By Richieson GYENI-BOATENG, CAMS

We live a country where every now and then, there is a new church or mosque being established. The number of churches and mosques in Ghana and even Africa is more than the number of manufacturing factories yet still crime and corruption are on the increase. What an irony.

What even makes it worse is that these churches and mosques have services throughout the week. Church members’ attitude towards work and their employers is nothing to write home about, with some literally collapsing the same institutions they work at by stealing, going to work late, poor customer service etc.

What I know from the bible and the church I attend is, the word preached from the pulpit should renew our minds to be better persons and contribute positively to society (Romans 12: 1-2, Philippians 4:8, Psalm 51:10) but the opposite is seen these days.

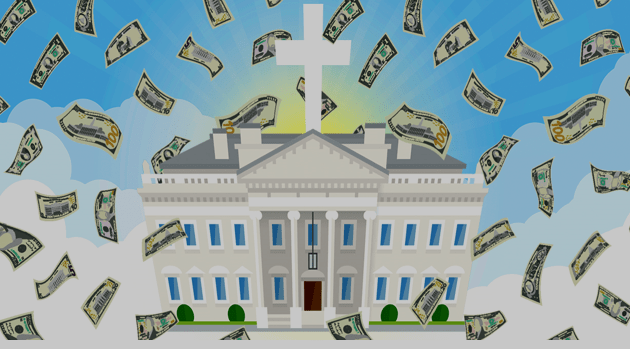

Reflecting on these made me believe criminals can or are taking over the pulpit to further expand their criminal activities, which includes the laundering of ill-gotten funds. This article throws more light on the activities of criminals, how they can use the religious organizations to launder money and finance the art of terrorism and how their activities could be brought under control.

The United Nations 2000 Convention Against Transnational Organized Crime, also known as the “Palermo Convention,” defines money laundering as the conversion or transfer of property, knowing it is derived from a criminal offense, for the purpose of concealing or disguising its illicit origin or of assisting any person who is involved in the commission of the crime to evade the legal consequences of his actions.

Also the Anti-Money Laundering Act, 2020 (Act 1044) section 1 (2) states that “A person commits an offence of money laundering if the person knows or ought to have known that a property is, or forms part of, the proceeds of unlawful activity and the person

- converts, conceals, disguises or transfer the property for the purpose

- concealing or disguising the illicit origin of the property; or

- assisting any person who is involved in the commission of the unlawful activity,

to evade the legal consequences of the unlawful activity

- conceals or disguises the true nature, source, location, disposition, movement or ownership of, or rights to, the property; or

- acquires, uses or takes possession of the property knowing or suspecting at the time of receipt of the property that the property is, or forms part of the proceeds of unlawful activity.

Simply put, money laundering is the process of making dirty money look clean. The washing of dirty money goes through three main processes or stages namely placement, layering and integration. Criminals using the religious organizations might use any or all the stages to wash their dirty money.

One way criminals can use the pulpit to launder dirty money is by setting up their own church and expanding their operations through it. The nonexistence of any entry barrier and supervisory authority over the activities of church in Ghana and some parts of Africa is encouraging criminals to wash their dirty money through the church.

After the church is registered and starts operations, the criminal is able to justify his or her source of funds as he or she is able to comingle the dirty funds with the offerings and tithes collected from church members. The issue is more prominent among the “one man” church set ups.

Some church leaders are using the church to acquire worth for themselves without paying any tax to the government. Some church leaders have reality shows and move around the world to delivery motivational and/or inspirational messages, all in the name of church activity, and avoid the payment of taxes. But professionals who delivery the same motivational and/or inspirational messages are taxed by the government.

Another way the criminal can launder ill-gotten funds through the church is by loaning the church funds for the construction of an auditorium or church related building. The repayment of this loan is mostly done via funds transfer and/or the issuance of cheque. The criminal is able to justify the source of the funds, when questioned, as coming from the church with an acceptable and reasonable purpose. The cheque and/or transfer will then find itself in the financial system as clean money.

Setting up scholarship and endowment fund for church members is another way criminals use to launder their dirty money. Once the dirty money has been cleaned through other means, the criminal has more money and power at his or her disposal to influence the society and the community they find themselves. They use the dirty money to set up all sort of funds to buy the conscious and loyalty of the beneficiaries of the fund. Example can be seen in the life of Pablo Escobar of Columbia.

Setting up investment clubs and other social clubs to lure church members to invest is another strategy used by criminal self-styled men of God to use the church to further wash their ill-gotten funds. They used the cover of the church is convince members to join and invest in their schemes and later defraud them of their hard earn cash.

These schemes are presented through seminars, meetings, and broadcasts on TV channels, promising members of greater returns on investments. Mention can be made of Self-proclaimed prophet Shepherd Bushiri, who is currently standing trial for about 350 charges, including fraud, money laundering, and racketeering.

Laundering money through the church has been made easy by criminals as this can be done using the private jets of the Man of God. It should be suspicious or a red flag if the Man of God flies to tax haven countries such as Bahamas, the Cayman Islands, Nevis etc frequently. This makes it easy for the criminal to launder his or her dirty money to other countries with lax anti money laundering controls.

Comingling of tithes, offerings and other donations with the ill-gotten funds and introducing it into the financial systems through deposits is another way criminals use the church to expand their operations. This even becomes worse when the “Man of God” is a televangelist. They then use the church to acquire properties for themselves and associates.

The non-reporting requirement of religious organizations to any regulator and/or authority makes it vulnerable to the activities of criminals in cassock as there is no stringent rules and guidelines over the operations of the religious body.

The regulatory body responsible for supervising and regulating the activities of religious leaders and their institutions should be strengthened and resourced to fight any form of money laundering in the industry.

The regulatory body should collaborate with the Financial Intelligence Center (FIC) to develop AML guidelines to understand and comply with AML/CFT & P laws and regulatory requirements and the implications of non-compliance of AML/CFT & P requirement.

Also the regulatory body should set standards for every religious leader. Example, requiring religious leaders to obtain a minimum academic degrees and certificates in theology as it is the case in Rwanda.

Training and creating the necessary awareness about money laundering activities among the citizenry will go a long way to thwart the activities of criminals in the church. Church leaders should factor AML trainings and lectures in their daily activities in order not to be vulnerable to criminals. Religious FM/ radio stations should use their medium to educate their listeners about the dangers and consequences of allowing criminals to enjoy their ill-gotten funds.

Another control that can be put in place to thwart the activities of criminals using the church is having an effective and efficient know your customer (KYC) procedures and principles. financial institutions onboarding religious organisations as their customers should properly identify all the leaders of the church, their source of funds and wealth. Enhanced Due Diligence should be conducted on these leaders by verifying all stated sources of funds and wealth.

This should be reviewed annually and properly documented. the accounts of these customers should be monitored keenly and where actual transaction activities differ sharply from estimated values, answers and documentary evidence requested. The leaders of these religious organizations should institute KYC (know your church member) principles to enable them to identify suspicious characters within their churches and report same.

With these legal and procedural changes, greater transparency would reduce the ability of religious organizations to be used to launder money and illegally buy political influence. The time to act is now.

Would you mind doing me a favor? Share this article with someone so that the awareness of money laundering and terrorist financing could be spread to avoid being used as a conduit by criminal.