By National Banking College.

In Ghana, Treasury bills (T-bills) are more than just short-term government securities—they are foundational pillars of the financial system.

Regularly traded and easily understood, they serve as a barometer for interest rates and signal the overall health of the economy.

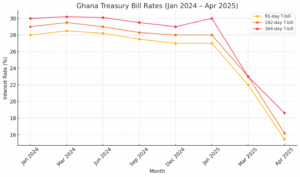

This article explores the powerful ripple effects of Treasury bill rates in Ghana. It delves into how a plausible reduction in the 91T-bill rate—from 28% to 15.45%—would affect the economy, individuals, businesses, and the government. It also reviews recent trends in Ghana’s T-bill rates from January 2024 to April 2025.

Ghana’s Treasury Bill Rates: January 2024 – April 2025

Over the past 16 months, Ghana has witnessed notable shifts in T-bill rates, influenced by macroeconomic factors such as inflation, currency pressures, and monetary policy adjustments.

From January–December 2024: Elevated Rates Amid Inflationary Pressures To combat rising inflation and stabilize the economy, the Bank of Ghana maintained high T-bill rates throughout 2024: These rates and other rates in 2025 can be found in the table below.

| January–December 2024 | January 2025: | March 2025: | April 2025: |

| 91-day bill: ~28%

182-day bill: ~29% 364-day bill: ~30%

|

91-day: ~27%

182-day: ~28% 364-day: ~30%

|

91-day: ~22%

182-day: ~23% 364-day: ~23%

|

91-day: ~15.45%

182-day: ~16.18% 364-day: ~18.62%

|

January–April 2025: Gradual Rate Reduction As inflationary pressures began to ease; rates began to decline:

This downward trend in T-bill rates reflects the government’s efforts to reduce borrowing costs and stimulate economic activity.

The significant decline in Ghana’s T-bill rates from early 2024 to April 2025 has had profound implications for the economy, businesses, and individuals.

Lower rates have reduced the government’s debt servicing costs, encouraged business investments through more affordable credit, and impacted individual savings strategies.

Understanding these trends is crucial for stakeholders to make informed financial decisions in Ghana’s evolving economic landscape.

The reduction in the rate of the 91-day Treasury Bill (T-Bill) from 28% in January 2024 to 15.45% in April 2025 has significant implications across various economic sectors.

This reduction reflects a shift in monetary and fiscal conditions and can have multiple effects on government borrowing, investor behavior, inflation, and the broader economy.

Government Borrowing Costs

The reduction in T-Bill rates means the government can now borrow at a lower cost, which can have several positive effects:

- Lower Borrowing Costs: The government will pay significantly less in interest on short-term debt, reducing the burden on its budget. This is especially important for a government that relies on debt to finance its budget deficits.

- Budget Flexibility: With lower borrowing costs, the government might have more flexibility in allocating resources to essential sectors like infrastructure, education, or healthcare, without being overly burdened by interest payments.

Impact on Inflation Expectations

The significant reduction in the T-Bill rate might also signal a change in inflation expectations:

- Lower Inflation Expectations: The reduction from 28% to 15.45% suggests that inflation expectations may have eased. If investors are willing to accept a lower return, it could indicate a belief that inflationary pressures are cooling. This might reflect the effectiveness of monetary policy (e.g., interest rate hikes by the central bank) in curbing inflation.

- Signaling Confidence in the Economy: A lower T-Bill rate might indicate that the market believes the government’s economic stabilization efforts are working, which can ease inflation fears and increase confidence in the local currency.

Impact on Investors

T-Bills are popular investment vehicles for conservative investors due to their low risk. The rate reduction, however, changes the attractiveness of T-Bills:

- Reduced Appeal for Investors: A lower rate (from 28% to 15.45%) means that T-Bills are offering a lower return on investment. For investors seeking higher yields, this may push them to seek alternative investment options, such as corporate bonds, stocks, or real estate, which offer potentially higher returns.

- Lower Returns on Safe Investments: For risk-averse investors, the appeal of T-Bills is still present, but the lower return reduces their income from these investments. This can lead to a reassessment of portfolio strategies, where more diversified investments might be considered to compensate for the lower T-Bill yields.

Monetary Policy and Central Bank Strategy

The reduction in T-Bill rates could reflect the central bank’s monetary policy stance:

- Sign of Loosening Monetary Policy: If the central bank has been cutting interest rates to stimulate the economy, the reduction in T-Bill rates aligns with this strategy. Lower short-term rates can encourage borrowing and investment, which may help boost economic activity in the private sector.

- Effective Policy in Controlling Inflation: The decline in rates may suggest that the central bank’s efforts to control inflation have been successful. A reduction in T-Bill yields indicates that inflation expectations have moderated, which may reduce the need for aggressive monetary tightening.

Bank Lending and Interest Rates

The reduction in T-Bill rates often influences the broader interest rate environment:

- Lower Lending Rates and the Implications for Credit Access

Treasury bill (T-Bill) rates serve as a benchmark for determining lending rates across the banking sector. When T-Bill rates decline, it generally signals a lower cost of capital in the economy.

