Key findings

- Fastest rise in selling prices since August 2014

- Output, employment and purchasing tick down

- Business sentiment improve

The recovery in Ghana’s private sector paused at the start of the second half of the year amid strengthening price pressures. New order growth slowed to a marginal pace, while output, employment and purchasing activity all ticked down. There was a marked improvement in confidence in the year-ahead outlook, however.

On the price front, sharp accelerations were seen in rates of inflation of both purchase and staff costs. In turn, companies raised their own selling prices at the sharpest pace in almost seven years.

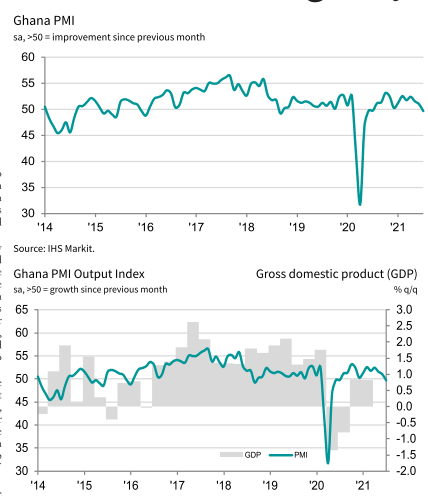

The headline seasonally adjusted Ghana PMI posted 49.7 in July, down from 51.0 in June and below the 50.0 no-change mark for the first time in a year. That said, the deterioration in business conditions signalled by the PMI was only fractional.

New orders continued to increase at the start of the third quarter, thereby extending the current sequence of expansion to 14 months. Some firms indicated that customer demand continued to improve. The rise was the softest in the current period of growth, however, with price increases reportedly deterring some clients.

The negative impact of price rises was evident across the latest survey, with anecdotal evidence citing this as a factor contributing to lower business activity, employment and purchasing. In all three cases, the reductions in July were marginal and ended 11-month sequences of expansion. Increased costs also deterred companies from holding inventories, with stocks of purchases decreasing for the third month running.

Inflationary pressures strengthened markedly in July. Purchase costs increased at the fastest pace since March 2017. Raw material costs were reportedly higher amid supply shortages, while rising freight and fuel prices were also mentioned.

The rate of wage inflation hit the steepest since September 2014, with firms linking higher staff costs to an increase in the national minimum wage and efforts to help staff with a higher cost of living.

In response to these greater input costs, companies in Ghana raised their own selling prices rapidly in July. Moreover, the rate of inflation was the sharpest in just under seven years. Suppliers’ delivery times lengthened marginally again at the start of the third quarter, largely attributed to goods shortages. Maize was mentioned in particular as being difficult to source.

Issues with the supply of materials combined with new order growth to lead to a fifth successive rise in backlogs of work. That said, in line with the trend in new orders, the rate of accumulation in outstanding business slowed.

Despite signs of a slowdown at the start of the third quarter, firms were much more confident in the year-ahead outlook for business activity than they had been in June. Sentiment was the highest since March, with optimism centred on expectations of higher new orders over the coming year and a reduction in the level of disruption caused by the COVID-19 pandemic.

Commenting on the latest survey results, Andrew Harker, Economics Director at IHS Markit, said: “The July Ghana PMI signalled a pause in growth in the private sector as inflationary pressures put the brakes on the economic recovery. Costs of a range of different inputs increased, leading to the fastest rise in selling prices for almost seven years. Customers were often reluctant to commit to orders given the hike in charges. “Firms will be hoping that the pause in July proves to be only a blip and that growth can resume as the third quarter progresses. Prospects in this regard appear good, with business confidence improving sharply over the month.