…despite growing past all sectors

Even though agriculture has become the most thriving sector over the past one year due to the coronavirus pandemic’s impact, lending to the sector remains abysmal and pathetic compared to the others – indicating that banks still consider it too risky to fund.

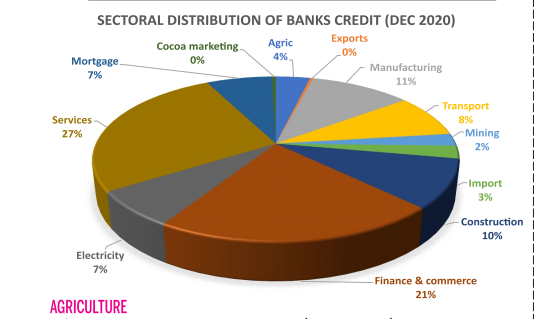

The statistical bulletin report for fourth quarter of 2020 shows that of the GH¢47.7billion credit advanced to all sectors in December, just GH¢1.7billion went to the agriculture sector; representing only 3.6 percent of total credit. In fact, the share of credit that went to the sector throughout the quarter was consistently below 5 percent.

Compared to December 2019, agriculture’s share of banks’ credit was GH¢2.6billion, representing 5.7 percent of total credit. This further shows that within a one-year period, lending to the agriculture sector has plunged by 32.5 percent – even though the sector has been the most-thriving ever since the pandemic struck the country.

In fact, the agriculture sector was the only one to record growth throughout the first year of the pandemic. It grew by 8.2 percent in the last quarter of 2020 and had an annual growth of 7.4 percent; the best it has ever achieved since the economy was rebased in 2014.

On the other hand, services grew by 4.6 percent and industry contracted by 0.4 percent. But ironically, those sectors got the lion’s share of banks’ credit even though the agriculture sector performed better. For example, the services sector alone got 26.6 percent share of total credit in December 2020 – up by almost 10 percentage points from what was advanced in same period 2019.

The simple reason often given by banks to explain this is that the nature of agriculture practiced in the country has made it a high risk-venture to invest in. Agriculture in Ghana is confronted with a plethora of challenges.

One age-old challenge of the sector is rampant land litigation issues which threaten the investments of businessmen and eventually lead them to abandon lands they have acquired with huge capital. This has discouraged many private investors from pushing resources into the sector.

There is also the problem of poor road networks linking farming communities to towns and cities, which are the main markets for farmers – resulting in post-harvest losses for the farmers. And again, agriculture – in this modern era – still relies on rainfall for irrigation; meaning farmers cannot produce all-year-round.

All these and other challenges have made the sector a high-risk one; hence, many banks and other financial institutions are cautious in lending money to players in the sector. Without adequate funds, farmers are left with no other option than to continue using outmoded methods of farming, such as weeding with hoes and cutlasses, to produce food.

Quite recently, Vice President Dr. Mahamadu Bawumia urged banks to reconsider their stance on categorising agriculture among high-risk sectors, and rather develop suitable lending schemes for the sector; adding that government will play its role in providing the enabling environment for that to happen.

“There is substantial evidence that next to availability of water, financing is the major bottleneck undermining full development of the country’s agricultural potential. With the realisation that the best pathway to sustainable growth and development is through agriculture, government is therefore committed to creating the enabling environment needed to generate the confidence for farmers and financing institutions to increase financial resources-flow into the agriculture sector.

“Government will continue its role as a catalyst for ensuring a stable financial environment in a sound macroeconomic environment to promote investment. The least government can do is remove uncertainties in the macroeconomic environment: by reducing inflation, lowering lending rates and delivering a stable exchange rate.

“Government through digitalisation is trying to create a better lending environment for financial institutions, hence interventions like the National ID system, National digital address system and mobile money interoperability,” he said.