By David Alemzero (PhD)

The paper examines fiscal consolidation in Ghana, comparing redistributionist (demand-side) and growthist (supply-side) approaches.

Drawing on the Laffer Curve and U.S. economic history, it argues that growthist policies, emphasizing tax cuts, deregulation, and privatization, are more effective for sustainable economic growth.

Ghana’s past growth-oriented policies under leaders like Rawlings and Kufuor yielded positive results, while recent redistributionist measures under Akufo-Addo led to economic challenges.

Recommendations include tax reforms, government downsizing, privatization, and pro-growth incentives. The conclusion favors a growthist approach, as seen in President Mahama’s proposed policies, for achieving fiscal sustainability and long-term prosperity in Ghana.

Ghana faces significant domestic and international debt obligations. The macroeconomic indicators exhibited negative trends last year, suggesting a state of debt distress; however, early signs of recovery are now apparent following the IMF Extended Credit Facility (ECF) bail plan.

In light of present debt levels, the government is obligated to enact measures to ensure fiscal sustainability, curtail the deficit, and generate fiscal capacity for essential infrastructure, health, energy, and pension expenditures, along with other initiatives crucial for economic recovery, as President Mahama has committed. The pursuit of fiscal consolidation has presented a considerable challenge in stimulating growth and productivity gains.

Ghana has undertaken fiscal consolidation measures since the inception of the Fourth Republic to enhance short-term productivity and redirect economic growth. A critical policy question involves identifying the optimal tempo and scope of fiscal consolidation. It is necessary to decide between raising taxes and reducing government expenditure. Regarding Ghana, the timing of fiscal consolidation and available policy options are understood in light of the economy’s debt distress. This paper examines the application of Laffer Curve theory in 1980s USA, exploring its contribution to economic prosperity.

The analysis proceeds by examining the empirical fiscal policies enacted by successive Ghanaian governments since the Rawlings administration, evaluating potential consequences and drawing comparisons with analogous United States fiscal policy and its effects. The theoretical framework is grounded in the Laffer curve, analyzing fiscal consolidation from redistributionist (demand-side) and growthist (supply-side) viewpoints.

In the view of Dr. Laffer, the effects of taxation on revenue are twofold.

- Mathematically, taxation increases revenue yield per dollar of the taxable base.

- Increased taxation disincentivizes labor participation, impacting the economy negatively

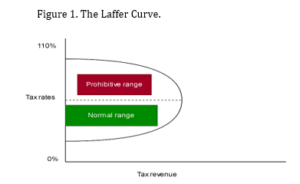

The Laffer curve suggests the existence of a tax rate that optimizes government revenue generation. Figure 1 provides a graphical representation of the Laffer curve. As illustrated in Figure 1. Tax revenues will meet projected targets if the government maintains tax rates within the predefined acceptable range.

Any tax rate falling within the designated green zone will generate maximal revenue below the dotted thresholds. Nevertheless, should governmental taxation exceed the prohibitive threshold (indicated in red), insufficient revenue will be generated for developmental initiatives. Productivity among the factors of production is not incentivized within the area designated as prohibitive.

According to Dr. Arthur Laffer, the American economist recognized for the economic growth during the president Reagan era, the five main pillars of macroeconomics are taxation, spending, money, regulation, and trade. The Reagan presidency oversaw a period of unparalleled economic growth in the United States, spanning the 1980s and extending into the early 1990s.

His argument centered on the premise that economics is defined by incentives, with individuals naturally pursuing attractive opportunities that serve as incentives. Incentives can be either positive or negative. Desired outcomes are encouraged through positive incentives; conversely, negative incentives discourage unwanted behaviors. The application of negative incentives will probably result in decreased production.

Proponents of demand-side economics(redistributionists) advocate for the transfer of wealth from the affluent to the less fortunate as a just and appropriate measure. They concur that output is predetermined, and that maximizing revenue necessitates increased taxation, with the government’s function being national redistribution through higher taxes.

Consequently, the state imposes taxes on high-income individuals to achieve a more equitable distribution of wealth. Environmental taxes and similar levies seek to modify behavior and lessen the disparate effects of climate change by redistributing resources from polluting entities to vulnerable populations via direct financial transfers or infrastructural development.

