The need for monetary policies that account for the structural challenges of developing and emerging economies took center stage at the launch of Monetary Economics in Developing and Emerging Countries.

The book, co-authored by Professors Joshua Abor, Peter Quartey, Joseph G. Nellis, and Dr. Lakshmy Subramanian, seeks to bridge the gap in economic literature, which largely focuses on advanced economies.

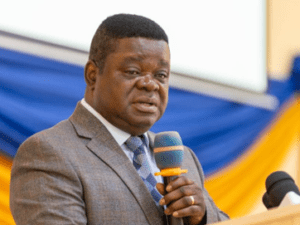

Professor Joshua Abor highlighted the distinct characteristics of developing countries that shape their monetary policies. He noted that underdeveloped financial markets, inefficient payment systems, and low levels of financial inclusion limit the effectiveness of monetary policy transmission.

“Monetary economics is a fascinating subject,” Prof. Abor said. “However, existing textbooks often rely on studies from developed countries, overlooking the complexities of formulating monetary policy in regions with financial infrastructure that is far from sophisticated. Students in developing countries need to understand these differences so they can appreciate why policy responses in their context are often slower and less direct—similar to maneuvering an articulated truck rather than a high-speed luxury car.”

The book examines how these structural challenges affect economic stability, financial system resilience, and overall growth.

Prof. Abor emphasized that without strong financial intermediation, monetary policy struggles to achieve its intended objectives.

The discussion also touched on the impact of the COVID-19 pandemic on financial systems in developing countries. He pointed out that during the crisis, studies revealed declines in deposit mobilization and lending, which weakened monetary policy transmission.

“If financial institutions cannot effectively play their intermediary role due to external shocks, then monetary policy effectiveness is significantly constrained,” he explained. “The pandemic exposed these vulnerabilities, reinforcing the need for policies that strengthen financial resilience.”

The role of payment systems in monetary policy effectiveness was another key theme. Abor stressed that promoting transactions in local currencies, particularly in the context of the African Continental Free Trade Area (AfCFTA), could help preserve foreign exchange reserves and enhance currency stability.

“This is a crucial initiative,” he said. “By conducting intra-African trade using local currencies, countries can reduce dependence on foreign currencies, which will, in turn, stabilize domestic currencies and lessen exchange rate pressures.”

Ghana’s transition from a controlled monetary regime to inflation targeting was also discussed. While acknowledging its relative success, Abor noted that weaknesses in financial market development still hinder policy effectiveness.

“Inflation targeting has performed better compared to previous regimes, with inflation trending downward on average,” he observed. “But monetary policy’s full potential remains untapped due to inefficiencies in financial markets. Strengthening these structures is essential to improving policy formulation and implementation.”

He also highlighted the unintended consequences of Ghana’s now-repealed electronic levy (e-levy), arguing that it discouraged financial inclusion and negatively impacted monetary policy transmission.

“The e-levy set back progress in digital payments adoption,” he said. “Many people abandoned mobile money transactions, limiting the reach of formal financial systems and, consequently, the effectiveness of monetary policy.”

Dr. Zakari Mumuni, First Deputy Governor of the Bank of Ghana, lauded the book for addressing gaps in monetary economics literature. He noted that many existing texts are heavily focused on advanced economies, making assumptions that do not always hold in developing contexts.

“This book is a significant addition to the study of monetary policy in emerging markets,” Dr. Mumuni said. “It provides practical case studies relevant to students, policymakers, and researchers, ensuring that monetary economics is understood from the perspective of developing countries.”