… amid currency stability

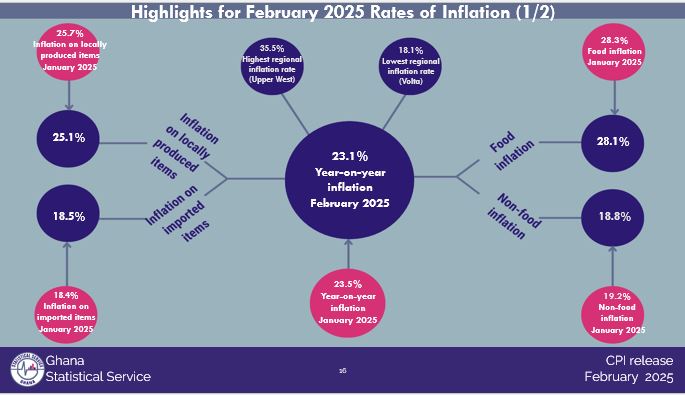

The inflation rate has eased marginally for the second consecutive month, reaching 23.1 percent in February – a slight decrease from January’s 23.5 percent, according to the Ghana Statistical Service.

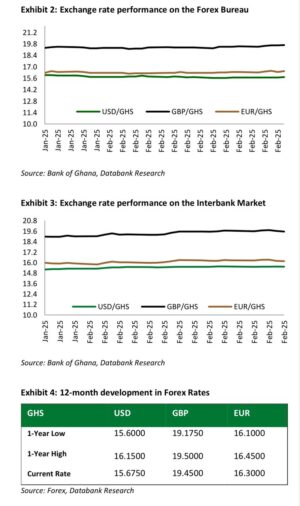

The moderation in inflation is partly attributed to relative stability of the cedi, which has shown signs of steadiness in recent months. This has helped temper the cost of imported goods, contributing to the overall slowdown in price increases.

“Food inflation stood at 28.1 percent from 28.3 percent in January, while non-food inflation stood at 18.8 percent from 19.2 percent. Month-on-month food inflation decreased by 0.2 percentage points from 2.0 percent to 1.8 percent in February 2025. Month-on-month non-food inflation decreased by 0.5 percentage points from 1.4 percent to 0.9 percent in February 2025,” the data stated.

Government Statistician Samuel Kobina Annim highlighted that the decline in inflation is primarily due to a slowdown in non-food inflation, although food prices continued to rise.

Despite recent declines, the current inflation rate remains significantly above the Bank of Ghana’s target range of 6 percent to 10 percent. The central bank has maintained its key interest rate at 27 percent in an effort to control inflation while supporting economic growth.

The economy has been navigating challenges, particularly in its key sectors like cocoa and gold. In September 2024 government increased the farmgate price for cocoa by nearly 45 percent, aiming to boost farmers’ incomes and curb smuggling. This move was expected to enhance crop output and stabilise the market.

Looking ahead, the Economist Intelligence Unit projects that the cedi will end 2025 at GH¢17.23 to one US dollar, reflecting a marginal depreciation.

This projection considers factors such as improved investor confidence, the conclusion of debt restructuring negotiations, and higher gold export receipts – which are anticipated to bolster the country’s international reserves and support the cedi’s value.

In January 2025, Ghana’s parliament passed a provisional budget allowing government to spend GHȼ68.1billion (approximately US$4.65billion) until March, averting a potential government shutdown.

This budget includes allocations for payments to energy sector suppliers, addressing critical needs in the sector.

As the country continues its efforts to stabilise the economy, recent trends in inflation and currency stability are seen as positive indicators. However, challenges persist and policymakers remain focused on implementing measures to achieve sustainable economic growth.