In theory, commercial banks are expected to follow suit by reducing their lending rates, thereby making credit more affordable for businesses and individuals. Such a reduction can stimulate borrowing, spur investment, and ultimately enhance overall economic activity.

However, the critical question remains: Have banks actually reduced their lending rates in response to the decline in T-Bill rates?

The answer may not be straightforward. Several banks may still be working with legacy cost structures, where the funds mobilized for lending were sourced at higher interest rates prior to the fall in T-Bill rates.

This time lag between market rate adjustments and actual changes in banks’ cost of funds can delay the transmission of monetary policy signals to the real economy.

Moreover, other factors such as banks’ risk appetite, non-performing loan levels, regulatory requirements, and inflation expectations may also influence their decision to adjust lending rates.

As a result, while a decline in T-Bill rates should ideally translate into lower lending rates, the actual impact on borrowing costs may vary significantly across institutions and over time.

Currency and Exchange Rate Impact

The reduction in T-Bill rates can also affect the local currency:

- Potential Currency Depreciation: If the reduction in rates leads to a decrease in foreign investor demand for T-Bills (since the return is lower), this could result in capital outflows. This might put pressure on the exchange rate, causing the local currency to weaken.

- Attractiveness of the Currency: On the other hand, if the rate reduction is perceived as a sign of stability and successful economic management, it could attract foreign investors, stabilizing or even strengthening the currency.

Public and Private Sector Confidence

The reduction in T-Bill rates can serve as a signal to the broader economy:

- Business Confidence: Lower borrowing costs for the government may improve business confidence, especially if the reduction in rates is seen as part of broader economic stabilization. With cheaper access to government debt, businesses may expect a more predictable economic environment.

- Consumer Confidence: Lower interest rates can also boost consumer confidence. Consumers might feel more comfortable taking on debt at lower rates, which can increase spending and demand for goods and services.

Impact on the Financial Sector

The financial sector, particularly banks and financial institutions, is closely tied to the T-Bill market:

- Narrower Interest Margins: As T-Bill rates decline, banks may face narrower interest margins. They typically rely on a spread between short-term interest rates (such as T-Bill rates) and the rates they charge on loans. A decrease in T-Bill rates might reduce this spread, which could lower bank profitability unless they can adjust by charging higher fees or increasing other types of lending.

- Shift in Investment Strategy: Financial institutions may adjust their investment strategies in response to lower T-Bill yields. They could shift into riskier assets in an attempt to maintain returns, potentially leading to greater volatility in the financial markets.

- Potential Risks of Lower Rates

While the reduction in T-Bill rates has several positive effects, it is not without risks:

- Excessive Borrowing: Lower borrowing costs could lead to excessive borrowing by both the government and private sector. If this is not managed properly, it could lead to a build-up of debt, which could strain the economy in the future.

- Financial Instability: A prolonged period of low rates could encourage investors to take on riskier investments, potentially leading to asset bubbles or financial instability if these risks do not materialize as expected.

Conclusion

T-bill rates are not just numbers, they are levers of economic direction. A reduction from 28% to 15% has multifaceted implications:

- For policymakers: It provides a tool to balance inflation control with economic stimulation.

- For businesses: It lowers barriers to credit and enhances market dynamism.

- For individuals: It challenges traditional saving methods and prompts a rethinking of financial strategies.

Practical Actions in Response to Falling T-Bill Rates

If T-Bill rates continue to decline, it will have far-reaching implications for investment behavior, financial planning, and policy responses. To remain resilient and take advantage of the changing environment, the following actions are recommended:

- For Individual Investors:

- Diversify Investments: Move beyond T-Bills by exploring higher-yielding instruments such as corporate bonds, mutual funds, equities, and real estate.

- Focus on Long-Term Planning: Shift from short-term savings to long-term investment strategies that align with personal goals and risk tolerance.

- Stay Informed: Enhance financial literacy to understand risk-adjusted returns and make informed decisions in a low-interest-rate environment.

- For Banking Organizations:

- Reassess Lending Rates: Align lending rates more closely with the falling T-Bill rates to stimulate loan demand and support economic activity.

- Innovate Products: Introduce investment products that offer better yields for depositors, including structured deposits, managed funds, or wealth management solutions.

- Strengthen Asset-Liability Management: Improve interest rate risk management to maintain profitability while protecting margins.

- For Government and Regulators:

- Channel Investment into Productive Sectors: Encourage investment in infrastructure, agriculture, and industry through targeted bonds and incentives.

- Deepen Financial Markets: Develop broader investment platforms and improve market access to offer alternatives to traditional government securities.

- Promote Public Awareness: Educate the public on the implications of low interest rates and available investment opportunities to ensure informed decision-making.

In summary, falling T-Bill rates present both challenges and opportunities. The key lies in strategic adaptation—diversifying investments, adjusting financial offerings, and redirecting capital to drive national development and financial growth.