The Ghanaian corporate history is replete with many instances of failure of corporate entities, predominantly indigenous corporate entities. An example of this phenomenon is the recent collapse of corporate entities in the financial sector, even though the failure of corporations is not only limited to the financial sector.

Many reasons may account for this phenomenon, key among them is the lack of good corporate governance, particularly relating to the composition of the board of directors. In response to the problem, some sector-specific legislations recently enacted include a more specific prescription on the composition of board of directors of companies engaging in business in these particular sectors.

In view of having such specific prescription under sector-specific legislations, it is argued that the time has come for Ghana to consider a general Corporate Governance Code applicable to all companies rather than a piecemeal approach of focusing on specific sectors.

Definition of Corporate Governance

Corporate governance first appeared in our legislation in 2016 in the Banks & Specialised Deposit-Taking Institutions Act, 2016 (Act 930). However, before then, the Companies Act, 1963 (Act 179) prescribed general governance systems for companies. However, there is no specific legislative definition in the Acts.

That notwithstanding, corporate governance has been defined as “the system of rules, practices and processes by which a company is directed and controlled”.[i] Corporate governance, therefore, goes beyond the law. It includes non-legal rules, practices and processes that must be put in place.

Corporate governance can also be defined as “the manner in which the power of and power over a corporation is exercised in the stewardship of its assets and resources to sustain the company and increase shareholder value as well as satisfy the needs and interests of all stakeholders”.[ii] The definition requires the corporate powers to be allocated to corporate constituents to exercise the powers in order to manage the business or object of the company. In sum, corporate governance dictates that constituents are created or recognised, and given specific powers to be exercised on behalf of the company.

Default Governance Structure under the Companies Act.

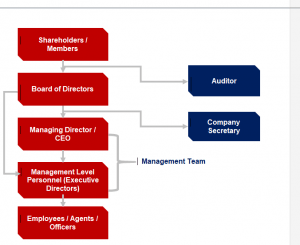

The Companies Act, 2019, which is the general law under which companies are created in Ghana, prescribes the structure for corporate governance. The diagram below shows the default governance structure:[iii]

The prescription of the Act on corporate governance is based on four pillars – shareholders or members, board of directors, management or officers of the company, and auditors. The Regulator is to ensure the prescription above is followed.

The Act provides for default allocation of the corporate powers among the various constituents and permits the constituents to exercise the powers on behalf of the company. Within the system of governance under the Act, the concept of separation of powers seems to have been adopted and incorporated to avoid the abuse of corporate powers.

In order to achieve that, the Companies Act allocates the power and imposes a number of limitations that act as checks and balances on the exercise of the powers by each constituent.

Role of Directors in Corporate Governance

Once the structure is created, the Companies Act prescribes rules relating to each of the constituents. Since the system of governance must fit the particular company, the Act prescribes what can be seen as the barest of the rules.

It allows promoters of companies to provide details in the company’s constitution. Even concerning the basic rules prescribed under the Companies Act, the Act allows promoters or shareholders to modify such rules in many instances under the company’s constitution.

The Act requires every company to have at a minimum:

- one shareholder

- two directors

- an auditor

- a Company Secretary

Then the Act prescribed default allocation of powers. It provides that the promoter or shareholder must allocate the corporate powers among shareholders and directors in the constitution.

However, failing such allocation in the company’s constitution, the default position is that the power to manage the company’s business is allocated to the board of directors.

Directors are therefore seen as the most important organ in corporate governance as they are seen as the mind of the company, which directs the business and object of the company.

However, other than the minimum number of two directors provided under the Act, there is no guide on the number, composition and distinction in the roles of directors. This has resulted in one-man-board in many companies.

In some instances, a husband and wife board, where one of the spouse is not aware of the action of the other in relation to the company. In some other instances, board members are selected based on friendship or other personal relationships other than qualification and the needs of the company.

In addition, other than a few disqualification requirements, there is no express requirement in terms of qualification – education or professional – that one must have to be a director of a company.

Persons are therefore appointed as directors who have no knowledge of the operations of the company in anyway. Lack of prescription on the number of roles a director can combine has resulted in situations where one director can double or triple as a director, board chairman, managing director, and Company Secretary. These are the requirements that recent sector-specific legislations are seeking to correct.

