- …as Minority calls for its suspension

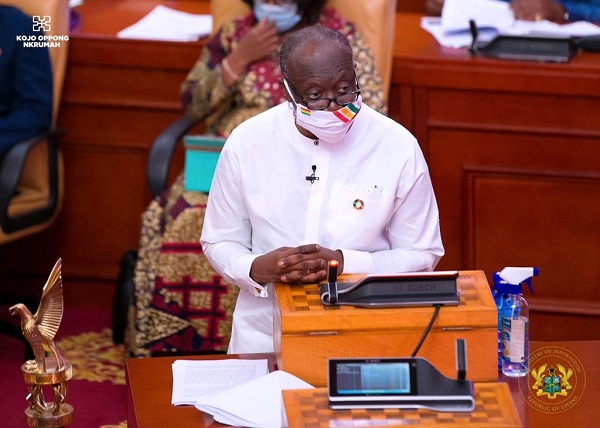

The Minority in Parliament has admonished government to suspend the Special Petroleum Tax from the 2022 budget which is expected to be presented to the House next month by the Finance Minister.

The call, according to the Minority, has become necessary to give some relief to Ghanaians from the recent increments in fuel prices at the pump, a situation that they argue has resulted in economic hardship among the citizenry.

According to them, as a net exporter of crude oil, the country has seen an increase in its petroleum revenue receipts due to a rise in crude prices, and must reflect on the lives of Ghanaians, hence the call.

“The Special Petroleum Tax imposed on petroleum products must be suspended in the 2022 budget to provide some respite for Ghanaians from the agonizing high cost of fuel at the pump. We make this demand because crude prices which was pegged at a benchmark price of US$54.75 per barrel in the 2021 budget statement has risen to over US$85 representing an increment of over 55 percent.

As a net exporter of crude oil, Ghana’s revenue receipts from petroleum exports are therefore expected to increase from the initially projected figure of US$800 million to over US$1.2 billion. What this means is that the nation is making unanticipated revenues from crude exports, hence the need to abolish the Special Petroleum Tax to ameliorate the suffering of the ordinary Ghanaian,” John Abdulai Jinapor, Ranking Member for the Mines and Energy Committee, and member of the minority caucus stated at a press briefing.

The minority also argued that, while wages of workers have not seen any significant increase in the last year, the price hikes of commodities, including fuel continue to impact negatively on livelihoods.

“It will be recalled that the Akuffo-Addo government during the course of the year announced a paltry 4 percent increase in wages for public sector workers for the 2021 financial year, by comparing this wage increment against the current inflation of about 10.6% (Bank of Ghana), one can only come to the conclusion that the ordinary worker is already worse off and therefore cannot be burdened further with such astronomical increases in fuel prices as this negatively impacts on the cost of living.”

The group also noted the depreciation cedi as a major contributor to the periodic price hikes in these commodities, urging government and its economic management team to salvage the situation.

“The attempt by government to blame world market prices of crude oil for this high fuel cost is untenable. The economic management team under the Leadership of Dr. Bawumia have lost and must sit up and be proactive by working with the Bank of Ghana to release forex when needed especially for BDS and other players in the oil and gas sector.”