CENTENARY OF BURNING ‘BLACK WALL STREET’:

A stock is an interesting concept and what better day to talk about the legal and financial constructs of one of Africa’s most active stock market than the centenary of Tulsa race massacre. Caucasians residents of Oklahoma, weaponized by city officials, attacked Black residents and burned business owned by people of African descent on May 31 and June 1, 1921. A heritage of rising economics and bustling trade and finance in a province called, ‘Black Wall Street’ was destroyed by brute force by a cross-section of a race who thought themselves superior.

Let us find focus in stocks, before this becomes a black decolonization rant. Stocks, like all ‘real’ things, is a legal construct such as a country or a company. A stock is an expression of fractions of ownership of a corporation. A stock is a property that entitles the owner to the profit and assets of the company, at least, to the proportion of the stock owned. A unit of a stock holding is a ‘share’. Stocks are private property and can be traded privately or on an exchange to the extent that the company complies with state regulations. A regulatory practice is like a labyrinth, but one we intently aid corporations figure out and thrive in. To appreciate what an exchange is, let us set some basics.

A stock exchange is the market for buying and selling ‘pieces’ of limited liability corporations. To incorporate a limited liability company, the promoters, among other things, will issue shares to members in accordance with Section 44 and 45 of The Companies Act, 2019 (Act 992). The members’ share will determine the control and ownership of the new company. These shares are ‘Issued Shares’ which must be duly paid for by the subscribers. The Corporation may however be set up as a private limited liability company or a public company. The Companies Act, 2019 (Act 992) sets clear requirements that are generic to all companies, whether or not it is private of public, such requirements are detailed in Chapter Two of the Act. An example of such generic requirements are the shares. It is however important to note that, shares are not common to all companies and the nature of the company may determine whether or not shares are relevant. Chapter Four of Act 992 is however particularly important to us as we discuss the Ghana Bourse.

Anytime a company needs money, finance teaches us that, traditionally corporations have three options: increase profitability and retain that profit for the purposes of funding the business, enter a debt agreement for financing or finance the business through the sale of shares. Typically, in a debt arrangement, payment terms and interest is agreed on, in accordance with the Borrowers and Lenders Act, 2020 (Act 1052). (An Act we shall examine thoroughly in subsequent articles). Share sale arrangements are agreements of sale of ‘equity’ in the business enterprise. Investors therefore participate in sharing the risks based on share class they purchase but share purchase grants a right to participate in profit share, contrary to a fixed interest agreed for a debt.

The historical antecedent for ‘equity’ is interesting and a detour is worth entertaining. In the early days of the Europeans travelling around the world, European governments gave charters to explorers and these explorers travelled with the aim of establishing effective occupation in other parts of the world in addition to finding tradable goods and people to bring back to Europe. Sea voyages however was extremely risky for the perils of ‘Acts of God’, if even one discounted the threat of rogue privateers (pirates). To reduce the risks to one person when a voyage failed, ship owners founded companies (an idea of a band who broke bread together in adversities). The investors were persons invested in the perils of the adventure. Investors put up percentages for funding voyages, every investor’s loss was therefore limited to the liability of money invested in the travels. An investor therefore participated as an equity holder in a limited liability venture.

These terminologies have lived on until today and have taken the form of words of art, known in the Lex Mercatoria, the body of law known as commercial practice. With the evolution of more ventures and growth of business enterprises during the industrial revolution, people owned shares in various enterprises. Stock Exchanges therefore started literally in cafes and inns, hangouts where ‘brokers’ will trade the ‘documents of ownership’ with one another for and on behalf of the equity holders.

Having defined the context, let us examine the Ghana Stock Exchange as Ghana’s bourse. Bourse is from the same root we get the word bursar; it is from the old French ‘borse’ which means ‘money bag or purse’. The stock exchange as the bourse was therefore the ‘meeting place of merchants’, a place where the purse is opened by the bursars to fund ventures.

The bourse primarily offers two things: The first is a ‘dividend’, which is historically one’s portion of the profit divided, measured primarily by the share’s dividend yield. The dividend yield is the dividend expressed as a percentage of the current price of the share. A company with a high dividend yield makes significant profits and pays a substantial share of its profits in the form of dividends. So for an investor who seeks income or a return of profit from the venture, the dividend yield should be the guiding number. The second thing the bourse offers is return on share or capital gains based on desirability of the venture and rising price based on increased demand.

