By Joshua Worlasi AMLANU and Ebenezer Chike Adjei Njoku

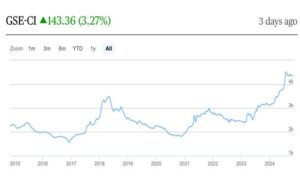

The Ghana Stock Exchange (GSE) reached a historic milestone, with its market capitalisation surpassing the GH¢100 billion mark, on the back of renewed investor confidence in the capital market.

Closing on Monday November 4, at GH¢102.07billion, the GSE has added approximately GH¢29 billion to its value since the beginning of 2024. This landmark achievement is being viewed as a significant indicator of the resilience and potential within Ghana’s economic landscape.

The current market performance has been driven by gains across multiple sectors, particularly in telecommunications, financial service and commodities.

As of Monday, November 1, 2024, those leading the day’s advances included MTN Ghana – closing at GH¢2.30 per share from the previous trading days of GH¢2.29 per share, however, the NewGold Exchange-Traded Fund (ETF) marginally declined, closing at GH¢443 per share from GH¢453.10 per share, previous day’s trade.

Managing Director-GSE, Abena Amoah, in response to B&FT on the development said the milestone reflects growing investor confidence and the capital market’s resilience.

“Reaching a market capitalisation of GH¢100billion is a historic milestone for the Ghana Stock Exchange, one that reflects the resilience and growing confidence in our capital market.

“This achievement underscores the collective commitment of listed companies, investors and stakeholders who continue to believe in our vision of fostering economic growth and financial inclusion,” she said.

The MD assured the market of solidifying recent gains, stating: “We are excited about the future and remain committed to further strengthening our market to create lasting value for our economy and our people”.

Overall, the GSE Composite Index posted gains, closing at 4,542.03 points, up from 4,529.30 points in the previous day’s trading, reflecting a year-to-date return of 45.10 percent.

The current market performance has been driven by gains across multiple sectors, particularly in telecommunications, financial services, and commodities. MTN Ghana and NewGold’s continued dominance in both volume and value reflects their significant roles in the GSE’s liquidity. MTN Ghana, a key player in the telecommunications sector, has experienced steady growth, supported by increased demand for digital services and financial technology integration.

Similarly, NewGold’s performance highlights a growing interest in commodity-backed investment options, as gold-backed ETFs have become a preferred choice among risk-averse investors seeking stability amid global uncertainties.

The GSE Financial Stocks Index – which tracks banking and finance sectors – closed the day at 2,242.34 points from 2,239.89 points for the previous day, contributing to a year-to-date gain of 17.92 percent, reflecting stability and growth, buoyed by investor interest in Ghanaian banks – which have strengthened their capital bases.

At the end of trading, 1.09 million shares had successfully changed hands, generating a turnover of GH¢2.49 million. The most active stock during the session was MTN Ghana, which accounted for 94 percent of the overall market activity.

Market analysts view the GH¢100billion milestone as indicative of growing confidence in the capital market and a broader shift in investor sentiment.

GSE expects to remain focused on expanding its influence and strengthening investor confidence. With more companies expected to list on the exchange and strategic initiatives in place to support market expansion, the stock market appears well-positioned provide a platform for sustainable wealth creation.