By Solberg Horve MISHIWO

With technology changing everything, Ghana’s tax system is being overhauled. Given Ghana’s unstable fiscal environment, this progression towards digital tax compliance is not just a trend; it is an urgent need. A digital reform of tax compliance processes by the Ghana Revenue Authority (GRA) could benefit taxpayers and the government.

Historical Context: A System in Need of Overhaul

For decades, Ghana’s tax system has been inefficient and inadequate. Dr. Kwame Anyimadu-Antwi, head of the University of Ghana’s Department of Economics, says, “Ghana’s tax-to-GDP ratio has remained unchanged at 12-14%, which is significantly lower than the threshold of 20% that is recommended for sustainable development.” This underperformance may be due to fundamental difficulties that conventional approaches have not yet solved.

Before digital technology, economic activity was poorly understood, compliance costs were high, resource allocation was inefficient, and corruption was common. These challenges have kept Ghana economically disadvantaged.

A more thorough investigation reveals that one of the leading causes of this ineffective tax system is the prevalence of cash transactions in Ghana’s informal sector, which contributes 30% of GDP.

Tax officials at the Ghana Revenue Authority have struggled to track and evaluate these taxable transactions. Another problem often cited is that manually processing tax returns has caused delays and inaccuracies that annoy tax authorities and taxpayers.

Small and Medium-sized Enterprises (SMEs) also suffer from high compliance expenses. SMEs may spend up to 15% of their yearly sales on tax compliance. This level is unsustainable for tight-margin firms.

Global Context: Ghana in the African Tax Landscape

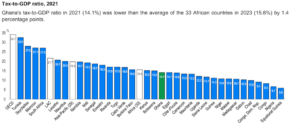

Recent data paints a sobering picture of Ghana’s position in the African tax landscape. In 2021, Ghana’s tax-to-GDP ratio stood at 14.1%, lagging behind the average of 33 African countries, which reached 15.6% in 2023. This 1.4 percentage point gap underscores the urgency of the GRA’s digital transformation efforts.

For more on the trend chart, see https://www.oecd.org/tax/tax-policy/oecd-classification-taxes-interpretative-guide.pdf

Mr. Kofi Nti, former Commissioner-General of the GRA, emphasises the global perspective: “We’re benchmarking against global leaders to create a world-class tax system that can propel Ghana into the ranks of advanced economies.” Indeed, countries like Estonia, Singapore, and Sweden have demonstrated the transformative potential of digital tax systems, achieving tax-to-GDP ratios exceeding 30%.

The success stories of these nations offer valuable insights for Ghana. Estonia, for instance, implemented its e-Tax system in 2000, allowing citizens to file taxes online in just five minutes. This system has contributed to Estonia’s impressive 99% compliance rate for income tax returns. Singapore’s IRAS (Inland Revenue Authority of Singapore) digital services have similarly revolutionised tax administration, with 100% of individual income tax returns filed electronically in 2020.

The GRA’s Digital Vision: A Holistic Approach

Digital ecosystems are essential to the GRA’s aim to revolutionise tax administration. GRA senior adviser Dr. Ama Sarpong asserts, “We do not limit our digital strategy to technology adoption. Our complete approach to reinventing tax administration for the 21st century puts taxpayers first.” Essentially, the digital ecosystem was projected to have six main components:

- Integrated Tax Application and Preparation System (iTaPS)

The GRA’s digital transition centres on iTaPS. This complete platform simplifies income tax, Value-added Tax (VAT), and customs costs for taxpayers. Tax compliance is easier with the system’s real-time processing, automated tax computation, and document pre-filling. Mr. Ernest Akore, GRA Chief Information Officer, describes the system’s adaptability as a design for scalability and flexibility to constantly improve by considering user input and new technology.

- Digital Tax Identification Number (TIN) System

The new TIN system’s structure serves taxpayer identification and data management. Biometric integration with national identification and corporate registration databases boosts security. This link is expected to prevent fraud and improve taxpayer profiles.

- Data Analytics and Artificial Intelligence Hub

The GRA is establishing a centralised data analytics centre to harness the power of big data and Artificial Intelligence (AI). This hub will enable predictive modelling for tax revenue forecasting, anomaly detection for identifying potential tax evasion, and sentiment analysis of taxpayer feedback for service improvement. Dr. Kwesi Ampofo, Lead Data Scientist at GRA, shares early successes: “Our AI models are already yielding insights that were previously unattainable. For instance, we’ve identified patterns in VAT non-compliance that have led to targeted interventions, resulting in a 15% increase in VAT collections in pilot areas.”

- Mobile-First Approach

Recognising Ghana’s high mobile penetration rate (about 130% as of 2023), the GRA has adopted a mobile-first strategy. This includes the development of a GRA Tax App with features like tax calculators, payment options, and educational content. The agency has also implemented USSD-based services for feature phone users and integrated with mobile money platforms for micro-payments from informal sector operators.

- Blockchain for Transparency and Trust

The GRA is piloting blockchain technology to enhance transparency and build trust in the tax system. Applications include immutable audit trails for all tax transactions, smart contracts for automated tax assessments and refunds, and decentralised storage of tax records for enhanced security.

