The burgeoning demand for digital financial services in Africa has brought about an unparallel increase in the size of the population with access to formal financial services on the continent – in Egypt, home of the biggest banking sector in North Africa and also the banking powerhouse of the region for more than a century, the adoption of digital financial services is enhancing financial inclusion in the country.

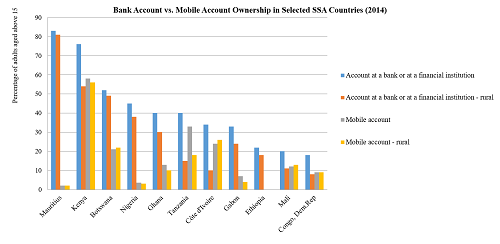

According to the World Bank, adults with bank accounts in Egypt increased from less than 20% in 2014 to close to 33% in 2017. In Sub-Saharan Africa (SSA) the expansion of digital financial services to the unbanked and underserved particularly in rural communities is ameliorating financial inclusion. In a report published by the European Investment Bank in 2016, the share of the population with mobile bank accounts in SSA was 11% in 2014 – the highest in the world.

Mobile banking is widely adopted in SSA, especially in rural communities, where the largest proportion of the population resides – low cost of transaction, high mobile phone penetration and a growing innovation by service providers has encouraged low-income households to subscribe to the services of mobile banking operators.

With the region hosting 27 out of the 28 poorest countries in the world as revealed by the World Bank, the tremendous growth of digital financial services in Sub-Saharan has established a newfangled market for accessible, affordable, reliable and sustainable financial services. As highlighted by the International Finance Corporation (IFC), access to mobile money services in SSA has increased daily per capita consumption levels of households – many poor households have been lifted from extreme poverty and standard of living has improved.

In SSA, where women constitute almost 50% of the labour force in the agriculture sector, mobile money services have played a pivotal role in the transition of women from subsistence farming to business occupations and sustainable livelihoods. Digital financial service is constantly improving the rate of financial inclusion on several accounts in SSA – in 2014 12% of the population in the region had mobile money accounts as compared to the global average of 2% with the area hosting almost 50% of the world’s mobile money providers.

Source: Global Financial Inclusion Database (Findex) data.

SSA is also performing extremely well in innovation and knowledge-sharing – through the Alliance for Financial Inclusion (AFI), Kenya shares knowledge in digital financial services with universal banks and regulators in Latin America. However, the level of financial inclusion brought about by digital financial services is not the same for all countries in the region.

In countries such as Mauritius and Botswana, the services of traditional banks are widely available in both urban and rural communities. Conversely, in countries such as Ghana, Nigeria and the Democratic Republic of Congo (DRC) the rural account gap for digital financial inclusion is largely untapped. Data from the World Bank indicates that financial inclusion in SSA between 2014 and 2017 has been largely driven by mobile money.

Source: Global Findex Database.

Source: Global Findex Database.

Between 2014 and 2017 the share of the population (adults) with an account with a financial institution (excluding mobile money account) increased by four percentage points – within the same period, ownership of mobile money accounts had increased by nine percentage points. In countries such as Cote d’Ivoire and Uganda, bank account ownership has been low but mobile money penetration continues to soar. The use of mobile money has spread from East African countries to West African countries – three years prior to 2014, the percentage of adults with mobile money accounts in Senegal was 6% but currently the share of mobile money account ownership is 32%.

The rapid growth in mobile phone penetration has heavily influenced the spread of mobile money in SSA – with more than 130 live mobile money services provided largely by mobile operators and a network of more than 1.4 million active agents, there were 395.7 million registered mobile money accounts in the area during the last quarter of 2018.

As revealed in the report of Global System for Mobile Communication, 456 million unique mobile subscribers were recorded by the end of 2018 in SSA, representing a penetration rate of 44% – an increase of 20 million subscribers over 2017. The report indicates that SSA will remain the fastest growing region in the world with a Compound Annual Growth Rate (CAGR) of 4.6% and an additional 167 million mobile subscribers by 2025 with Ethiopia and Nigeria projected to record the highest growth rates of 11% and 19%, respectively.

Mobile phone penetration has a tremendous effect on economies in SSA – in 2018, mobile technology and services accounted for 8.6% of GDP in SSA, amounting to over $144 billion of economic output with the mobile ecosystem supporting about 3.5 million jobs and raising close to $15.6 billion via taxation.

The Global System for Mobile Communication projects that by 2023, mobile technology and services will account for 9.1% of GDP in SSA, representing almost $185 billion – countries in the region will benefit from an increase in productivity for using mobile services. One of the sectors that could benefit more from digital financial services in SSA is agriculture – according to McKinsey Global Institute, although agriculture employs more than 60% of the population and contributes about 23% of GDP in SSA; growth in agriculture is precarious in the region.

