“A brand is defined by the customer’s experience. The experience is delivered by the employees” ….. Shep Hyken

Last week, I highlighted a series of concerns currently being expressed among some bank staff working in the digital banking era. Their concerns mostly harbour around the positive but intrusive 4th Industrial Revolution where most transactions are powered by artificial intelligence, and the power of collaboration with fin-techs is taking banking to a new level. It is like a roller coaster of highs and lows. Highs, because of the enhanced speed and delivery of service. Lows, because of the reduced need for human intervention in some of the services delivered, leading to the loss of jobs.

The Dilemma of some Executives and Managers

The problem is not only about branch banking staff or front- line staff. The potential loss of jobs in the financial services industry is real. Let us examine this real-life situation of an executive, extracted from “The Financial Brand” newsletter in February 2020:

“At the beginning of the previous decade, I was working as a strategic consultant for a large marketing services organization serving the financial services industry. I was 55 years old, and concerned that the way banks and credit unions were going to connect with consumers would change drastically, moving from direct mail to digital communications. Just as concerning was the prospect of clients assuming I was too old to keep pace with these changes relatively late in my career.

Rather than being complacent and continuing with “business as usual,” I decided that I needed to embrace the marketplace changes that were inevitable, take personal risks, and disrupt my career that had been quite successful for more than 30 years. I decided that I needed to learn new skills and build a personal brand that would show that I was still relevant to clients, prospects and peers.

This is the same crossroads that every financial institution executive and manager faces today. Will people who have built successful careers for decades be able to adjust for the massive changes taking place? Or will they hope that change will not impact them, or that they will retire before they are forced to change or asked to leave the organization?”

The Crossroads

Many bankers have reached a crossroad, with several questions on their minds: “Shall I quit and move onto another industry? What is my future in banking? What courses can I take to make myself more relevant and stay?”

Lifelong Education always ensures Relevancy

At a period of continuous massive change in the financial services sector, coupled with closure of financial institutions, one should not be impervious to learning what went wrong and learning how to stay relevant to ensure survival in the marketplace as well as for ongoing survival for businesses. These days one should not stop learning when one graduates from school. Today’s successful leaders need to learn everything that is relevant to their businesses. The advent of sandwich programs, evening and week-end courses has helped many bank staff re-enter the formal learning system while others either rely on training offered by their institutions, or pursue self-development through reading, videos, podcasts, etc. In the new era of digital banking, there is a need to learn new skills in business today including coding, digital analytics and others. There is an obvious need for mastery of essential knowledge to apply data handling methods to inform business and financial decisions. While some organizations are embracing this need by committing to training their employees, most organizations expect employees to learn on their own.

The business of banking

The latest regulation in Ghana, The Banks and Specialized Deposit Institutions Act 930 (2016) was established to cover various activities in the banking sector:

(a) acceptance of deposits and other repayable funds from the public;

(b) lending;

(c) financial leasing;

(d) investment in financial securities;

(e) money transmission services;

(f) issuing and administering of means of payment including credit cards, Travellers cheques, bankers’ drafts and electronic money;

(g) guarantees and commitments;

(h) trading for own account or for account of customers in:

(i) money market instruments, (eg T/Bills <12 mths),

(ii) foreign exchange, or

(iii) transferable securities; (CDs)

(i) participation in securities issues and provision of services related to those issues;

(j) advice to undertakings on capital structure, acquisition and merger of undertaking;

(k) portfolio management and advice;

(l) keeping and administration of securities;

(m) credit reference services;

(n) safe custody of valuables;

(o) electronic banking;

(p) payment and collection services;

(q) bancassurance;

(r) non-interest banking services; and

(s) any other services that the Bank of Ghana may determine.”

What a tall list! This should give consolation to bank staff that for so long as they remain in banking, they can still be marketable in many other areas, if they have the expertise to move into them. When you scrutinize the list of activities carefully, you will realize that most of them are now performed digitally, as a means to ensure seamless delivery plus greater speed and accuracy.

Another tool to take advantage of is ChatGPT, where artificial intelligence has gone a step further to direct enquiries into the appropriate areas for learning and research purposes, without re-inventing the wheel.

Paradigm shift in skills required for Banking

There has been a shift over the past decade in the type of skills that leaders say they are looking for. Banks are looking for employees who can work well with new technologies but also display leadership, creativity, empathy and curiosity. This shows that it is not enough to have only technical skills related to digital services and artificial intelligence. In making reference to the permissible activities, banks have collaborated with fin-techs to perform transactional services in all aspects of banking.

Let us take some of the services listed in Act 930, and see how useful employees can benefit from them. These are money market instruments, foreign exchange, transferable securities; (CDs), participation in securities issues and provision of services related to those issues, advice to undertakings on capital structure, acquisition and merger of undertaking, portfolio management and advice, keeping and administration of securities, credit reference services, safe custody of valuables. The transactional processes can best be done by digital means for speed and accuracy.

Re-Tooling Bank staff

Since banking is a human institution with much concentration on customer-centrism, Management of banks would not normally just go out on a recruitment spree to bring on board new functionaries for the sake of it. While finding skilled workers and retraining current employees is imperative, digitalization always result in some job losses because some employees would not be employable after the process or may not be able to adjust well in the new digital era. This phase needs to be handled with tact and transparency, with both the customers and the employees at heart. In our part of the world, with high illiteracy rates, what are the customers’ priorities? A millennial banking in an upstage urban branch only needs digital banking to survive. They do not have time to meet bank functionaries unless there is a problem. However, an illiterate customer in a small remote branch in a rural community prefers to engage with people, since he or she may not understand the intricacies of some transactions. Re-tooling bank staff should never be cast in stone, because bankers need to know their customers’ personalities, needs and expectations in every setting. Identifying employees who are not too technologically inclined but more relational inclined do best in customer advisory, assisting with those who need simple services.

Staying Relevant in The Branch Space

Accenture’s research into what human characteristics were vital in yesterday’s and in today’s American banking space is interesting. It was noted that the focus in yesterday’s banking space was on being service-focused, procedural, re-active and hierarchy-driven. On the other hand, they found that today’s market space focuses on being digitally-savvy, open and communicative, customer-oriented, results-driven, advice-focused, teamplay, energetic and self-motivated.

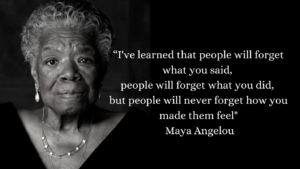

There’s been a lot of discussion in the industry about the future of the branch. There’s no arguing that branches are expensive, and many players have even argued that they’re no longer relevant in a “digital world.” However, branches represent an opportunity for banks to differentiate and build loyalty with their customers. This can be through great, advice-driven experiences with frontline staff. There are several benefits of moving frontline staff from transactional to advisory positions. Bank branches now have less transactions and rather need more expertise. What customers now need is guidance and advisory services. After all is said and done, Banking is a “feelings business”

TO BE CONTINUED

ABOUT THE AUTHOR

Alberta Quarcoopome is a Fellow of the Institute of Bankers, and CEO of ALKAN Business Consult Ltd. She is the Author of Three books: “The 21st Century Bank Teller: A Strategic Partner” and “My Front Desk Experience: A Young Banker’s Story” and “The Modern Branch Manager’s Companion”. She uses her experience and practical case studies, training young bankers in operational risk management, sales, customer service, banking operations and fraud.

CONTACT

Website www.alkanbiz.com

Email:alberta@alkanbiz.com or [email protected]