… interoperability sees over 940% growth within a year

The value of transactions recorded on the country’s largest payment systems platform, mobile money, has seen an astronomic rise over a one-year period, with the interoperability push even recording more than nine times the value recorded last year, indicating the pandemic has forced individuals and businesses to adapt to the new normal.

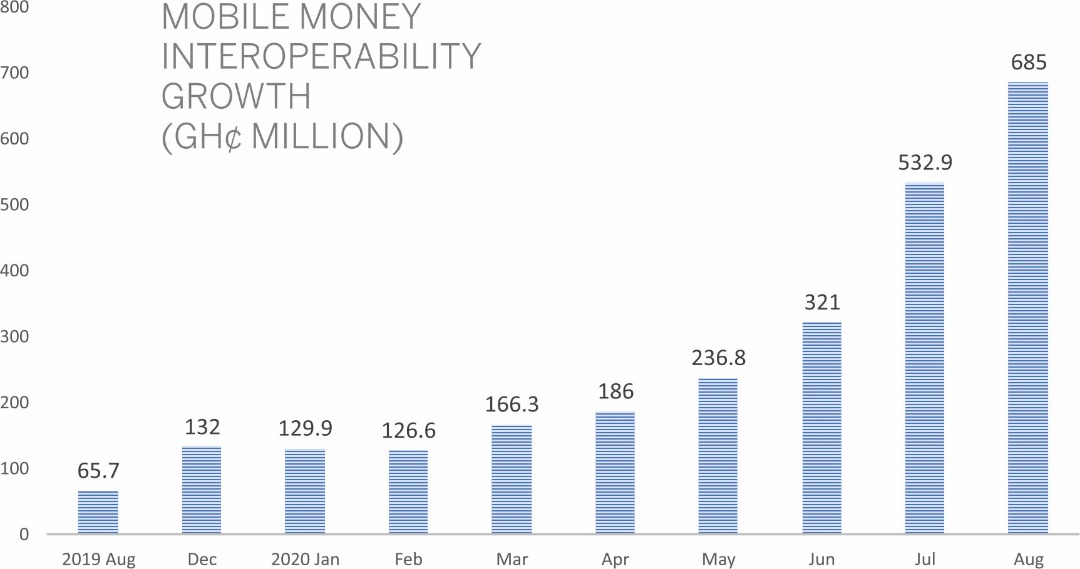

The Summary of Macroeconomic and Financial data (September 2020) published by the Bank of Ghana shows that the mobile money interoperability platform, which makes it possible to transfer money, not only to different mobile networks, but to banks, E-zwich card etc, and vice versa, saw its transactional value hit GH¢685 million, representing more than 940 percentage point increase from the GH¢65.7 million recorded same period last year.

Furthermore, the general mobile money platform has also hit a transactional value of GH¢56 billion in August 2020 compared with GH¢26.1 billion a year ago, signifying 114 percent rise within the period.

The increase in the use of both platforms for payment shows the country is making significant strides towards the financial inclusion agenda, thanks to the positive impact of the coronavirus pandemic which has forced people who were formerly apprehensive about the use of the system– due to safety concerns – to now change their usual pattern of doing business and embrace electronic transactions.

The point is even clearer when the data is considered historically. The very month (March 2020) the coronavirus disease was first recorded in the country, transactions on the mobile money interoperability platform jumped 31.4 percent.

Prior to this, the interoperability platform recorded a contraction of 1.6 percent and 2.5 percent in January and February respectively, indicating that most consumers were still comfortable with using hard cash for their business transactions.

However, the sudden appearance of the virus in Ghana on March 12, automatically changed the status quo, as many, especially, the educated and elite class, resorted to cashless transactions for fear of contracting the disease through the exchange of hard cash.

The change in consumer behaviour also reflected in the number of transactions recorded on the interoperability platform.

The number of transactions increased to 4,580,000 in August while that of March was 1,987,000, signifying a 130 percent growth compared to a 2 percent decline in February.

The data further shows an increase in active mobile money accounts to 15.9 million in August from 14.8 million in March.

The number of active agents has also increased to 280,000 from 239,000 within the stated period.

The figures depict a bright future for the financial inclusion agenda as the mobile money platform has become the main driver of this project. In fact, a World Bank research says that mobile money is what will drive the financial inclusion agenda of Africa, especially Ghana, as the country is the fastest growing market for the payment platform on the continent.

With the coronavirus pandemic changing the way financial transactions are carried out, it is obvious that the mobile money platform, especially with the interoperability, will continue to experience impressive growth as more and more people are daily subscribing to the platform and consider it more convenient than other payment platforms.