Overview of Sector-Specific Legislation on Directors

- Financial

Due to recent happenings in the financial sector, especially the collapse of some banks and other non-banking financial institutions, the Bank of Ghana as a regulator has issued two Directives pursuant to powers conferred under section 92 of the Banks and Specialised Deposit-Taking Institutions Act, 2017. The two Directives provides details required on good corporate governance under section 58 of the Act. The Directives are “The Banking Business – Corporate Governance Directive, 2018” and “The Fit & Proper Person Directive, 2019”.

Unlike the Companies Act, the Directives set a minimum number of 5 and a maximum number of 13 for boards of banks and non-financial institutions. In addition, the Directives have prescriptions on the percentage of the board that must be non-executive directives and independent directors. There is no such requirement under the general Companies Act. Further, a person proposed to be appointed as director must be approved by the Bank of Ghana.

The approval is based on the assessment as to whether the person is a fit and proper person based on prescriptions on education, profession experience and other qualification requirements set out the Directive.

It, therefore, prevents a person who lacks knowledge of the business from being appointed as a director just to satisfy the statutory requirements. The absence in the Companies Act of such provision creates a problem where a person who is appointed as a director does not understand the business and ends up not participating in directing the business of the company.

- Insurance Sector

The Insurance Act, 2021 (Act 1061), which was passed this year, seeks to follow the path of the financial sector as stated above by having prescriptions beyond the Companies Act, 2019. Persons must have specific qualifications to be appointed as directors of the licenced insurance and re-insurance companies.[iv]

The proposed person must be approved by the National Insurance Commission, which approval is based on the qualification and suitability of the proposed person.

- Pension

The National Pension Act 2008 (Act 761) also provides additional prescriptions in terms of board composition of trustees that can manage pension schemes. This includes having an independent director.

- Listed Companies

In order to protect investing public, particularly in relation to publicly listed companies, the Ghana Stock Exchange also has a prescription beyond the Companies Act, 2019 on directors.

The Ghana Stock Exchange Listing Rules (2006) and Stock Exchange (Ghana Stock Exchange) Listing Regulations 1990 (L.I. 1509) also seeks to give the Council of the Exchange the power to determine the suitability of directors of public companies that have applied to be listed on the Exchange.

Rule 11 requires that satisfactory evidence must be provided that the management possesses the requisite experience. The character and integrity of the directors and management are assessed by the evidence provided. Pursuant to this, the Securities and Exchange Commission has issued the SEC Corporate Governance Code for Listed Companies.

Need for a General Corporate Governance Code

The point to note is that the gap in the Companies Act, which the sector-specific rules seek to fill is not peculiar to the sectors. Of particular importance is the gaps in the rules on the composition of the board of directors of a company, which is seen as the most important organ in the corporate governance structure.

The emerging trend of having sector-specific legislations each have silo prescriptions for companies operating in the sector does not deal with the problem wholly. A holistic resolution will best deal with the issue. It is, therefore, suggested that it is about time there is a Corporate Governance Code that applies to all companies irrespective of the sector of operation.

This effort, ideally, should be championed by the Registrar of Companies as the primary regulator of companies. The Corporate Governance Code should prescribe the standard rules for different levels of companies either in terms of capital, turnover, assets, number of employees, etc.

These factors could be used to group companies into small, medium, large and multinational companies to determine the standard prescriptions on board composition. In line with the Companies Act, these should not be mandatory prescriptions but provide guidance that can be departed from based on the explanation provided in the incorporation documents, annual return or the prescribed form on appointment or change of directors.

Subsequent publication will provide an overview of the manner in which the guidance must be provided in the proposed Corporate Governance Code/Guide. In the meantime, promoters or shareholders of company must consider having such prescriptive rules in the company’s constitution, shareholders’ agreement or have a tailored corporate governance code to guide board composition beyond what is prescribed under the Companies Act.

[i] Richard Smerdon, A Practical Guide to Corporate Governance (4th edn, Sweet & Maxwell, 2010).

[ii] Commonwealth Association of Corporate Governance.

[iii] Ferdinand D. Adadzi, Modern Principles of Company Law in Ghana (Ghana Publishing, 2021).

[iv] See section 75 of the Insurance Act, 2021 (Act 1061).

Ferdinand is a Partner at AB & David, a multi-specialist pan-African business law firm practicing in many jurisdictions in Africa including Ghana. He currently heads the firm’s Energy, Infrastructure & PPP Group, and co-head the Corporate & Finance Group. He is also a lecturer at GIMPA Faculty of Law where he lectures in Company Law and Contract Law. Contact: [email protected]