the youthfulness of Ghana’s population, there is no direct proportion between their literacy levels and their financial savviness. However, it is advantageous that young persons find it easier to adopt basic banking products on their smartphones. Some of the illiterate ones are, however, gullible to innovations that have inadequate controls and security, resulting in losses from cyber crime and eventual loss of confidence in the system.

The Influence of Culture

Culture is of great influence in all our daily endeavours. Many traditionalists are still not comfortable dealing with machines. Customers who were risk averse have reluctantly joined the digital banking populace as a necessity to stay safe. Continuous education is key to guide such new entrants in their transactions to sustain their interest and loyalty. Such customers continue to demand the service of human interaction intermittently to get reassurance of the security of their funds usually in the form of investments, pensions and long term-schemes. Despite the global adoption of digital banking, culture matters in all societies. That is why there is a constant need to use Artificial intelligence to data analytics for proper segmentation of customers. FinTechs are Banks must continue to collaborate to expand the omni-channel systems to meet the special needs of customers.

Has the Banker-Customer Duties and Responsibilities towards each other Changed?

We have the tendency to forget ourselves that technology is an enabler to facilitate processes and not necessarily to replace human beings. Out of sight should not be out of mind. Obviously, there are always reductions in employee numbers during technological innovations. Artificial intelligence and data analytics will give us fast data and predict human behaviour, but the rest of the service is up to the human being. Can robots completely replace humans? Banking includes a “feelings business” and robots cannot identify emotions of customers to be able to show empathy to an angry customer. Robots cannot identify a customer who has become mentally unstable, or an anxious one who needs immediate re-assurance from a human being. The banker-customer relationship will continue to be covered by law, statutes and best banking practices. With regards to the duties and responsibilities of each party to the other one, let us remind ourselves of a few which are still dominant:

The Banker’s duties in the traditional and Digital space:

- To receive customers’ funds for the credit of the account

- To repay the customer’s funds upon presentation of the customer’s written authority, or other agreed mechanisms. eg digital services.

- Confidentiality in customer’s dealings.

- To advise the customer of any known forgeries to his signature, or digital transactions and exercise care and diligence in handling the account.

- To exhibit a duty of care to ensure e-banking services are convenient, private, secure and available.

- Advise customers on appropriate fees for services rendered and conditions attached.

The Customer’s Duties in Traditional and Digital Space:

- To pay fees for the use of the bank’s facilities.

- To seek out the bank, or its virtual equivalent for repayment, either through physical or electronic means.

- To seek payment up to the amount in the account or up to an agreed overdraft limit.

- To advise the bank of known forgeries to his/her signature, or suspicion of fraudulent attempts on the electronic banking facility.

- Duty of care when drawing cheques or performing digital transactions so as not to facilitate fraudulent alterations. In e-banking, customers must protect their passwords, pin codes, etc, to avoid impersonation and fraud.

Whether traditional or digital, these duties and responsibilities remain the same.

Enablers for the WIN-WIN Strategy in Digital Banking

Banks, Telecommunication companies and FinTechs need to continue to build a collaborative strategy to meet the channels of digital banking and create winners of all parties and for the end-users as well. Digital banking has come to stay and banks’ Business Continuity Plans have incorporated mitigating effects against COVID 19 and any future pandemics. Here are a few enablers to win the digital banking revolution:

- Know Your Customer:while designing products for general use , banks still need to categorize customers according to their demography, age, gender, economic backgrounds, educational levels, needs and experiences with the banking systems and proficiencies in digital interaction. This is a tall list but the FinTechs are there to support.

- Customer First: Placing the customer experience at the center of the design of customer journey. Avoid generalizing customers. After all, not all millennials are tech savvy, and not all baby boomers have techno-phobic.

- Research and review: Regular reviews and research into customer pain points, to get genuine feedback and address them with better products and services.

- Workforce effectiveness: Encouraging your staff to embrace new ways of improving customer treatment by providing tools and training to deliver better service.

- Re-tooling Staff: Frontline staff should be confident in using the mobile apps, and recommending them to customers. There need to be an active buy-in from staff, to be confident and more tolerant of queries from customers.

- Adequate Controls: Dual control, segregation of functions and regular reconciliation will reduce frauds and losses to banks as well as to customers.

- Re-Training Staff: Re-training staff on soft skills to handle customers challenges both physically and virtually. There is the need for them to exhibit active listening skill, to succeed in on-boarding more digital customers Good communication skills require a high level of professionalism. Chat-box conversations with customers should be real.

- Educating Customers on Security of Digital transactions: Regular updates and awareness of processes to aid security and avoid cyber-crime is an avenue for enhanced customer loyalty.

My Final Thoughts

In addition to promoting financial inclusion through the expansion of access points, the financial sector must continue to innovate and diversify its products, services, and distribution channels to meet the diverse and growing needs of consumers. The system of delivery of digital banking service is now the competitive edge that differentiates banks. It is now easier for customers to “vote with their feet” when they are dissatisfied with a banking product and service. However, all parties need collaboration to ensure the sustainability of the enhanced trend for a win-win situation. Fintechs and banks must continue to strive for improvements in digital banking to bring out the best of both worlds for customers to enjoy the new trends in digital banking.

ABOUT THE AUTHOR

Alberta Quarcoopome is a Chartered Banker and Fellow of the Institute of Bankers. She has a BA from University of Ghana, EMBA from GIMPA, Certified Microfinance Expert from Frankfurt School of Finance & Management, a Certificate in Women in Entrepreneurship and Leadership, from China-Europe International Business School. With over three decades of banking practice, she is currently the CEO of ALKAN Business Consult Ltd, and the Author of two books: “The 21st Century Bank Teller: A Strategic Partner” and “My Front Desk Experience: A Young Banker’s Story”.

As a weekly columnist of “THE RISK WATCH” in the Business & Financial Times newspaper, she has published about three hundred articles on risk management in banking, to date. She is also the Recipient of the National Banking Education Category of the 2014 “Women in Banking and Finance Awards” held in February 2015.

She is an adjunct Facilitator at the Chartered Institute of Bankers, Ghana, The National Banking College and the China-Europe International Business School (Accra Campus).

A critical thinker, with extensive knowledge in various aspects of banking practice, she has trained over four thousand staff of various Universal Banks, Savings and Loans Companies, Microfinance Companies and Rural Banks in Ghana. She uses her banking experience and practical case studies to facilitate programs in operational risk management, sales, customer service, banking operations, ethics and fraud. Her current passion is motivational speaking and mentoring young professionals to strive for excellence.

CONTACT

Website www.alkanbiz.com

Email:alberta@alkanbiz.com or [email protected]

Tel: +233-0244333051

On all Social media platforms.