Painfully, political interference and poor transparency have emerged as the most significant roadblocks to oil exploration, as cited by 45 percent of respondents in Deloitte’s ‘Oil and Gas Survey Analysis Report’.

They are seen as major barriers to the sector’s growth, affecting decision-making and project implementation. This echoes concerns prevalent in other industries, where political influences similarly disrupt operations.

In fact, the report comes in the wake of recent remarks by the United States Ambassador to Ghana, Virginia Palmer, who urged government to respect the sanctity of contracts in the oil and gas sector.

It will be recalled that Ambassador Palmer said some investors view Ghana’s business climate as less accommodating to smaller firms, compared with other African oil-producing countries.

Additionally, the country’s crude oil production has been on a steady decline – further compounding concerns in the sector. According to the Public Interest and Accountability Committee’s (PIAC) 2023 annual report, crude oil output dropped to 48.25 million barrels in 2023; a significant fall from its peak of 71.44 million barrels in 2019.

The decline represents an average annual reduction of 9.2 percent over the last four years and a 7 percent drop compared to 2022’s figure of 51.7 million barrels.

Another major concern among respondents is the country’s limited local capacities – financial, human and technological – which are driving companies toward regional and international collaborations.

Despite these challenges the industry remains hopeful, with international collaborations and strategic government incentives seen as key to unlocking the sector’s full potential.

The survey focused on three main themes – financing and investing in oil and gas, the regulatory landscape and sustainability considerations – and had 83 percent of respondents at the executive management level.

These included executive and managing directors, chief operating officers and general managers.

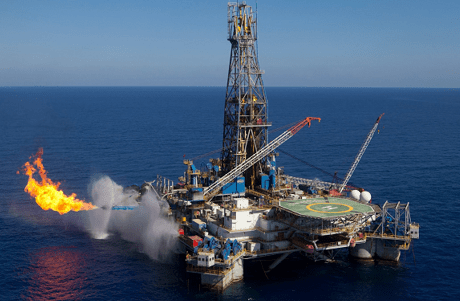

These notwithstanding, 73 percent of respondents view deep-water basins as offering the most promising opportunities for future exploration. With the right investment and strategic management, these deep-water resources could play a critical role in driving the sector’s long-term growth.

For financing, 40 percent of respondents noted that collaboration between local and regional players would enhance financing for oil and gas.

Approximately 60 percent believe indigenous exploration and production (E&P) companies can fund their operations through local capital markets and commercial banks.