In contrast, a drawback of this theory is the reduced incentive to produce for both the producer and the recipient. What incentive would motivate an individual to innovate if guaranteed monthly payment? It encourages laziness. According to Dr. Arthur Laffer, this approach—taxing those above the average income to support those below it—disincentivizes production, ultimately leading to zero net income.

The growthist theorists, also known as supply siders, argue that output is not predetermined. Governmental actions influence productivity levels, contingent upon the nature of the implemented incentives. Reductions in taxation are necessary to stimulate production. It is imperative that factors of production are not subject to excessive taxation. This ensures the resources are channeled to producers to increase and augment their production capabilities. This entails procuring new machinery, expanding the workforce, and constructing additional factories or production lines, thereby achieving economies of scale.

It is imperative to avoid overly taxation on all production factors, which include labor, land, and capital. Output will be negatively impacted by the imposition of excessive taxes on factors of production. Consequently, elevated tax or interest rates correlate with diminished output, indicating an inverse relationship between taxation and production.

For instance, if a product is priced too high, it may not sell; conversely, if priced too low, the producer might incur losses. The producer must determine a price equilibrium for the product to breakeven. The sample principle can be applied to taxes. Regarding a monetary policy, an increase in the Bank of Ghana’s monetary policy rate leads commercial banks to raise their lending rates, increasing borrowing costs and potentially crowding out the private sector. The effect of this policy will be to dissuade entrepreneurs from borrowing loans for production.

Significant Policy Frameworks of the USA

The Great Depression, lasting until 1939, serves as a prime example of how high-income taxes negatively impact economic growth. The United States implemented a federal income tax in 1913; the maximum tax rate was 7 percent, levied on less than 1 percent of the population. Subsequently, a peak of 77% was achieved two years later. Following the First World War, the Harding-Coolidge administrations implemented policies of tax reduction and deregulation to stimulate economic expansion.

The United States experienced a robust economic expansion during the 1920s, characterized by increased productivity, rising living standards, minimal unemployment, and affordable housing. Networked infrastructure developed significantly during this era. The decrease in the marginal income tax rate to 24% resulted in a rise in government revenue during this period. Thereafter, World War II and the Great Depression led to unemployment rates as high as 24%, prompting the government to increase taxes, with marginal rates reaching 94% by the end of World War II. This precipitated a marked decrease in the American quality of life.

A number of presidents adopted growth-oriented strategies through tax cuts which propelled the American economy into a phase of sustained prosperity. The Kennedy administration’s tax cuts, combined with amplified defense spending, spurred a period of unparalleled economic growth in the United States. Alternatively, the economic policies enacted by Presidents Johnson, Ford, Nixon, and Carter inhibited growth and resulted in stagflation during the 1970s.

In contrast, President Reagan’s administration revitalized the American economy through tax cuts and simplification of the tax code. President Clinton enacted policies that reduced government spending as a percentage of GDP and reformed welfare programs, resulting in a period of robust economic expansion.

The presidencies of Barack Obama and George W. Bush were marked by tax increases and substantial stimulus packages, which negatively impacted economic growth. Likewise, the Trump administration enacted significant tax cuts, reducing the corporate tax rate to 21% from 35%, imposing higher tariffs on foreign-held assets, and modifying both individual income tax rates and the broader tax code. Following the Trump-era tax reductions, United States GDP growth surpassed that of European nations.

A study by the Tax Foundation projects a 2.4% change in the long-term GDP of the United States economy as a consequence of President Trump’s tax and tariff policies. Conversely, the aggregate effect of US tariffs and partial foreign countermeasures on GDP will be a 1.7% reduction in US GDP. The New York Times reported on January 4th, 2024, that the Chinese government responded to President Trump’s imposition of ten percent tariffs on Chinese imports. This could mark the commencement of reciprocal countermeasures from the United States’ principal trading partners, Mexico and Canada.

The analysis demonstrates the efficacy of a growth-oriented fiscal consolidation strategy in achieving lasting economic growth, especially within the context of the United States.

Ghana’s Fiscal and Economic Policies

Now considering Ghana’s fiscal policy framework. The 1980s economic restructuring plan constituted a pivotal macroeconomic policy initiative in Ghana, designed to address macroeconomic challenges and foster economic expansion. Since joining the IMF, Ghana has sought its assistance in achieving macroeconomic stability and productivity enhancement on 18 separate instances.

