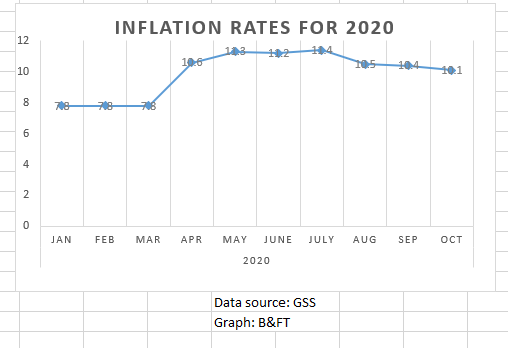

General prices of goods and services for October 2020 have recorded their lowest rate since April, when panic-buying in preparation for the lockdown propelled traders to hike the prices of products – resulting in a significant jump in inflation.

Data released by the Ghana Statistical Service (GSS) on Wednesday have shown that inflation for October recorded 10.1 percent, a 0.3 percentage point lower than it recorded the previous month – making it the lowest rate since the figure jumped from 7.8 percent in March 2020.

From the data, food inflation was 12.6 percent higher than the 11.2 percent recorded in April. The non-food basket, on the other hand, recorded 8.3 percent inflation compared with the 9.8 percent in September. The main price driver of October’s inflation was housing, water, electricity, gas, food and non-alcoholic beverages – which all recorded rates higher than the national average of 10.1 percent. Food’s contribution was 54.7 percent, higher than that of the two previous months.

Inflation for locally produced items was 12.2 percent and that of imported items was 5.1 percent. At the regional level, the overall year-on-year inflation ranged from 1.6 percent in the Upper West Region to 15.2 percent in Greater Accra.

Will decline cut the policy rate?

The decline in inflation to 10.1 percent comes ahead of the Bank of Ghana’s Monetary Policy Committee meeting later this month to determine a new policy rate for the financial sector. Ordinarily, it would have been expected that a continuous downward trend in inflation should lead to a cut in the policy rate.

However, conditions in the economy seem not to favour such a decision; considering inflation, though it has declined, is still outside the medium-term target band of 6 to 10 percent. In addition to that, the economy continues to be bruised by the coronavirus pandemic – which has consequently forced government to revise all macroeconomic targets. The fiscal deficit is therefore projected to hit 11.4 percent to GDP from a pre-pandemic target of 4.7 percent.

Governor of the Bank of Ghana, Dr. Ernest Addison, after announcing in September that the policy rate had been maintained for the third straight time at 14.5 percent, said any future cut would be determined by the economy’s fiscal situation.

“Fiscal policy has been a source of considerable stimulus, driven by exceptional expenditures directed toward goods and services, capital expenditures, COVID-related spending, and expenses in the energy sector. As at July 2020, the budget deficit was higher than programmed. Indications from banking data point to a faster budgetary execution in August relative to the annual target of 11.4 percent of GDP, supported by exceptional domestic and foreign financing sources.

“The drivers of economic growth are returning to normal, with prospects for a good recovery. Monetary and fiscal policies have been supportive, providing the necessary underpinnings for the economy to withstand negative output shocks arising from the pandemic. However, this has come at the cost of moving away from the consolidation path and could pose a risk to long-term macroeconomic stability if decisive measures are not taken to define a feasible fiscal adjustment to stabilise debt,” he said.

So, considering that the fiscal situation is not getting any better, with debt to GDP hitting more than 68 percent in July and various sectors of the economy still picking up their pieces – together with others still in the woods, it looks very unlikely that the Monetary Policy Committee will cut the policy rate again for the remaining part of the year.