By Kizito Cudjoe

Two conflicting directives issued in November 2024 regarding the mining lease for the Prestea-Bogoso Mine, have raised questions about the supposed transparency of the process surrounding the purported acquisition of the mine by newly formed Heath Goldfield Ltd.

The letters, both signed by former Minister of Lands and Natural Resources, Samuel Abu Jinapor, were issued days apart in the same month.

The first letter, dated November 12, 2024, approved the mine to be awarded to Heath Goldfields Ltd., citing the company’s technical and financial capacity. It directed the Minerals Commission (MinCom) to ensure compliance with the country’s Minerals and Mining Act while facilitating the process to secure jobs, revive economic activities, and mitigate environmental risks associated with the mine’s closure.

However, another letter, issued only a few days later on November 20, 2024, ordered the suspension of all processes related to granting the mine to any company, including Heath Goldfields, a Ghanaian company.

This directive, referencing petitions received by the government, instructed MinCom to halt any further actions pending further review.

This directive is consistent with the law, which requires any dispute over the termination of a mining lease is first resolved before a new lease can be granted. In such circumstances the the original lease holder is able to continue to own and operate the mine as if the termination hadn’t occurred.

The emergence of these contradictory letters has fueled speculation about whether Heath Goldfields has any right at all to claim ownership over the mine.

Their presence at the mine site has caused confusion amongst the workers and the community who are desperately concerned about the rapidly rising water levels underground and the stability of the tailings dam which could collapse under the impending rains leading to the catastrophic loss of life in the neighbouring community if not addressed.

Despite claiming to be the legal owners Heath Goldfield have not produced a copy of their mining lease and have not invested in these critical areas, which were being actively addressed by the owner, Blue Gold Bogoso Prestea before the termination of their lease by the former Minister of Land and Natural Resources in September 2024The fallout has led Blue Gold to launch international arbitration proceedings against the Government with a minimum claim value of $1bn.

The situation has raised concerns among industry stakeholders about regulatory consistency and transparency in the country’s resource governance, as well as the risk of the loss of the mine which is the fourth largest resource in Ghana, if urgent action isn’t taken soon.

The Ministry of Lands and Natural Resources has yet to comment on the discrepancies. However, industry observers say the government’s handling of the matter will have broader implications for investor confidence in the country’s mining sector, a key driver of the economy.

According to sources and reports in some section of the media, the National Security has intervened in the Prestea-Bogoso Mine dispute given the conflicting information about whether Heath Goldfields have any right to claim ownership at all.

This follows a prior investigation by the Economic and Organised Crime Office (EOCO).

The National Security investigation arises as this new correspondence on the mine’s surfaces. Two documents appear to show the Minister struggled to make decisions about the Prestea-Bogoso Mine, which many claim is in disrepair due to a controversial international arbitration estimated at US$1 billion.

Blue Gold restarted operations at the Bogoso and Prestea mine in August 2024 following a period of care and maintenance, since December 2023, but this was promptly stopped when the lease was terminated in September 2024.

Underground mining activities and dewatering started, and the team were in the process of preparing the plant for a gold pour. However, the actions of the Minerals Commission to hand the lease to local company, Heath Goldfields, notwithstanding apparent directions to the contrary from the sector minister, has meant all activity and investment in the mine has now stopped.

Prior to the lease termination Blue Gold providing proof of substantial financial backing, including definitive documentation from investors demonstrating over US$100 million in daily liquidity. Despite this the Minerals Commission and the then Minister reportedly refused to consider the company’s existing licenses or halt its decision to terminate the lease.

Through the Ministry’s and MINCOM actions the assets of Blue Gold were moved and purportedly reassigned to Heath Goldfield Limited (HGL)—a company with no mining experience and with a share capital of only 10,000 cedis.

Legal battles

Legal battles are already underway. Kimathi & Partners, acting on behalf of Blue Gold, has filed for an injunction to prevent the Ministry from issuing any new leases.

Additionally, Kimathi & Partners have filed an injunction against Heath Goldfield Limited. Blue Gold has commenced international arbitration under the Bilateral Investment Treaty in the UK, with a minimum claim value of $1bn, ensuring its existing leases remain intact and effective.

The ongoing dispute has left the mine non-operational for three months, with the Minerals Commission failing to generate revenue or maintain the site, which is reportedly falling into disrepair.

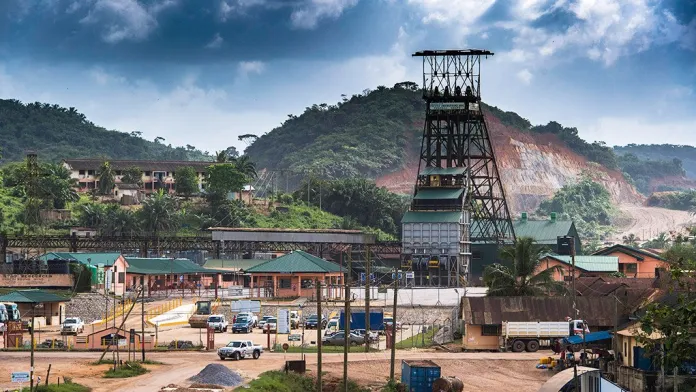

The Bogoso and Prestea gold mines are among Ghana’s oldest and largest mining concessions, located within the Ashanti gold belt. Blue Gold Holdings aims to transform these assets into a multi -generational, low-cost gold producing operation, with an estimated 18-year life of mine based on the 5.1 million ounces of measured and indicated resources outlined in the SK-1300 filing with the SEC.

Meanwhile, some workers and the community members are concerned at the dire state affairs of the mine since the November. The is on account of the fact that the mine faces flooding from the underground water which has the potential to damage the mine for good.