The Ghana Stock Market was incorporated in July 1989 after the implementation of the 1971 Stock Exchange Act and The Accra Stock Exchange Company had failed. The Ghana Stock Exchange started trading on 12th November, 1990. The Ghanaian funding market, ‘the merchant’s club’ in Ghana has about 37 merchants currently, selling ownership in five different variations of equity. Some of the industries listed on the bourse are banking, manufacturing, telecommunication, brewing and mining. The nature of the exchange like all other markets in a liberalized economy work on the principles of demand and supply (The All-Knowing Invincible yet invisible Hand). There are however rules that guide the market, rules set by the various regulators. The volumes of trade and the value at which investors and entrepreneurs agree to sell and buy their pieces of ownership determine price and value of companies as a share is known to be of ‘no par value’ in accordance with section 43 of Act 992. It is therefore argued that, until Ghana can truly enable a retail driven stock exchange, a market of vibrant negotiations and trade, the true market place for funding will remain a sub-optimized ghost town. The Ghana Stock Exchange Composite Index (GSE-CI) measures the overall market performance of the market.

The 2020 returns of the GSE-CI had a negative average return behavior. The standard deviation which is a measure of a financial asset’s return volatility was high with respect to the average return and implied that the stock market of Ghana exhibited high volatility in the market returns. From the data, there was a negative skewness in the distribution of the index return series. This was an indication that there was a greater chance of large decreases in returns than increases, implying long left tail for the distribution. Pardon the financial gimmickry, long story short, you were more likely to lose money on the stock exchange, at least for 2020.

We cannot deny the effect of Coronavirus on such performance but an analysis of the market in the long term does not exactly tell a different story. It is the goal of this write-up to ask one question, what should be done to resurrect this market place, a place that ought to be vibrant as a purse for business people in Ghana. The question begs, how do we build and preserve a ‘Black Wall Street’ in Ghana? We must however recognize some market happening and the launch of the ‘Capital Market Master Plan’, which hopefully will help sanitize the market place but far more must be done and we must ask ourselves as lawyers, finance people, governments and entrepreneurs, how do we grow this purse to fund ventures?

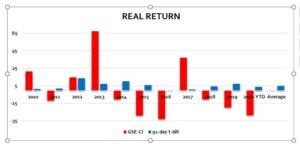

The conclusion of the matter for investors is returns, how much do they hope to return on an investment. Let us therefore examine an analysis of the return on the bourse in comparison with treasury bill and we present that comparison over the last decade. We will subsequently tell the stories of every company on the bourse and will follow the market closely with the view of contributing to an effective market place regulation but until then, let the comparison echo to the manager of the bourse that we need an effective bursar.

The Nominal return on the 91-day treasury bill from 2010 ranged from 12.25% to 25.79% whereas that of the stock market ranged from –17.94% to 78.81%. On the average, nominal returns on the 91-day treasury bill averaged 16.99% from 2010-to-date compared with an average nominal return of 11.73% on the bourse. To obtain the true or real return earned by investors for the two asset classes over the period, we need to factor in the respective annual inflation rates to arrive at the real return.

In real terms, the Ghana Stock Exchange averagely returned -0.09% compared with 5.17% on the 91-day treasury bill. The exchange irrespective of the return challenges still remains an important financing option and it is our view that we may work more closely with the Commission, Investors and Entrepreneurs in deepening and building a more effective money bag.

Finally, the Legal requirements for Private Companies to convert to Public Companies are set out in Section 302 of Act 992. The requirements laid down are:

- The Company must pass a special resolution to alter its registered constitution in a manner that is appropriate to a public company.

- Within twenty-eight days after the date of the special resolution to alter its capacity to operate as a private company or alter the registered constitution, the company shall deliver to the Registrar for registration a copy of the resolution in accordance with section 165.

- The Registrar shall then be required to publish notice of the conversion of the company in the Companies Bulletin.

- In accordance with section 303 of Act 992, the public company shall within twenty-eight days after incorporation, or after its conversion from a private company deliver to the Registrar for registration a statement in lieu of prospectus, signed by every person, who is named in the statement as a director or a proposed director of the company or by the agent of that person authorized in writing.

- A copy of the statement in lieu of prospectus shall finally be delivered to the Commission.

It is our concluding hope that we will work together as a financial and regulatory practice, focusing corporations to appreciate the nature of Ghana’s exchange and investment landscape as a viable vehicle for portfolio management and funding option.

Yaw is a Lawyer, a Financial Risk Practitioner, and believe in African Enterprise.

Disclaimer: This article does not constitute a legal opinion or financial advice and may only be used for educational purposes. Anyone who makes an election to use the article for any other purposes either than for the goal of educating the public makes that election freely and voluntarily, without liability on the author. You may however contact the author at [email protected] for any further clarifications.