- API Economy and Ecosystem Approach

The GRA fosters an ecosystem of third-party developers and service providers through open APIs. This approach encourages innovation in tax-related services and products, allows for seamless integration of tax compliance into business processes, and enhances data sharing across government agencies.

Stakeholder Perspectives: A Mixed Bag of Reactions

Several stakeholder groups have responded differently to the digital revolution of the Ghanaian tax system. According to Gold Fields Ghana’s CFO, Mr. Kweku Asante, “the new system has streamlined our tax compliance processes dramatically; our finance team can now concentrate more on strategic projects because there has been a 40% drop in man-hours devoted to tax issues.” The benefit of the new systems extends beyond time savings for major enterprises. When such technology-based real-time tax assessments are made, it makes it possible to improve cash flow management. International businesses in Ghana have also benefited from the enhanced ability to address tax concerns swiftly.

However, the actual digital transformation process has been difficult for some organisations. Some firms had early difficulty connecting their financial systems with GRA platforms, and the demand for more regular and thorough reporting has required internal process improvements and personnel training. SMEs, for instance, have had difficulties from technological innovation as the new systems demand more technological awareness and adoption than they are used to. This is not to say that the system has not also helped SMEs through the decreased need for tax professionals and increased access to financial services made possible by the verified tax system. Due to time savings, many SME owners may now concentrate more on strategic planning and their core operations. However, digital literacy remains challenging for SMEs, especially those in rural or traditional industries. As some SME owners have expressed concerns regarding data privacy and security, the GRA must continue to educate and build trust.

In economic planning and administration, the ability to access real-time economic data will likely change policymaking. The government can now quickly evaluate tax adjustments, making economic management more flexible and responsive. This transformation in tax administration is linked to the automation of compliance duties, which sets the grounds for high-level tax strategy and planning.

Technological Infrastructure and Implementation The success of Ghana’s digital tax transformation hinges on robust technological infrastructure and effective implementation strategies. The GRA, in collaboration with the National Information Technology Agency (NITA), has invested heavily in building a state-of-the-art digital backbone. First, high-availability data centres with disaster recovery capabilities, secure government cloud services for data processing and storage, and a countrywide internet network are needed for accessibility. The cybersecurity operations centre should focus on real-time threat monitoring and response. While progress is slow, the NITA Director of IT Infrastructure, Kwasi Owusu, has continually noted, “We are building a digital backbone that goes beyond tax administration.” When this happens, Ghana can execute its digital governance objectives and lead Africa in e-government services.

To prevent disruptions and guarantee smooth acceptance, deployment should be meticulously scheduled. An Agile development method is recommended for quick iteration and improvement, stakeholder communication and feedback loops, and a gradual rollout with pilot projects in major economic sectors used in this strategy.

Creating a thorough GRA staff change management and training plan is also important to the implementation approach. This training programme gives General Accounting Department staff the skills and expertise to succeed in the new digital environment and represent taxpayers supporting the change.

Conclusion: A New Era in Fiscal Governance

The digital transformation of tax compliance in Ghana represents a paradigm shift in fiscal governance. It’s a bold attempt to redefine the relationship between the state and its citizens, leveraging technology to foster transparency, efficiency, and economic growth. Mr. Ken Ofori-Atta, the former Minister of Finance, encapsulates the vision: “This digital journey is about building a more prosperous, transparent, and inclusive Ghana. It’s about creating a system where every citizen feels empowered to contribute to our nation’s development.” As Ghana embarks on this ambitious journey, the world watches with keen interest. The success of this initiative could set a new standard for fiscal management in the developing world, creating a true win-win for both the Ghana Revenue Authority and taxpayers.

The coming years will determine whether this digital dream will become a transformative reality for Ghana’s economy. Challenges remain, from bridging the digital divide to ensuring data security and overcoming resistance to change. However, the potential rewards – increased tax revenue, improved economic planning, enhanced transparency, and a more inclusive financial system – are immense. As Ghana continues to refine and expand its digital tax ecosystem, it stands poised to become a beacon for other developing nations seeking to modernise their fiscal systems. The journey ahead is complex and fraught with challenges, but it also brims with opportunity. If successful, Ghana’s digital tax transformation could mark the beginning of a new era of economic prosperity and fiscal responsibility, not just for Ghana but for the entire African continent.

References

1 African Tax Administration Forum (ATAF) – Digital Transformation in African Tax Administrations: https://www.ataftax.org/digital-transformation-in-african-tax-administrations

2 Ghana Revenue Authority Official Website: https://gra.gov.gh/

3 World Bank Data on Tax Revenue (% of GDP) for Ghana: https://data.worldbank.org/indicator/GC.TAX.TOTL.GD.ZS?locations=GH

4 IMF Country Report on Ghana (2022): https://www.imf.org/en/Publications/CR/Issues/2022/07/13/Ghana-2022-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-the-520418

The writer is a seasoned finance expert with extensive experience in tax consulting, management consulting, and auditing. He has provided strategic guidance to numerous local and multinational businesses by offering valuables insights and expert opinion on financial and tax matters. He is a chartered Accountant and Chartered Tax Practitioner and a member in good standing of the Chartered Institute of Taxation, Ghana and Institute of Chartered Accountants, Ghana.

He can be reached via:

M: 0248 887 053

E: [email protected]

LinkedIn: Solberg Horve Mishiwo | Twitter: @Solberg_Horve