The World Bank estimates that SSA has 200m hectares of land suitable for agriculture that has not been cultivated – this arable land is more than the cultivated land size in the United States and also close to half of the cultivated land in the world. The major challenge for smallholder farmers in SSA is the difficulty associated with securing financial products and services for agriculture – farmers have been able to access only 20% out of the $33 billion required for agriculture with more than 90% of the 48 million smallholder farmers lacking access to formal credit, according to the Food and Agriculture Organization of the United Nations.

This egregious condition has been influenced by the high cost of credit risk assessment in SSA. Inadequate financial information from farmers, insufficient credit bureaus and limitations in legal institutions makes it a daunting task for financial institutions to extend credit to many farmers.

Through financial technology, this perennial problem in the agriculture sector is gradually being solved – in Eastern Africa, specifically Kenya, FarmDrive, a FinTech startup that uses mobile phones, data and machine learning to make financial services accessible to the unbanked and underserved smallholder farmers by closing the data gap that discourages financial institutions from lending to farmers has increased the agriculture loan portfolio of financial institutions and currently has the capacity to make financial services accessible to more than 3 million smallholder farmers.

Through financial technology, this perennial problem in the agriculture sector is gradually being solved – in Eastern Africa, specifically Kenya, FarmDrive, a FinTech startup that uses mobile phones, data and machine learning to make financial services accessible to the unbanked and underserved smallholder farmers by closing the data gap that discourages financial institutions from lending to farmers has increased the agriculture loan portfolio of financial institutions and currently has the capacity to make financial services accessible to more than 3 million smallholder farmers.

Evidently, the digital footprint of mobile money transactional history will not be sufficient to qualify a farmer for loans from financial institutions but Virtual City, a technology firm that focuses on developing and delivering supply chain automation solutions in East Africa has partnered with a bank to collect relevant data such as Know Your Customer (KYC) of farmers in the value chain the company is digitising. This arrangement has made it possible for agribusinesses with access to Virtual City’s digital solutions to offer bank loans to the farmers they work with.

In SSA, Small and Medium-sized Enterprises (SMEs) represent an integral component of economies in the region – SMEs account for more than 90% of all businesses but the travail in accessing finance has been the utmost drawback in the development of SMEs. Data from the World Bank Enterprise Survey and a survey of banks in Sub-Saharan Africa by the European Investment Bank in 2018 shows that lack of access to finance is the predominant challenge to the growth of SMEs in SSA – between 2011 and 2017, 26% of respondents to surveys, cited access to finance as the main snag hindering the development of SMEs.

To curb the sluggish growth of SMEs as a result of lack of finance, financial institutions in SSA are relying on digital financial services to make credit accessible to SMEs – five banks in Kenya have launched a lending service via mobile phone. The SME lending service adopted by the Commercial Bank of Africa, NIC Group, Cooperative Bank of Kenya, KCB Bank Kenya and Diamond Trust Bank has the capacity to reach out to more than 3,500 businesses.

An additional 10,000 businesses will be enrolled in the second phase of the project. Other companies such as Branch International, a FinTech that uses machine learning algorithm to assess the credit worthiness of applicants via their mobile phones has presence in SSA, with offices in Nigeria, Kenya and Tanzania – more than 75% of the loans accessed in Nigeria have been have been invested in businesses, making credit accessible to the unbanked and underserved in the country.

About the authors

Kwaku Asiedu-Nketiah Jr is an entrepreneur with a profound understanding of the intricacies of African markets. Kwaku holds a master’s degree in finance and management from Heriot-Watts University and a bachelor’s degree in accounting and management from the Mount Royal University. He is also a member of the Canadian Association of Petroleum Production Accountants (CAPPA).

Alexander Ayertey Odonkor is a chartered financial analyst and a chartered economist with a stellar expertise in the financial services industry in developing economies. He has completed the International Monetary Fund’s (IMF) program on Financial Programming and Policies – with a master’s degree in finance and a bachelor’s degree in economics and finance, Alexander also holds postgraduate certificates in entrepreneurship in emerging economies and electronic trading on financial markets from Harvard University and New York Institute of Finance, respectively.

References

- Oxford Business Group ‘‘The Report: Egypt 2019’’ London, United Kingdom. Available at: https://oxfordbusinessgroup.com/egypt-2019(Accessed: 06 June, 2020).

- European Investment Bank (2016) ‘‘Banking in Sub-Saharan Africa: Recent Trends and Digital Financial Inclusion. Economics Department, Luxembourg. Available at: https://www.eib.org/attachments/efs/economic_report_banking_africa_digital_financial_inclusion_en.pdf (Accessed: 28 April, 2020).

- Food and Agriculture Organization of the United Nations (2017) ‘‘A first atlas on rural migration in Sub-Saharan Africa’’ 2 November, Rome. [Online]. Available at: http://www.fao.org/news/story/en/item/1054009/icode/ (Accessed: 28 April, 2020).

