By Seth KRAMPAH, Odumasi Krobo

The Manya Krobo Rural Bank PLC at Odumase in the Manya Krobo Municipality in the Eastern Region has held its 43rd Annual General Meeting of shareholders and posted remarkable growth in all financial indicators for the 2023 year under review.

The bank recorded a profit before tax of a little over GH₵ GH¢4.01 million as against GH₵ 3.44 million in 2022 representing an impressive growth of 16.42 %. The growth in the pre-tax profit was driven by a substantial increase in interest income from loans and overdrafts.

The sustained performance trajectory as demonstrated by the net profit of GH¢2.8 million (2022: GH¢2.3 million) reflects the sound policies put in place by the Board and Management.

The Bank demonstrated remarkable improvement in its financial performance in 2023, with total income soaring by 18.69% to GH¢36.08 million compared with GH¢30.4million in the previous year.

It also incurred total expenses of GH¢32.08, which represented an increase of 18.98% over GH¢26.9 million spent in 2022. The expenditure in 2023 included a subsequent impairment of GH¢100,000 in addition to GH¢474,000 posted in respect of the Bank’s bonds under the Domestic Debt Exchange Programme (DDEP).

The Bank recorded a robust balance sheet, with a significant increase in total assets, fuelled mainly by deposits. The balance sheet expanded by 29.88% to reach GH¢174.9 million at the end of 2023 (2022: GH¢ 134.7million), driven by a 29.72% increase in customer deposits, which closed the year at GH¢ 150.6 million (2022: 116.1 million).

The Bank’s growth in loans and advances portfolio was 28.40%, from GH¢33.03 million to GH¢ 42.41 million. Investment securities portfolio experienced a 27.12% surge, from GH¢86.11 million to GH¢ 109.5 million.

The Bank recorded a 13.64% increase in shareholders’ funds, reaching GH¢15.09 million at the end of the year, from GH¢13.3 in 2022. The capital adequacy ratio of 15.48% in December 2023 exceeded the threshold minimum of 10% required by the Bank of Ghana.

This is indicative of a strong capital and liquidity position to undertake more rewarding business activities. The Board and management have assured a regular review of the Bank’s competitive position in the context of its capital base, considering the prevailing systemic risks in the business environment.

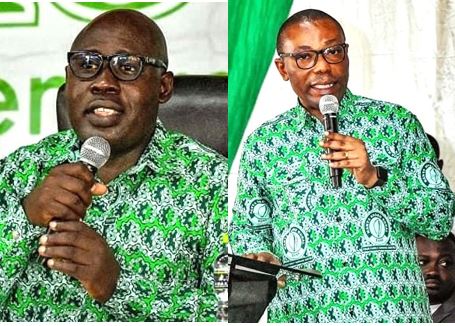

Chairman of the Board of Directors, Patrick Amanor Buckor announced these and more at the bank’s 43rd Annual General Meeting of shareholders held last Saturday at the Agormanya Roman Catholic Parish Hall at Odumasi Krobo.

According to him, Ghana went through some macro-economic challenges that affected the business environment. Notable among these challenges were the effect of the domestic debt exchange programme (DDEP) and the elevated inflation rate. Internal fiscal imbalances and external shocks raised concerns about Ghana’s debt sustainability. These came on the back of the country’s restricted access to the international capital market.

The inflationary rate in the country was high. This fed into increases in benchmark interest rates, leading to high costs of credits and advances. The Central Bank’s increase in the monetary policy rate from 27% in January, progressively to 28%, 29.5% and then 30% in December 2023 was in response to high levels of inflation.

Headline inflation which was 54.10% in December 2022 decelerated to 23.2% in December 2023. The disinflation process was supported by strong monetary policies, relative stability in exchange rates, favourable international crude oil prices and effective liquidity sterilization efforts.

The Ghanaian cedi depreciated by 27.80% against the US Dollar, compared with a depreciation rate of 29.90% in 2022. Similarly, the performance of the cedi against the British Pound and the Euro showed depreciation rates of 31.90% and 30.30%, respectively.

Operational Performance

In spite of the challenging macroeconomic environment coupled with the unprecedented occurrence of DDEP amidst high inflationary rate that pertained during the reviewed year, the bank managed to pull a remarkable operational performance in all key financial indicators as shown in the table.

| PERFORMANCE INDICATOR | 2023 (GH¢) | 2022 (GH¢) | INCREASE | |

| A. | Net Operating Income | 29,127,502 | 24,928,801 | 16.84% |

| B. | Operating Expenses | 25,118,312 | 21,485,106 | 16.91% |

| C. | Pre-Tax Profit | 4,009,190 | 3,443,695 | 16.42% |

| D. | Profit After Tax | 2,814,274 | 2,328,470 | 20.86% |

| E. | Total Deposits | 150,654,502 | 116,095,078 | 29.77% |

| F. | Gross Loans and Advances | 42,407,967 | 33,027,172 | 28.40% |

| G. | Total Investment | 109,468,168 | 86,114,487 | 27.12% |

| H. | Shareholders’ Fund | 15,094,897 | 13,283,325 | 13.64% |

| I. | Total assets | 174,905,740 | 134,669,189 | 29.88% |

Dividend

The Board, after reviewing the performance of the Bank, recommended a dividend of GH¢0.030 per share, subject to the approval of the Bank of Ghana. The Central Bank after reviewing the Bank’s request for dividend payment approved GH¢0.020 per share based on a 37.75% payout from the profit of GH¢2.8 million attributable to the ordinary shareholders for the 2023 financial year.

Corporate Social Responsibilities

The Bank in the year under review, spent a total amount of GH¢252,677 on Corporate Social Responsibility (CSR) activities compared to GH¢203,077 in the previous year. These donations underscore the Bank’s continuous dedication to supporting its various stakeholders in times of need, especially the operational territories of the Bank.

The Bank’s CSR activities focused on health, education, social infrastructure and community development. Notable among these CSR activities were scholarships to brilliant but needy students, donations to some traditional councils in the area in support of festival celebrations, donations to a major hospital in the community and donations in support of the national Farmers Day celebration in the Yilo Krobo Municipality.

Future Outlook

The Chief Executive Officer of the Bank, Godfred Asante Hanson in an interview with Business & Financial Times said the Bank would continue to put in pragmatic measures to ensure positive growth and achievement of the Strategic Plan of the Bank.

He stressed that the Bank would intensify loan recovery, embark on intensive deposit mobilization, strengthen internal controls and maintain quality assets to increase profitability.

He has also emphasised that the Bank’s business focus in 2024 is on driving growth, innovations, efficiency and service as the main pillars in achieving profitability.

Mr Asante Hanson stressed the Bank would develop the human capital to meet demands of functioning profitability as well as achieving the objective of overcoming the shocks of the unfriendly macro economy and rising cost of living as well as its devastating effects.