Key findings

- Slowest rise in new business in nine months

- Rate of job creation at 20-month high

- Inflationary pressures remain relatively muted

Business activity was unchanged in Ghana during October as the rate of new order growth softened amid challenging financial conditions. That said, new business continued to increase over the month and the rate of job creation hit a 20-month high as business confidence strengthened. Input costs and output prices rose again, but at relatively modest rates.

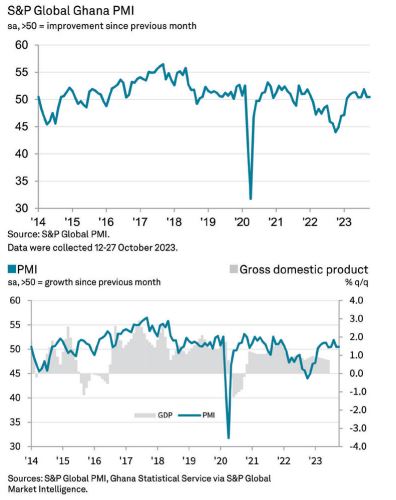

The S&P Global Ghana Purchasing Managers’ Index was unchanged at 50.5 in October, thus remaining above the 50.0 no-change mark for the ninth consecutive month and signalling a modest monthly improvement in the health of the private sector.

Helping to support the latest improvement in business conditions was a ninth consecutive monthly expansion in new orders as firms were reportedly able to secure new customers amid relatively stable economic conditions. That said, money shortages and financing issues limited the pace of expansion, which was the softest in the current growth sequence.

These factors also acted to limit business activity at the start of the fourth quarter. Output was unchanged over the month, thereby ending a period of expansion which began in

February. Those firms that registered a rise in activity linked this to sustained new order growth.

The ongoing improvements in new orders encouraged companies to take on extra staff and work to fill outstanding vacancies with permanent hires. As a result, employment increased at a solid pace, and one that was the most marked since February 2022.

This expansion in capacity, alongside softer growth of new orders, meant that firms were able to keep on top of workloads in October. Outstanding business decrease solidly, and to a slightly larger extent than was the case in September.

In line with the trend in new business, purchasing activity increased at a slower pace in October. Where input buying rose, this was linked to growth of new orders and confidence in future demand inflows.

Confidence in the future path for business activity was also signalled, with optimism rising to a nine-month high amid hopes for a stable exchange rate over the coming

year. Exactly 79% of respondents predicted an expansion in output over the next 12 months.

Rising purchasing activity helped firms to expand their inventories, with faster supplier deliveries also supporting stockbuilding efforts. In fact, inventories increased at a solid pace, and one that was the joint-fastest in almost five-and a- half years.

The rate of overall input cost inflation ticked higher in October, but remained relatively muted and much softer than seen during 2022. Sharper increases in both purchase prices and staff costs were signalled.

Purchase price inflation was mainly due to currency weakness, while staff costs increased on the back of hiring activities and pay rises to help workers with rising living costs.

Companies in Ghana responded to higher input costs by increasing their own selling prices again. The rate of inflation was solid and broadly in line with that seen in September

Comment

Andrew Harker, Economics Director at S&P Global Market Intelligence, said:”Demand growth continued to soften in Ghana’s private sector during October, prompting companies to pause the recent spell of expansion in business activity.”

The labour market remained a key source of positivity, however, with job creation hitting a 20-month high.

Business confidence was also up, suggesting that firms are expecting the current slowdown to be more of a softpatch than a downturn in activity.”