Fidelity Bank has denied allegations that it seized US$25million from the Minerals Income and Investment Fund (MIIF), a state institution that manages national mineral...

Trans-Sahara Industries and Opportunity International Savings & Loans Ltd have struck a partnership to provide financing to rural consumers for bicycles under the USAID...

By Dr. Bernard TAWIAH

In May 2025, the African Development Bank (AfDB) will elect its new president, a decision that will have profound implications for...

Yellow Card, Africa’s largest stablecoin on/off-ramp, is prioritizing helping businesses streamline cross-border transactions across Africa and expand their operations. The company’s focus is on...

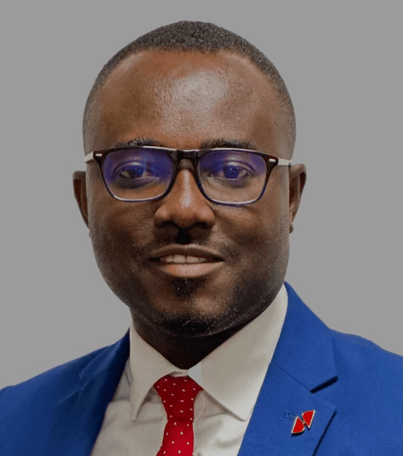

By Kenneth Owusu Asante AMPONSAH

Managing employee knowledge and skills—termed "human data"—is a critical but frequently overlooked aspect of risk management in financial institutions.

This...

By Isaac FRIMPONG (Ph.D.)

Fraud in financial institutions remains a persistent challenge in Ghana, despite regular audits, technological improvements, and discussions among stakeholders. The Bank...

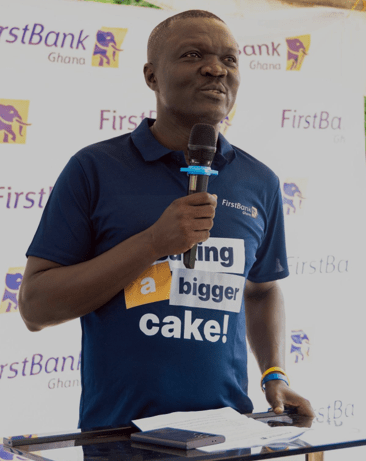

By Buertey Francis BORYOR

FirstBank Ghana Limited has kicked off the year with its annual health walk at Peduase in Accra, promoting employee fitness, strengthening...

In a heartwarming display of compassion, the Orange Women's Network (OWN) at Fidelity Bank, Ghana's largest privately- owned indigenous bank, extended a helping hand...

By Samuel SAM

As rural banks continue to bridge the gap between traditional banking and underserved communities, Sonzele Rural Bank PLC (SRB) stands as a...

By Kenneth Owusu Asante AMPONSAH

Managing employee knowledge and skills—termed "human data"—is a critical but frequently overlooked aspect of risk management in financial institutions.

This...