Given the current economic situation, the past NPP government’s imposition of numerous taxes is questionable, particularly government’s measures which hinder post-pandemic recovery. The multiple taxations implemented post-recession revealed significant fiscal mismanagement. A contracting economy would be unable to produce sufficient tax revenue. If there is a government budget deficit, it would be prudent to reduce income tax and associated taxes.

To reiterate an earlier point, the negative incentive structure inherent in taxation undermines economic productivity and output. It is important to remember that taxes are not extraterrestrial in origin. Taxes are imposed on the productive inputs of labor, capital, and land. Excessive taxation will significantly constrain investment and impede economic expansion. Profit shifting and other available strategies may be employed by large firms to evade taxes, both legally and illegally.

Global fiscal consolidation efforts have largely been unsuccessful due to the challenging choices involved, frequently resulting in suboptimal decisions and outcomes. The fiscal consolidation program undertaken reported by the African Development Bank (AfDB) in October 2023, unfortunately, resulted in higher taxes without realizing the intended goals. High levels of indebtedness persist, coupled with an unsustainable fiscal deficit. The public debt-to-GDP ratio currently exceeds 70%. As of December 2024, the monthly inflation rate is 23.8 %. In 2022, the Ghanaian cedi experienced a depreciation of more than 18.6% against the United States dollar.

President Rawlings spearheaded the 1982-83 Economic Recovery Program (ERP) in Ghana, marking the beginning of the nation’s economic recovery and market-oriented reforms. This reversed Ghana’s economic decline and spurred real growth. The period witnessed the privatization of numerous state institutions to improve efficiency. As many as 200 state-owned institutions were privatized.

Ghana attained a real economic growth rate of 4.2% in 1996, marginally lower than the 4.6% recorded in 1995. Due to a nationwide power crisis in the first eight months of 1998, growth was revised downward by 5.8%. President Rawlings’s introduction of a 10% Value Added Tax (VAT) in December 1998 replaced the prior 15% sales and services tax. The prevailing economic policies were fundamentally growth-oriented, characterized by tax reductions and extensive privatization, thereby fostering a free-market environment.

President Atta Mills reduced spending as a percentage of GDP by cutting waste and taxes equally. President Atta Mills cut the size of his government, resulting in national savings. His administration oversaw periods of significant economic expansion, featuring exceptionally positive macroeconomic indicators and lower levels of debt. The President oversaw the construction of the Atuabo Gas Processing Plant and other crucial infrastructure projects.

It is imperative to note that President Ata Mills’s ascension to power followed the 2008 global financial crisis; despite this external shock, Ghana experienced robust economic growth during his term. Cost savings included a 50% reduction in the State protocol budget and foreign official personnel, the negotiation of a unified salary scale, and a review of exemption schemes. President Atta Mills’s decision to forgo the purchase of two Presidential Jets constituted an austerity measure designed to safeguard national finances.

Furthermore, President Kuffour’s administration implemented social welfare programs, most significantly the establishment of a National Health Insurance System (NHIS). President Kuffour implemented fiscal policies that included reduced taxation on fuel and grain imports amidst increasing food prices. He refrained from raising taxes.

President Kufuor’s administration in 2007 oversaw a year marked by a fall in headline inflation of 10.7%, GDP growth of 6.3%, and a domestic public debt representing approximately 12% of GDP. The aggregate budget deficit constituted 5.7% of the GDP. Furthermore, the president’s elimination of certain distorting taxes and levies, coupled with reductions in corporate income tax rates, resulted in a rise of revenue to 22.3% of GDP by 2006. President Kufuor’s fiscal policies included several pro-growth measures that significantly benefited the nation.

A key feature of President Akufo-Addo’s two terms (2017-2024) was the adoption of a redistributionist fiscal policy. In 2021, the government implemented a minimum of ten new taxes. Despite the abolition of certain taxes, his administration has implemented the most extensive tax policies.

