By Constance GBEDZO

Governance, as an English word, has become a boardroom and C-suite lexicon in Ghana in recent times. It simply means ‘the amalgam’ of processes and structures designed to help the organization/institution/firm achieve its objectives.

Every firm has the goal to enable effective, entrepreneurial, and responsible management that guarantees the company’s long-term prosperity.

Corporate governance, therefore, is the method through which firms are directed and governed to achieve their respective objectives. It refers to the way a company directs and controls its systems, ethics and account.

It also focuses on promoting transparency and fairness within establishments or firms by monitoring performance and ensuring accountability. It encompasses the things that a firm’s board of directors would do and how it would determine the organization’s values.

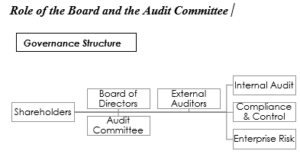

Role of the Board and the Audit Committee

Corporate governance is the responsibility of the board of directors. The responsibility of the shareholders in governance is to appoint the directors and auditors, ensuring that a suitable governance framework is in place. These processes and structures are influenced by risks that affect a firm’s ability to achieve objectives, and also, efforts to mitigate identified risks and discern unidentified risks.

The board oversees and monitors the firm’s strategy, operational, financial and compliance risk exposures. It collaborates with management in setting risk appetite, risk tolerances, and alignment with strategic priorities of the firm. In doing so, the board of directors must establish structures and processes that define governance within the firm, considering the perspectives of investors, regulators, management, and other important stakeholders.

Corporate governance practices for listed companies mostly require the use of audit committees to provide reinforced oversight of the financial and ethical integrity of publicly held companies.

The audit committee, made up of independent directors, can greatly strengthen the independence, integrity, and effectiveness of audit activities by providing independent oversight of the internal and external audit work plans and results, assessing audit resource and qualification needs, and mediating the auditors’ relationship with the firm.

Audit committees need to ensure that audit results are exposed and any recommended improvements or corrective actions are addressed or resolved. Audit committees can serve the same function in privately held and public sector organizations. In this regard, the role of auditors, be it internal or external in governance, is absolutely important.

Role of Internal Audit

Ideally, internal audit should report functionally to the board or audit committee and administratively to management. Professionally, strong management and board support of internal audit is nurtured by relationships they built on mutual trust, and frequent and meaningful interactions with the chief audit officer.

Internal audit provides objective assurance and insight on the effectiveness and efficiency of risk management, internal controls, and governance processes. Internal audit provides assurance by assessing and reporting on the effectiveness of governance, risk management, and control processes designed to help the organization achieve strategic, operational, financial, and compliance objectives.

It is best situated to provide such assurance particularly when its resource level, competence, and structure are aligned with firm’s strategies. Internal auditors need to follow recognized standards of audit practice.

Internal audit is able carry on its role effectively by maintaining its independence; it is free from undue influence. Internal audit can perform its assessments objectively by providing management and the board an informed and unbiased critique of governance processes, risk management, and internal control. Based on its findings, internal audit will recommend changes to improve processes and follow up on the implementation of such change proposals.

While maintaining its independence, and functioning independently within the establishment/firm, internal auditing must be performed by professionals who have an unfathomable appreciation of the importance of strong governance, an in-depth understanding of business systems and processes, and a fundamental drive to help their organizations succeed.

Internal audit must provide insight; acting as a catalyst for management and the board to have a deeper understanding of governance processes and structures. Insights provided by internal audit, especially on governance, risk and control have the potential to provoke positive change and innovation within the organization/firm.

It will inspire organizational confidence and enable competent and informed decision making. Successful internal auditing can provide foresight to the organization by identifying trends and bringing attention to emerging challenges before they become crises.

Internal audit has incredible value addition by providing consulting advisory services intended to improve governance, risk management, and control processes, inasmuch as internal audit takes up no management responsibility within the firm.

All of this is crucial for internal audit to maintain the objectivity and avoid conflicts of interest. In deciding and selecting the type of audits or services to be accomplished, there is need to consider the audit activity’s authority, maturity, purpose, and the firm’s needs and issues.

