By Joshua Worlasi AMLANU [email protected]

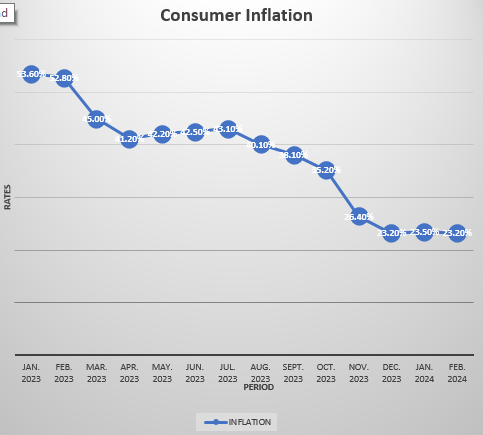

Consumer inflation rate eased back to 23.2 percent in February 2024, down from 23.5 percent in January, according to data from the Ghana Statistical Services (GSS), defying market expectations of an increase.

Despite the drop, analysts warn that inflationary pressures remain elevated and March figures could see a spike.

The marginal 0.3 percent decrease in February was driven by a slowdown in both food and non-food inflation. Non-food inflation eased from 20.5 percent in January to 20 percent, while food inflation continued its downward trend, reaching 27 percent.

Key contributors to the high inflation rate included alcoholic beverages (38.5 percent), restaurants and accommodations (31.9 percent), personal care (30.3 percent), health (28.1 percent), food and non-alcoholic beverages (27 percent), recreation and culture (25.6 percent), and furnishing and routine household maintenance (25.4 percent).

The month-on-month inflation between December 2023 and January 2024 was 2 percent, the highest since July 2023, when it stood at 3.6 percent.

Regionally, the Volta Region recorded the highest inflation at 33.9 percent, while the Greater Accra Region had the lowest at 14.5 percent. Inflation for locally produced items dominated at 24.6 percent, while imported items eased to 21.1 percent.

Expectations of March inflation

Despite the slight easing in February, analysts anticipate inflationary pressures to intensify in March. GCB Capital stated: “We reiterate our expectation of further increases in inflation through March 2024 following the surprise 30-basis-point increase in January”.

The risks to the inflationary curve remain elevated in the near-term after a period of sustained disinflation in the last six months, ending January 2024.

Similarly, GCB Capital is suggesting that inflation could reach 25-26 percent by March, driven by base effects and currency pressures, before returning to a disinflationary path from April.

These expectations are compounded by recent developments, including a 4.6 percent increase in fuel prices in early March, leading to a 30 percent hike in transport fares effective March 7. Additionally, delays in reaching an agreement with Eurobond holders and ongoing intermittent nationwide power cuts have further fuelled concerns about rising inflation.

In light of these factors, Apakan Securities anticipates that the central bank will hold the policy rate at its March Monetary Policy Committee meeting, stating: “We believe this will prompt the central bank to hold the policy rate in its March MPC meeting scheduled at the end of the month”.