The country’s economic indicators show a decline, with inflation rates above 50% prior to a reduction to 24% at the end of his administration. The Akuffo Addo administration confronted unforeseen external shocks that exacerbated the domestic macroeconomic climate due to questionable fiscal policies implemented in the wake of the COVID-19 pandemic and the Russia-Ukrainian War. These external shocks could have less domestic negative effects if internal fiscal policies were robust to contain these external shocks. Nonetheless, the government’s receipt of IMF funding facilitated pandemic response and increased fiscal flexibility.

President Mahama’s first-term economic policies exhibited a redistributionist focus, as evidenced by the introduction of new taxes within the budget. A 20% excise duty on imported plastic products was implemented to safeguard the environment. A tax stamp system was implemented for the informal sector. A range of taxes were both newly introduced and reassessed. The gift tax and capital gains tax rates were raised; the latter increased from 5% to 15%.

Furthermore, the foreign services withholding tax rate has been raised from 5% to 15%. A levy was established for the recovery of debt owed to the Tema oil refinery. The objective was to resolve the substantial debts of the refinery, impacting the county’s banking sector balance sheets. Nevertheless, the aforementioned levy has proven ineffective. In 2010 and 2011, Ghana, under Mahama’s leadership, experienced significant GDP growth of 8% and 14%, respectively; the 2011 figure being exceptionally high in recent years. Robust performance in the oil and service sectors, the latter contributing 48.5% to GDP, were the primary drivers of growth.

President Mahama 2.0 is implementing a growth-focused strategy that involves eliminating many of the taxes introduced by the previous NPP government. The E-levy and betting tax are slated for immediate abolishment. This is a praiseworthy strategy that will alleviate the tax burden for Ghanaians. President Mahama will expand the tax base by including a greater number of individuals and implementing lower tax rates, thereby increasing tax revenue elasticity while minimizing the perceived tax burden.

Under President Mahama 2.0, Value Added Tax (VAT) collection will be simplified, ensuring fairness and minimal disruption. A pro-growth economic recovery and fiscal consolidation plan is promised by him for implementation within the first 100 days of his government. Government downsizing and waste reduction are among the planned objectives. This aligns with the ideology of growth-focused schools of thought. He has pledged to limit ministerial appointments to a maximum of sixty. That is indicative of a pro-growth economic ideology. The aforementioned policies are projected to stimulate private sector expansion and broader economic development.

Policy Recommendations

The evidence from both the U.S. and Ghana suggests that growth-oriented fiscal consolidation is more effective in achieving sustainable economic growth. Key recommendations for Ghana include:

- Tax Reforms: Reduce tax rates to incentivize production and investment, particularly in labor, capital, and land. Simplify tax collection to improve compliance and revenue elasticity.

- Government Downsizing: Cut wasteful expenditures and streamline government operations to reduce fiscal deficits.

- Privatization and Deregulation: Encourage private sector participation by privatizing inefficient state-owned enterprises and reducing regulatory burdens. The ideal to privatize ECG is economically prudent.

- Pro-Growth Incentives: Implement policies that stimulate innovation, entrepreneurship, and investment in critical sectors like energy, infrastructure, and healthcare. Specifically, within the energy sector, there is encouragement for small, community-based renewable energy projects. This will guarantee energy independence and energy security, thereby liberating the nation from reliance on Independent Power Producers (IPPs) and associated liabilities. We might consider adopting the South African Renewable Energy Independent Power Producer Procurement Programme (REIPPP) model. This is a deliberate program to boost private investment in the energy sector. To promote transparency in healthcare, hospitals should adopt standardized pricing, allowing patients to know the cost of services in advance.

Conclusion

Fiscal consolidation in Ghana requires a strategic balance between equity and growth. While redistributionist policies aim to address inequality, they often undermine productivity and economic output. In contrast, growthist policies, grounded in supply-side economics, have proven more effective in driving sustainable economic growth and increasing government revenue.

Historical examples from the U.S. and Ghana demonstrate that tax cuts, deregulation, and pro-growth incentives can lead to robust economic expansion. As Ghana navigates its fiscal challenges, adopting a growth-oriented approach, as proposed by President Mahama, offers a viable path to fiscal sustainability and long-term prosperity.

The writer is with the School of Management and Economics- Southwest University of Science and Technology. No.59-Minayang-China.

Email: [email protected]/[email protected]