…ahead of policy rate announcement

Recent public discontent about the wide gap between policy rate and lending rates of banks has put the Monetary Policy Committee (MPC) in a tight corner on what decision to take despite prevailing conditions giving it a strong case not to cut rate this time.

Various stakeholders, including the business community, President Nana Akufo-Addo and his special advisor, Yaw Osafo-Maafo, have called the gap between lending and policy rates unacceptable, thereby, charging the Bank of Ghana leadership to come with workable polices that will address the situation.

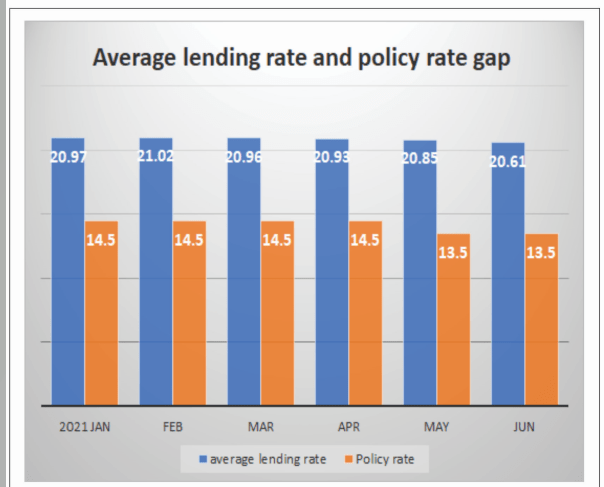

Currently, whereas policy rate stands at 13.5 percent, average lending rates hover around 21 percent. So, as the MPC holds its last meeting today to determine the policy rate, it faces a conflicting situation of either kowtowing to the President’s will or focusing on its core mandate of ensuring macroeconomic stability by controlling inflation and keeping the currency stable.

Ideally, the good news for many would generally have been for the Committee to announce a cut of the policy rate on Monday so that banks could further trim lending rates downwards. But such an expectation looks quite elusive, given the status of the fundamentals that determine the prime rate such as inflation forecast, exchange rate pressures, and global conditions – all now in an unfavourable situation.

This is underscored by banking consultant Dr. Richmond Atuahene, who, in an interview with the B&FT, said, given the weak fundamentals, he expects the MPC to maintain the rate at the current 13.5 percent.

“For me, looking at the fundamentals – inflation is inching up; oil prices have gone up internationally; the cedi hasn’t been stable and competing treasury bills rate – I don’t think it will be conducive for Bank of Ghana to bring the policy rate down.

Especially with the global oil prices going up, inflation expectation will also go up. And Bank of Ghana will still want to keep inflation within the target band of 8±2, so I don’t think it will rush to reduce the rate. The probability for it to be maintained is very high,” he said.

With regards to inflation, according to data released by the Ghana Statistical Service (GSS), surging food prices in the northern regions of the country continues to drive overall inflation upwards, making it record the highest rate in 20 weeks.

The August inflation figure hit 9.7 percent, taking it closer to the upper target band (10 percent) of the central bank. The data further show that food prices in the northern part of the country continues to be the main driver of the national inflation.

Food prices in the Northern Region, according to the GSS data, increased by 21.6 percent; that of Upper West increased by 18.3 percent; and Upper East increased by 15.9 percent. This made the Northern Region maintain its position, for the second consecutive time, as the region with the highest overall inflation, thereby, unseating the Greater Accra Region which has long held that record.

Concerning the currency, the cedi has fallen back into a free fall mode against its counterpart major trading currency, the US dollar, as it has recorded its highest depreciation since the beginning of the year. Data from the Bank of Ghana interbank FX rates shows as of Tuesday September 9, 2021, the cedi was trading at GH¢5.85 against the dollar, compared to GH¢5.76 it traded at the beginning of the year – representing 1.64 percent depreciation, the highest it has recorded this year.

In fact, up until May, the dollar was rather weakening against the cedi, as the latter recorded five consecutive months appreciation against the former. The local currency appreciated between 0.2 and 0.5 percent against the dollar within the five-months period.

However, the tables began to turn in June when the cedi recorded no appreciation at all and started depreciating in July. It saw a 0.6 percent depreciation in the month and followed with -1.5 percent at the end of August.a

And on oil, a report by Reuters indicates prices have eased but remained well above US$75 a barrel on Thursday, supported by growing fuel demand and a draw in U.S. crude inventories as production remained hampered in the Gulf of Mexico after two hurricanes.

According to Bloomberg, Brent crude could reach US$90 per barrel if the weather in the northern hemisphere turns out to be colder than normal this winter. All these unfavourable underlying conditions make a strong case for the policy rate to be at best, or worst, maintained, even though that will be an unpopular decision by the MPC.