A Bank of Ghana report has revealed serious lapses in the structures, systems and processes in place to promote consumer protection and the early resolution of customer complaints, as poor and unfair customer service has been going on in the banking industry for a long time.

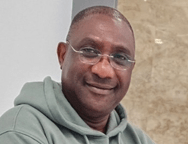

Dr. Richmond Akwasi Atuahene, a banking consultant, believes the Bank of Ghana must get tough with errant banks. Atuahene is of the conviction that proactive efforts by the regulator to end these unprofessional and unfair practices should be taken.

The report revealed some banks are engaging in serious unprofessional conduct that violates BoG’s guidelines on customer service and safety; which should ensure customers have access to adequate redress that is fair, efficient, timely and without cost to the complainant.

The findings showed weaknesses in five areas: namely board and management oversight of the complaint handling function; unfair banking practices; disclosure and Transparency requirements; data protection; marketing and advertising; and ambience.

It was established that some banks’ Consumer Reporting Officers (CROs) were not submitting reports on customer complaints to the board, as there was no evidence of Board of Directors reviewing the CROs’ reports for policy directions.

Also, channels provided by banks to enable customers lodge complaints – such as SMS, website portals and dedicated telephone lines – did not function. Additionally, under-reporting of complaint data to the Bank of Ghana, and non-compliance with the regulator’s complaint resolution timelines were also uncovered.

The findings further reveal data protection breaches; personal details taken from remittance customers were subsequently used for telemarketing promotional activities without consent of the affected persons; abandoned forms or slips used by customers for balance enquiries and other transactions were not properly disposed of – thereby exposing customers’ personal details to third parties.

Dr. Atuahene stated that it is not enough for the regulator to expose what the banks are doing to their customers, but rather must follow up with severe sanctions in order for them to take issues on customer service seriously.

Atuahene’s submission is spot-on, because as regulator the BoG has authority to insist that its provisions are respected and applied. Customers have unduly suffered from such breaches, and some take it for granted and believe they must be quiet in order not to incur the wrath of banking officials.

Banks primarily render a service, and must treat customers with decency and decorum.