By Clara ADADE

Social trends are changing; environmental issues are constantly increasing; day-in-day out, the public expect some sort of accountability and good governance practice from the Companies whose operation create environmental and social challenges. This is what birthed ESG reporting.

ESG in itself stands for Environmental, Social and Governance and represent pillars that are used to measure both financial and non-financial risk and opportunities that are inherent in a company’s daily operation.

These pillars generally help sustainable financiers assess whether the activities of the Companies they fund are environmentally sustainable, promote good corporate governance practice and is supported by a balanced and healthy social capital.

Many ESG problems are directly attributable to externalities resulting from the operations of Companies. To an investor, investing in an ethical company can be interpreted as – not just an interest in immediate return but a concern to know how a Company manages it risk.

Be it as it may, managing externalities tell the story of a Company that is not just interested in profitability but also keen to create an impact in the community they thrive in. This creates brand loyalty and is likely to impact future trends in return. Truth be told, with the emergence of the media, the greatest asset of a company is its goodwill which generally will ride on the market’s perception of the company.

This article explores the history behind ESG reporting, models used in reporting, how ESG is integrated into investment strategies, benefits, challenges and future outlook of ESG reporting.

Understanding ESG Reporting

ESG reporting is not just an addition to the complexities in reporting but a tool for companies to communicate clearly and for stakeholders to understand, evaluate and make decisions about a Company’s sustainability practices, initiatives and outcomes.

ESG reporting also known as sustainability reporting is simply for companies to disclose their performance and impact on ESG matters.

Reasons why stakeholders will require ESG reporting is;

- To obtain detailed and transparent information about a company’s governance, social, and environmental performance.

- To identify and evaluate substantial ESG risks and opportunities that may have an impact on a company’s long-term viability and financial performance.

- To help firms find areas where they can increase efficiency, cut costs, boost brand loyalty, and attract customers and investors.

ESG reporting is not an emerging concept. It can be traced to the 50’s when Howard Bowen created awareness about corporate social responsibility through the release of his book – Social responsibility of the business man. In the book, Bowen explored the concept of corporate social responsibility and argued that, businesses have a broader responsibility beyond maximizing profit and serving shareholders. This laid the foundation for discussions and debates about the ethicl implications of business decisions and practices.

Although Bowen’s book was not readily accepted at the time, the rise of black power, women’s right, and other soacial intervention measures compelled many stakeholders and investors to start paying closer attention to social issues.

Following this evolution, the market started raising concerns about environmental issues such as land degradation, global warming, over pollution, green house emission, and health issues caused by industrial activities.

In the 80’s the UN established an autonomous body to investigate the connection between human activities and the environment and what it meant for economic and environmental policy.

This was what birthed the release of the “who care wins report” by the United Nations Global Compact (UNGC) in 2005. This report played a significant role in advancing the business case for corporate sustainability and responsible business practice. It helped raise awareness among companies, investors, policy makers and other stakeholders about the potential benefit of integrating sustainability into business strategies and operations.

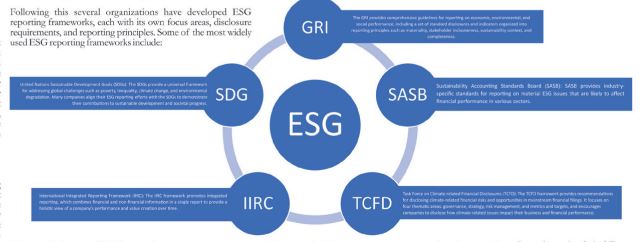

Following this several organizations have developed ESG reporting frameworks, each with its own focus areas, disclosure requirements, and reporting principles. Some of the most widely used ESG reporting frameworks include:

Currently, about 29 countries (including Japan, UK, Singapore) across the globe maintain some degree of mandatory ESG disclosure regulation. In Ghana however, there are no specific legislative requirements that enforces ESG reporting. Despite this, some provisions such as the Environmental Protection Agency Act, 1994 (Act 490) mandate some form of ESG reporting.

Investor View and how to ESG in Investment Strategies

Many investors today, have developed interest in the daily operations of businesses starting from the supply chain, how eco-friendly raw materials are and drilling down to how industrial waste are even discharged. This is forcing many businesses to re-look at their operations including their procurement process to ensure their operations are ethical. Research has shown that good ESG score and corporate performance are intrinsically intertwined and businesses that integrate ESG into their businesses are able to gain competitive advantage.

ESG integration is an ongoing process and varies among companies. There are varying approaches to integrating ESG into investment strategies, and the strategy selected is dependent on a firm’s existing structure, processes and values. Some of the most widely used strategies are:

- ESG integration – Integrating the ESG criteria into the traditional financial analysis

- Environmental traditional planning – Here, Investment strategy is basically centered around environmental sustainability

- Norm based screening – aligning investment analysis with those set by international bodies such as the UN.

Regardless of the strategy adopted, investors can create portfolios that do not only provide returns but also contribute to the greater good. Despite the long-term benefit that integrating ESG promises, there has been questions on whether there exists a trade-off between returns and responsible investment.

Do you give up returns to invest responsibly?

Contrary to the perception that responsible investing requires sacrificing return, evidence suggest that responsible investing can align with financial performance as there is a positive correlation between ESG integration and financial performance. Also addressing ESG risk gives a company a competitive advantage and helps boost financial performance. ESG matters are not a walk in the park. It has presented many challenges over the years including:

- Lack of a single reporting standard: There is no one legislative framework or widely accepted standard for ESG reporting, resulting in conflicting and inconsistent data requests and disclosures.

- Data availability and quality: Collecting relevant and trustworthy data on ESG measures can be difficult, particularly for smaller or privately held businesses that are not obligated to report them.

- Materiality assessment: Determining whether ESG concerns are essential and relevant to an organization is subjective and varies based on the stakeholder’s perspective.

- ESG reporting can result in greenwashing which occurs when organizations exaggerate or misrepresent their ESG performance or effect in order to attract investors or customers, compromising the credibility and usefulness of ESG reporting.

Future Outlook

The future of ESG reporting can be viewed from at least three different angles. These include legal reforms, industry convergence around specific frameworks, and inter-framework consolidation.

Under the legal reforms for example, the US sustainability finance has included Corporate Sustainability Report Disclosures (CSRD), the EU taxonomy and Sustainability Finance disclosures (SFDR), which will oblige corporations to disclose additional ESG-related information. Companies will be required to disclose their policies and targets including reduction targets. This will serve as a performance measurement tool.

Conclusion

ESG has come to stay and is gradually becoming the driver of key discussions which influences decisions among many stakeholders. ESG frameworks are being updated to promote comparability across board. Companies are being pushed to assess the impact of their operations on the environment and set targets to reduce impacts. The focus of the public and the market have gradually shifted to companies with responsible operations. Business leaders are creating a niche for themselves using their ability to mitigate ESG related risk. It is only empirical for investors to identify portfolios that serve the good of all while not trading off returns.

Clara is a student of ACCA with a keen interest in international reporting issues.