- World Bank ‘‘Poverty and Shared Prosperity 2018: Piecing Together the Poverty Puzzle’’ 1818 H Street NW, Washington DC 20433. Available at: https://openknowledge.worldbank.org/bitstream/handle/10986/30418/9781464813306.pdf (Accessed: 28 April, 2020).

- International Finance Corporation (2018) ‘‘Digital Access: The Future of Financial Access in Africa’’ Available at: https://www.ifc.org/wps/wcm/connect/96a4f610-62b1-4830-8516-f11642cfeafd/201805_Digital-Access_The-Future-of-Financial-Inclusion-in-Africa_v1.pdf?MOD=AJPERES&CVID=mdz-QF0 (Accessed: 28 April, 2020).

- Food and Agriculture Organization of the United Nations (2011) ‘’The Role of Women in Agriculture’’ Available at: http://www.fao.org/3/am307e/am307e00.pdf (Accessed: 28 April, 2020).

- European Investment Bank (2017) ‘‘Digital Financial Inclusion in Sub-Saharan Africa’’ Availableat:https://www.eib.org/attachments/general/events/africa_day_2017_roundtable_proceedings.pdf (Accessed: 29 April, 2020).

- World Bank Group ‘‘The Global Findex Database 2017’’ Available at: https://globalfindex.worldbank.org/ (Accessed: 29 April, 2020).

- GSMA ‘‘The Mobile Economy: Sub-Saharan Africa 2019’’ The Walbrook Building, 25 Walbrook, London EC4N 8AF. Available at: https://www.gsma.com/mobileeconomy/wp-content/uploads/2020/03/GSMA_MobileEconomy2020_SSA_Eng.pdf (Accessed: 30 April, 2020).

- McKinsey & Company (2019) ‘‘Winning in Africa’s agriculture Market’’ Available at: https://www.mckinsey.com/industries/agriculture/our-insights/winning-in-africas-agricultural-market# (Accessed: 1 May, 2020).

- The Economist (2018) ‘‘Africa has plenty of land. Why is it so hard to make a living’’ Available at: https://www.economist.com/middle-east-and-africa/2018/04/28/africa-has-plenty-of-land-why-is-it-so-hard-to-make-a-living-from-it (Accessed: 1 May, 2020).

- Wendle, J. (n.d) ‘‘Closing the Smallholder Financing Gap’’ Grow Africa. Available at: https://www.growafrica.com/news/closing-smallholder-financing-gap (Accessed: 1 May, 2020).

- Food and Agriculture Organization of the United Nations (2017) ‘’FarmDrive improves access to credit for smallholder farmers’’ Available at: http://www.fao.org/e-agriculture/news/farmdrive-improves-access-credit-smallholder-farmers (Accessed: 1 May, 2020).

- EWB Canada (2019) ‘‘FarmDrive receives additional investment to provide credit to 3 million smallholder farmers in Kenya’’ Available at: https://www.ewb.ca/en/news-and-events/news/farmdrive-additional-investment/ (Accessed: 1 May, 2020).

- GSMA (2019) ‘‘Improving Financial Inclusion through Data for Smallholder Farmers in Kenya’’ 27 June [Online]. Available at: https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2019/06/GSMA_AgriTech_Improving-financial-inclusion-through-data-for-smallholder-farmers-in-Kenya.pdf (Accessed: 1 May, 2020).

- International Finance Corporation (n.d) ‘‘SME Initiatives’’ Available at: https://www.ifc.org/wps/wcm/connect/REGION__EXT_Content/Regions/Sub-Saharan+Africa/Advisory+Services/SustainableBusiness/SME_Initiatives/ (Accessed: 1 May, 2020).

- Gandhi, D. (2018) ‘‘Figures of the Week: Financing for Small and Medium-Sized Enterprises in Sub-Saharan Africa’’ Brookings Institution. 30 November. [Online]. Available at:https://www.brookings.edu/blog/africa-in-focus/2018/11/30/figures-of-the-week-financing-for-small-and-medium-sized-enterprises-in-sub-saharan-africa/ (Accessed: 1 May, 2020).

- Obulutsa, G. (2019) ‘‘Kenyan banks to test mobile lending app to ease SME squeeze’’ Reuters, 20 May [Online]. Available at: https://www.reuters.com/article/kenya-banking/kenyan-banks-to-test-mobile-lending-app-to-ease-sme-squeeze-idUSL5N22W3WG (Accessed: 1 May, 2020).

- Adepetun, A (2018) ‘‘Branch International facilitates N1 billion loan in Nigeria’’ The Guardian, 18 June [Online]. Available at: https://guardian.ng/business-services/branch-international-facilitates-n1-billion-loan-in-nigeria/ (Accessed: 1 May, 2020).

- Bradshaw, T (2019) ‘‘Fintech start-up Branch raises funding for EM lending push’’ Financial Times, 8 April [Online]. Available at: https://www.ft.com/content/6917b93e-57c2-11e9-91f9-b6515a54c5b1 (Accessed: 1 May, 2020).