It is worth noting, therefore, that internal audit strengthens corporate governance by adopting risk-based audits that provide assurance and insights on the processes and structures that drive the organization toward success.

As risks grow and become more complex, internal audit’s role is likely to expand in areas such as risk governance, culture and behavior, sustainability, and other nonfinancial reporting measures.

As organizations address the growing array of risks created by new technology, geopolitics, cyber security, and disruptive innovation, a vibrant and agile internal audit function can be an indispensable resource supporting sound corporate governance.

Role of External Audit

Nonetheless, external auditors that are required of most publicly listed companies, also serve as one of the primary protectors of corporate governance in any organization. An external auditor’s role in corporate governance is to represent interest of shareholders; and protecting their interests.

This is possible because external auditor’s reports are conducted independent of the company’s influence. External auditors report the state of a company’s finance and attest to the validity of financial reports that may have been released. They ensure that the board receives accurate and reliable information. The board may also question the auditors’ views and assessment on the appropriateness of the accounting principles used by a company.

External auditors also promote accountability within the firm. They are likely to introduce measures and policies designed to induce accountability in the workplace. For instance, auditors could recommend penalties for officers who manipulate financial statements by inflating figures or cooking accounting figures. Penalties for such acts could include stripping the officers of their positions or compensation; reducing annual bonuses, and their pensions.

More so, external auditors assess and mitigate risks by conducting period risk assessment. Auditors review the security procedures that a company has in place to mitigate corporate fraud or corruption.

In addition to assessing potential risks, auditors also analyze the overall risk tolerance of the company and the efforts the company has made toward mitigating risks. For instance, if a company or government agency has an under-performing whistleblower system, efforts should be made to improve it.

Nonetheless, external auditors assist to manage corporate crises by developing efficient crisis-management plans to be used in the event of allegations of fraud or corruption. This plan essentially involves assigning responsibilities to different administrative officials.

This way, if the company gets involved in a financial crisis, officials have an active plan to use in sustaining confidence among investors. Crisis-management plans need to involve control measures to be used with the media and law-enforcement officials.

The efforts of external auditors help maintain strong relationship with regulators; foster a good relationship with them. Most regulators are supportive of companies and agencies that appear to have transparent operations. External auditors evaluate the organization of a company for compliance with regulations.

Regulators also trust disclosures made by company/firms after an auditor attests to those disclosures.

Importance of Auditors

The Importance of Auditors in ensuring the practice of good corporate governance cannot be ever-emphasized.

Publicly traded companies are required by the Ghana Securities and Exchange Commission (SEC) to have financial records audited regularly by an independent external accounting and auditing firm.

Banks and Specialized Deposit Taking Institutions are also required by the Bank of Ghana to submit audited financial reports.

Overall, auditing provides assurance to investors and creditors that company funds are handled appropriately.

Auditors protect the public from investing in companies that use corrupt business practices or that attempt to defraud investors with false financial statements.

By reviewing financial statements and digging into accounting records, auditors can determine whether the financial statements and records accurately depict the company’s true financial position.

Auditing also helps to spot financial risks, such as too much debt, reliance on only one or two large customers for most of a company’s revenue, opportunities for fraud in purchasing or expense reimbursements and embezzlement.

Consequently, good corporate governance establishes corporate success, economic progress and prosperity. It gives the best incentives to owners and management to achieve goals with respect to the interests of the shareholders and the company.

Effective corporate governance mitigates wastages, corruption, hazards, and mismanagement. Supporting brand building and growth, corporate governance ensures the company is managed in terms of the interests of all shareholders.

The practice of strong and good corporate governance maintains investors’ confidence and the company is able to raise capital efficiently and effectively. It lowers the cost of capital.

I wish to recommend Corporate Governance Audit as a useful approach in ensuring that a firm has followed all applicable laws and adequate internal control systems, policies, and procedures in place to meet the interests of all stakeholders.

The author is Governance and Enterprise Development Expert