Debt servicing costs are increasing rapidly while annual refinancing needs have tripled to about US$60billion

As 2024 starts, the good news is that there haven’t been any notable requests by a low-income country for comprehensive debt relief since Ghana’s, more than a year ago. Despite this, vulnerabilities remain, with high debt servicing costs a growing challenge for low-income countries.

Financing pressures due to relatively high interest payments and the pace at which low-income countries need to repay debt are straining budgets. That prevents these countries from spending more on essential services or the critical investment needed to attract business, create jobs, improve prosperity, and build climate resilience.

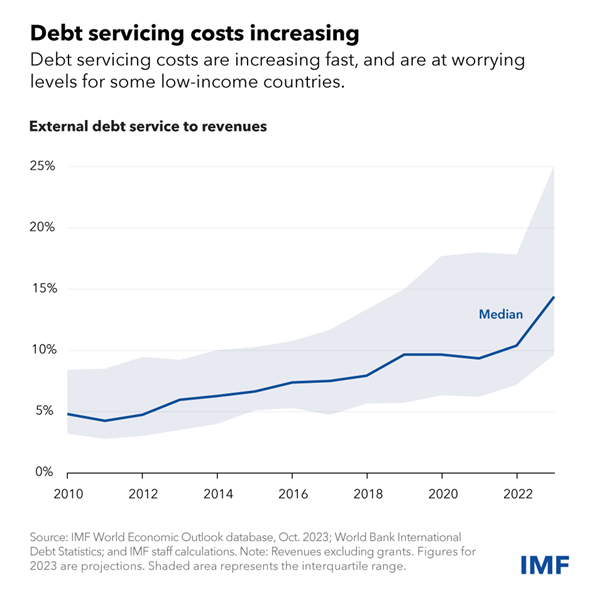

One important metric is the share of revenues the government collects from its population through taxes and other fees that goes to pay its foreign creditors. While the scale of the burden differs greatly across countries, it’s generally about two and a half times higher than a decade earlier. This means for a typical low-income borrower, the share has risen to about 14 percent, from about 6 percent, and as much as 25 percent, from about 9 percent in some economies. This is one of the key indicators used in the framework for assessing debt sustainability that signals a country might be at risk of needing financial support from the IMF or of missing a debt payment.

Low-income countries also have significant debt repayments falling due in the next two years. They need to refinance about US$60billion of external debt each year, about three times the average in the decade through 2020. But with many competing demands for financing, including from advanced and emerging market economies that are also trying to adapt to climate change, there’s a significant risk of a liquidity crunch—failure to raise sufficient financing at an affordable cost. That could in turn lead to a destabilising debt crisis.

To address this financing challenge, we must understand why it’s happening and what affected countries and the broader international community can do to help.

Exacerbating liquidity squeeze

One factor was higher government borrowing and deficits to mitigate the impact of the pandemic and other external economic shocks. This has increased the level of debt and consequently the cost of servicing it. It’s encouraging that this trend is reversing as countries bring primary deficits back in line with pre-pandemic levels.

In addition, central banks have significantly raised borrowing costs to tame inflation. That makes it costlier for governments to raise new debt or refinance existing debt. While central banks may be done raising rates, it is not clear when they will start to cut, and this uncertainty may be reflected in volatile financial market conditions.

Low-income countries have also increasingly borrowed from the private sector—with about one third of financing coming from private creditors in the last decade, compared with about one fifth in the previous decade. This reflected a slowdown in financing from multilateral development banks (MDBs) in the earlier part of the decade and through official development assistance (ODA) agencies over 2020-22 compared to borrowing needs. This shift has increased both financing costs and vulnerability to global financial shocks.

Avoiding a costly debt crisis

Building resilience in the face of these trends requires countries to act. Some countries have made progress— for instance, Angola, The Gambia, Nigeria and Zambia have taken steps to implement significant energy subsidy reforms to create space for development spending.

But many are lagging behind, especially in efforts to increase revenues, such as broadening the tax base, reducing tax exemptions, and increasing the efficiency of tax administration. For instance, the typical sub-Saharan African country raised only 13 percent of gross domestic product in revenues in 2022, compared with 18 percent in other emerging economies and developing countries, and 27 percent in advanced economies.

And those with high debt vulnerabilities can’t afford to wait. Policy reforms are needed to boost growth and capture more revenue from that growth, for instance, through tax reforms. This will directly improve countries’ key debt metrics and ensure they can avoid a costly debt crisis.

However, reforms take time to deliver results; so countries should also proactively work on mobilising funding at lower costs, in particular grants. For some, this might mean turning to the IMF for help. This is, indeed, one of our key roles—helping countries bridge a financing gap while working with them to strengthen their policy frameworks. Other partners, particularly MDBs or providers of ODA, may also be willing to extend financing, especially to support reforms that help address global challenges such as climate.

And official creditors face their own limitations. Efforts to ensure the IMF has sufficient resources to meet our members’ needs, together with efforts to scale up MDB support, are critical. In the same vein, efforts to protect ODA budgets will ensure the least fortunate have the opportunity to participate more fully in the global economy.

More systemic solutions needed?

It is not yet clear whether country-driven actions and scaled-up multilateral financial support will be sufficient to address these challenges, but some analysts have begun questioning whether a more systemic approach to reprofiling or refinancing debt is needed. Low-income countries can already seek debt relief through the Group of Twenty’s Common Framework, including to reduce their immediate debt servicing burden. To date the Common Framework has only been used to help countries reduce the level of debt –with the exception of the debt standstill agreed for Ethiopia. But it was also intended to provide more temporary liquidity relief. However, to be effective in that role would require greater predictability and speed. There has been progress—the agreement on a debt treatment by official creditors for Ghana took less than half the time it took for Chad two years earlier—but continued engagement on technical issues, including through the Global Sovereign Debt Roundtable (established last year by the IMF, World Bank and G20), is important.

Overall, the funding squeeze facing low-income countries must be closely monitored. A scenario where sufficient low-cost funding materialises is possible, but there are also scenarios where more ambitious reforms, stronger international cooperation, and faster improvements in the global debt restructuring architecture may be necessary to help them emerge stronger and more resilient.

—Chuku Chuku, Neil Shenai and Madi Sarsenbayev contributed to this post.