By Elizabeth PUNSU

FirstBank PLC has introduced its private banking and wealth management services, aiming to provide convenience, exclusivity and tailor-made banking solutions to its upwardly-mobile customers.

This initiative comes at a time when the global economic landscape is becoming increasingly complex, characterised by volatile markets, geopolitical uncertainties and a growing demand for comprehensive wealth management solutions.

The new offering is designed to address the unique needs of high-net-worth individuals (HNWIs) and upwardly-mobile clients, providing them with personalised financial solutions to secure their wealth and enhance their lifestyles.

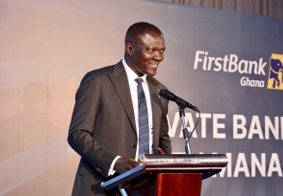

At a ceremony in Kumasi to introduce the service, Chief Executive Officer and Managing Director (CEO/MD) of FirstBank, Victor Yaw Asante, highlighted the key features of the Private Banking and Wealth Management proposition.

“FirstBank’s Private Banking and Wealth Management services provide a comprehensive suite of offerings, including investment management, wealth protection, personalsed banking, property management and other lifestyle-enhancing solutions.

“In Ghana, our economic landscape, coupled with the growing population of high-net-worth individuals, necessitates a focus on the specific needs of upwardly-mobile clients. These needs include securing quality education for their children, access to better healthcare, wealth preservation and maintaining their social status,” he said.

He emphasised that the services are designed to complement each other, allowing clients to tailor solutions to their personal wealth aspirations.

Mr. Asante also assured customers of the confidentiality and privacy of the services.

“”The confidentiality and privacy offered through our Private Banking and Wealth Management services will give you the peace of mind to manage your wealth effectively. Additionally, our concessionary rates, fast-tracked decision-making and access to a global network of products and advisory services will provide you with a competitive edge in your financial activities,” he added.

The service is supported by FirstBank’s robust IT infrastructure and a team of well-trained, service-oriented professionals dedicated to providing exclusive and personalised attention to each client. According to Mr. Asante, the flagship service is accessible at all FirstBank branches across Africa, as well as in London and Paris.

He further expressed confidence that the Private Banking and Wealth Management proposition will elevate the banking experience for the bank’s esteemed clients, reaffirming FirstBank’s commitment to putting customers first and delivering exceptional financial solutions tailored to their unique needs.

Meanwhile, FirstBank Group Executive, Private Banking, Idowu Thompson, highlighted the importance of preserving family wealth, a key aspect of the Private Banking and Wealth Management service.

“If you look at a lot of our countries, how many families have been able to keep wealth to the second or third generation, it’s really thin. So, our work as private wealth advisors is also to help channel that effort so that there’s a sustainability of wealth.

The wealth of individuals affect the wealth of the nation. When the nation does well, the individual also do well and vice versa. They are able to pay their taxes well and engage in more economic activities; there’s a lot more social equity and people are happy,” Mr. Thompson noted.