By: Benjamin Opoku FOFIE

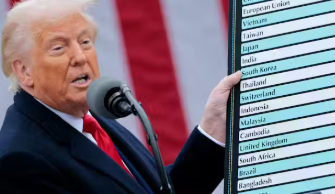

The administration of U.S. President Donald Trump implemented a series of tariffs primarily targeting China, the European Union, and other key trading partners as part of a broader protectionist trade agenda.

Initially, China faced a 34% tariff on its exports, but the overall rate has since increased to 145%. European imports were subjected to tariffs of 20%. In addition, the EU faces a 25 percent US tariff on steel, aluminum and cars.

The European Union is currently preparing to announce counter measures against these tariffs. These measures have led to increased market volatility, a slowdown in global trade, and a decline in cross-border investment.

Export-dependent and emerging economies have been hit particularly hard, grappling with reduced demand, disrupted supply chains, and heightened investor uncertainty.

Sectors such as agriculture, manufacturing, and technology were among the most impacted, as rising production costs forced many companies to relocate operations in an effort to avoid the tariffs.

Ghana – US Trade Summary

While Ghana was not a direct target, these tariffs have had indirect effects on Ghana’s economy through global trade dynamics, commodity prices, and bilateral trade relations.

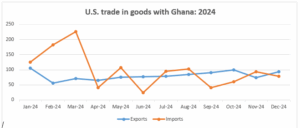

In 2024, total goods trade between the United States and Ghana reached $2.1 billion. U.S. exports to Ghana amounted to $967.3 million, representing a 12.3 percent increase compared to 2023.

Imports from Ghana totaled $1.2 billion, reflecting a 28.0 percent decline from the previous year. Consequently, the U.S. recorded a goods trade deficit of $204.4 million with Ghana in 2024. (Office of the United States Trade Representative, Executive Office of the President, https://ustr.gov/countries-regions/africa/west-africa/ghana)

Source: United States Census Bereau

NOTE: All figures are in millions of U.S. dollars on a nominal basis

Key Effects on Ghana

Ghana’s reliance on key exports such as cocoa, gold, and textiles, many of which are destined for the U.S, faces a new challenge with the imposition of a 10% U.S. tariff on imports from several countries, including Ghana.

While the direct financial impact, estimated at around $120 million (less than 1% of GDP), may seem modest, we believe it poses broader risks due to Ghana’s limited negotiating power.

The tariff could increase operational costs for Ghanaian exporters and raise prices for U.S. consumers, potentially reducing demand and weakening Ghana’s competitiveness in the U.S. market.

Additionally, rising tariffs on imports from regions like China and Europe may increase the cost of machinery and goods re-exported to Ghana, putting upward pressure on retail prices and inflation.

Below are some of the areas that will be heavily affected by the tariffs:

- Fuel and Energy Prices:

Canada, the United States’ largest foreign supplier of crude oil, has responded to the tariffs by introducing retaliatory measures, including export restrictions.

U.S. refineries, which depend heavily on crude imports from Canada and Mexico, could face supply disruptions, leading to a potential increase in global fuel prices.

Given that Ghana imports a substantial portion of its refined petroleum products, this could result in higher transportation and energy costs. The ripple effect may lead to inflationary pressures, ultimately raising the cost of goods and services across the country.

- Potential Rise in Non-Performing Loans:

Companies with debts in foreign currencies could also struggle to meet payments, increasing the risk of defaults.

As some businesses cut back or close, job losses may rise, leading to lower household incomes and a reduced ability to repay personal loans like mortgages, car loans, and credit facilities. However, with the recent appreciation of the Cedi the cost of foreign debt on companies and households will reduce.

- Increased External Pressures on Oil Exporters:

The external accounts of oil exporters are particularly at risk, as a heavy reliance on oil sales for dollar inflows leaves them highly exposed.

- Elevated Yield Environment :

Eurobond yields may spike due to rising global trade uncertainty, which will increase pressures on already stretched fiscal balances.

- Currency:

- Ghana’s economy remains heavily dependent on commodity exports such as gold, cocoa, and oil. While global trade tensions typically disrupt demand and supply chains, leading to price volatility, the recent surge in global gold prices has worked in Ghana’s favor. This, combined with a marked increase in gold export volumes, has significantly boosted the country’s foreign reserves. As a result, the Cedi has appreciated by approximately 40% against the U.S. dollar and other major trading currencies. The substantial rise in gold exports has led to higher foreign exchange inflows, easing pressure on the Cedi and strengthening Ghana’s external balance.

- The depreciation of the U.S. dollar partly driven by trade tensions has resulted in a notable appreciation of the local currency.

- The appreciation of the Ghanaian cedi has made locally produced goods more expensive for international buyers when priced in foreign currencies. This shift in exchange rates reduces the price competitiveness of Ghanaian exports on the global market, which could lead to a decline in demand and a potential slowdown in overall trade volumes. Over time, this may impact export revenues and put pressure on sectors that rely heavily on foreign markets.

Opportunity for Ghana

- Despite the potential effects on the Ghanaian economy, we believe this presents an opportunity for Ghana to expand its trade relationships and fully leverage the advantages of the African Continental Free Trade Area (AfCFTA). Through this, Ghanaian exporters can tap into new markets, lessen reliance on the U.S., and enhance the economy’s ability to withstand the adverse impact of tariffs. Additionally, it can boost the competitiveness of local producers, promote domestic manufacturing, and decrease dependency on imported goods.

- As previously noted, this presents an opportunity to strengthen both our gold and foreign exchange reserves by increasing gold exports amid rising gold prices, thereby supporting the stability of the local currency. In the event that trade tensions ease and the U.S. dollar begins to regain strength, a well-buffered reserve position will enhance the Cedi’s resilience, helping to mitigate potential shocks and reduce exchange rate volatility.

- Global trade disruptions and rising import costs present a strategic opportunity for Ghana to accelerate industrialization by promoting domestic production, investing in agro-processing, and advancing import substitution industries.

- The ongoing trade tensions offer Ghana a timely opportunity to enhance trade logistics, streamline the business environment, improve customs efficiency, and reduce regulatory hurdles to attract increased global investment.

Benjamin is a Fixed Income Broker, Regulus Investment and Financial Services Ghana Limited