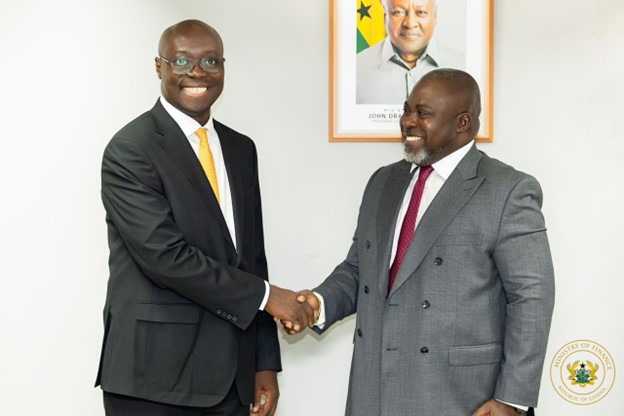

At a time when discussions have centered on Ghana’s inability to generate enough revenue to support its development agenda, the appointment of Anthony Kwasi Sarpong as Commissioner-General of the Ghana Revenue Authority (GRA) is seen by many as a decisive step towards catalyzing growth on the revenue front.

With a tax-to-GDP ratio of just 13%, compared to the sub-regional average of 18%, the need for bold, transformative leadership in revenue mobilization has never been more critical. The selection of a seasoned Chartered Accountant and Tax Expert like Mr. Sarpong signals Ghana’s intent to strengthen its fiscal foundation and enhance domestic revenue generation.

Background of new GRA boss

Mr. Sarpong brings nearly three decades of experience in finance, taxation, restructuring, and public financial management to the role.

As a proven leader with a reputation for driving innovation and accountability, his appointment promises a professional boost to the GRA’s efforts to modernize tax administration, close revenue leakages, and expand the country’s tax base.

His proven expertise in leveraging technology, managing risks, and leading large organizations positions him as the leader to address Ghana’s revenue challenges and lay the foundation for sustainable economic growth.

Prior to his appointment, Mr Sarpong served as the Country Managing Partner of KPMG Ghana, where he oversaw a team of over 500 professionals and contributed to shaping the organization’s strategic direction across Africa.

As a seasoned professional, Mr. Sarpong has successfully led high-stakes projects, including developing domestic revenue mobilization policies for the Ministry of Finance, designing frameworks to support Micro, Small, and Medium Enterprises (MSMEs), and spearheading public financial management reforms in partnership with the World Bank.

His unparalleled qualifications solidify his position as an industry leader of great repute. A Fellow of the Institute of Chartered Accountants, Ghana (ICAG), and a member of the Chartered Institute of Taxation, Ghana (CITG), he also holds an MSc in Financial Risk Management from London Metropolitan University and has completed executive programs at Harvard University and the London Business School.

Priorities

As Commissioner-General, Mr. Sarpong has his work cut out for him: the modernization of Ghana’s tax administration to boost domestic revenue generation.

Drawing from his extensive experience in restructuring and technology-driven solutions, it is expected that he will transform the GRA into a world-class institution that fosters compliance, simplifies processes for taxpayers, and reduces revenue leakages.

One of Mr. Sarpong’s core mandates would be to leverage technology to expand Ghana’s tax base and ensure efficiency in tax administration.

With Ghana’s economy increasingly becoming digitized, there is a strong need to integrate innovative systems to track and collect revenue more effectively. His experience in implementing technology-driven solutions during his tenure at KPMG will play a pivotal role in achieving this transformation.

In addition, Mr. Sarpong is expected to strengthen collaboration with stakeholders, including businesses, development partners, and international organizations, to create a revenue administration system that aligns with Ghana’s broader development goals.

Mr. Sarpong’s leadership credentials extend beyond his professional achievements. As Chairman of the Ghana ENACTUS Board, he has mentored young entrepreneurs, inspiring innovation and capacity building among Ghana’s youth. His leadership philosophy, rooted in collaboration and accountability, has earned him the respect of colleagues and stakeholders alike.

Having worked in various jurisdictions including Ghana, Nigeria, and South Africa, his wealth of experience across diverse economies gives him a unique perspective towards addressing Ghana’s revenue challenges.

Anthony Kwasi Sarpong’s appointment signals a commitment to excellence and innovation in public financial management. With his depth of expertise, strategic vision, and passion for transformative leadership, he is well-positioned to steer the GRA toward becoming a world-class revenue administration body.

As he takes on this new challenge, Ghanaians can expect a reinvigorated GRA that prioritizes transparency, efficiency, and service delivery, making tax compliance seamless for individuals and businesses alike. Mr. Sarpong’s leadership promises not just to elevate the GRA, but to contribute significantly to Ghana’s development journey.