By Kizito CUDJOE

Email: [email protected]

Mobile / WhatsApp: +233 268899614

The 2023 announcement of commercially viable lithium deposits in Ewoyaa, in the Central Region, sparked nationwide excitement.

The discovery of lithium—a critical mineral in the global shift to green energy—positioned Ghana as a potential key player in the industry, promising a fresh revenue stream for the country’s resource-driven economy.

Beyond national economic gains, the project held immense local promise. Expectations soared for direct and indirect employment, royalty payments to its local business partner and corporate social investments that could uplift communities.

However, what started as a groundbreaking opportunity has now entered an uncertain phase due to delays in ratifying the lithium agreement in Parliament two years after the government signed it.

The stalled agreement: A risky delay

In a widely publicised move, the government signed what it called an “unprecedented mining agreement” with Barari DV Ghana Limited, a subsidiary of Australia’s Atlantic Lithium Limited. Officials touted it as a landmark deal that would set a new standard in Africa’s lithium sector.

According to the Natural Resource Governance Institute (NRGI), the deal exceeds Ghana’s legislated fiscal regime and offers a competitive edge over lithium producers in Australia, the Democratic Republic of Congo and Zimbabwe.

NRGI’s analysis estimated an average effective tax rate—government revenues as a share of mine profits—of 58 percent (excluding state equity), a strong indicator of the projected benefits to the nation.

However, 70 percent of these government revenues hinge on the profits Barari DV Ghana Limited reports, raising concerns about long-term fiscal stability.

Despite the government’s approval, the agreement has yet to be ratified by Parliament. With the dissolution of the 8th Parliament, the contract now faces further delays, as it must undergo fresh legislative scrutiny before taking legal effect.

Given that there is a new government in place, NRGI’s Africa Senior Programme Officer, Denis Gyeyir, in an interview with B&FT earlier in the year, cautioned that any attempt to renegotiate could undermine investor confidence and deter future investments.

Mr. Gyeyir stated that this is a crucial time for the new Minister of Lands and Natural Resources, who must decide whether to proceed with or reassess the current agreement.

Why delays matter: Economic risks at play

Policy experts have long warned of the risks tied to delaying the nation’s lithium production. Eliasu Ali, Policy Lead for Minerals and Mining at the Africa Centre for Energy Policy (ACEP), highlighted that lithium price volatility could significantly impact government revenues.

A study by ACEP found that a 10 percent change in lithium prices results in approximately a 27 percent change in government revenues, whereas similar changes in royalties, carried interest or corporate income tax rates have a much smaller impact.

In simpler terms, timing is everything—delays could mean Ghana enters the market when prices are low, missing out on peak profitability.

Recent global trends reinforce these fears. The lithium market is experiencing a sharp price decline, largely due to increased supply. Carboncredit.com reports that in February 2025, lithium carbonate CIF North Asia prices fell below US$10,000 per metric tonne, a drop of 4.5 percent to US$9,550/t—the lowest level since February 2021. Analysts predict further production cuts throughout 2025 as the market struggles to stabilise.

The primary driver of this downturn? Surging production from competing nations. In January 2025, Chile’s lithium exports jumped 22.8 percent compared to the previous month, flooding the market.

Meanwhile, new lithium mines in Mali—Bougouni and Goulamina—are set to add 40,528 metric tonnes of lithium carbonate equivalent (LCE) in 2025. Argentina’s Ganfeng Lithium Group also started production at the Mariana brine project, boosting Argentina’s role as the dominant producer in the Lithium Triangle.

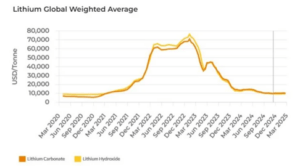

Carboncredit.com reports that Benchmark Mineral Intelligence indicates a decline in the global weighted average price of lithium, driven by rising supply, as shown in the chart.

Source: Benchmark Mineral Intelligence (via carboncredit.com)

Already, some lithium producers have taken a hit after the price slump. Mineral Resources Ltd., an Australian miner, announced in November 2024 to shut down its Bald Hill lithium project, citing the crash in prices of the key battery material.

“Following a strategic review and in light of a prolonged period of low spodumene concentrate prices, Bald Hill will be safely transitioned into care and maintenance from this week,” an Australian mining services company said in a statement, with its shares falling as much as 7.8 percent in Sydney after the announcement.

It has been reported that the development would result in approximately 300 job losses, with the final spodumene shipment scheduled for December 2024.

Mineral Resources, based in Australia, has reduced its workforce by 570 jobs and is slowing down underground construction at its Mt. Marion lithium project in Western Australia. This decision came during a time of consistently low lithium prices and ongoing issues related to tax evasion, as reported by the Australian Financial Review (AFR).

What is at stake for Ghana?

The implications for Ghana’s lithium ambitions are clear. The longer it takes to ratify the agreement and begin production, the greater the risk of missing a lucrative window. In doing so, Ghana jeopardises expected revenues from the project, local economic development and the creation of new jobs, and may significantly dent investor confidence in its domestic mining sector.

Without clear policy direction, Ghana risks being left behind as other African producers, such as Mali and Zimbabwe, fast-track their projects to capitalise on the global demand for battery metals.

The resource governance expert, Gyeyir, has said “delays in ratifying the agreement, coupled with ongoing price declines, could dampen investor appetite—not just for this project but also for other lithium ventures in the Ewoyaa enclave”.

He warned: “This will also have livelihood impacts, as chiefs from the area have already raised concerns about their inability to undertake farming and other economic activities since the area has been designated for mining”.

The way forward

To prevent further setbacks, the government must prioritise parliamentary ratification of the lithium deal. There should also be open discussions on whether adjustments to the agreement are needed to reflect current market realities.

While Ghana’s deal was initially seen as favourable, falling lithium prices may warrant a reassessment of fiscal terms to ensure long-term benefits for the country.

For Ghana, time is running out. The lithium price boom has been and gone. Whether the country can reap what is left of the rewards from Ewoyaa depends on swift, strategic decision-making.

The country cannot afford to sit on the sidelines while global competitors move ahead. The next steps from policy-makers will determine whether Ghana cements its place in the global lithium market—or watches the opportunity slip away.