The Bank of Ghana (BoG) has revised its target for achieving single-digit inflation, projecting it to second quarter-2026 instead of the previously announced first quarter.

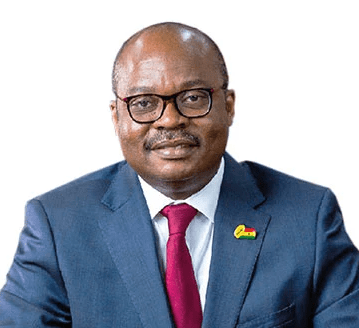

BoG Governor Dr. Ernest Addison announced this during a press briefing after the Monetary Policy Committee’s (MPC) 122nd meeting at the Bank’s headquarters in Accra this week.

Dr. Addison attributed the revised timeline to prevailing economic conditions and structural challenges, noting that achieving the new target will depend on continued fiscal consolidation and adherence to International Monetary Fund (IMF) programme guidelines.

Inflationary pressures in 2024 were driven largely by rising food prices, which were exacerbated by climate-related issues such as dry-spells in key agricultural regions and delay in the onset of rains.

These factors adversely affected food production, while supply chain disruptions also played a role.

Inflation rose from 23.2 percent in December 2023 to 25.8 percent in March 2024, primarily due to currency pressures and aggressive foreign reserve accumulation. The inflation rate subsequently declined to 20.4 percent in August, but climbed again to 23.8 percent by December as food prices surged.

“The issue of food prices played a significant role. This is mainly what you see when you look at food price behaviour throughout the year,” he noted.

Coupled with the above, 2024 being an election year introduced heightened exchange rate volatility driven by market sentiment and speculative activities – further complicating inflation management.

These considerations played a major role in efforts to stabilise inflation and address structural issues, leading the MPC to maintain the policy rate at 27 percent. The decision aligns with BoG’s broader disinflation strategy and reflects a need to allow time for fiscal and monetary policies to take effect.

BoG’s latest inflation forecast projects a gradual decline in inflation, with a return to its medium-term target range of 8±2 percent within the extended timeline.

Dr. Addison stressed the importance of fiscal discipline in achieving these targets, noting that the 2025 budget must adhere to parameters set under the IMF programme.

BoG anticipates further discussions with the IMF under its monetary policy consultative clause, as the current inflation rate of 23.8 percent nears the upper boundary of acceptable levels.