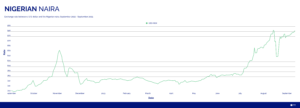

Nigeria: We’ve been here before — the naira shatters its previous resistance level.

Ghana: August Inflation eases in Ghana.

South Africa: The rand shows initial gains on the back of strong Chinese lending figures.

Egypt: Annual urban inflation reaches a record 37.4% in August.

Kenya: Forex reserves drop as the shilling weakens.

Uganda: Uganda has licensed its first Islamic bank after waiting 20 years.

Tanzania: The shilling continues to trade within a narrow range against the U.S. dollar

XOF Region: Record figure of $350 million invested by the IFC in 2022.

XAF Region: Consumption increases in private sector allowing an overall increase to the GDP.

Nigerian Naira (₦)

Compiled by Ikenga Kalu

The naira continued its steady depreciation over the past week, falling from USD/NGN 930 to 945. The 940 level was the previous resistance band encountered before the massive trend reversal observed in mid-August, supported by lofty declarations from the central bank.

The Nigerian Association of Road Transport Owners, who are generally responsible for hauling fuel across the country, have called on the federal government to stop the proposed imposition of a 7.5% VAT tax hike on the cost of diesel. The association claims that such an increment could disrupt fuel distribution across the country. This springs from the fact that truck owners would not be able to pass down the extra costs to the fuel retailers who have already been mandated to sell fuel at a pegged price.

FX demand in the parallel market seems quite heavy, with a few trades reported to have tested the 950 level. We expect further NGN depreciation in the coming days in the absence of further attempts by the central bank to forestall the naira’s decline.

Further reading:

Punch — 7.5% VAT on diesel may disrupt fuel supply – NARTO

Ghanaian Cedi (GH¢)

Compiled by Sakina Seidu

The exchange rate for USD/GHS has inched up to 11.62 this week.

Inflation rate for the month of August saw a 200 basis point decrease to 40.1% recorded. Prices of food, both locally produced and imported, saw a significant dip, contributing to this decrease. With year-on-year inflation climbing since April, the month of August’s drop serves as a welcome respite to consumers.

Although this is in line with Fitch Solutions prediction of the cedi ending the year at USD/GHS 11.40, the trend in the past years has been the opposite, where the cedi loses its value rapidly towards the end of the year. This has been the case as demand for the dollar increases to accommodate a surge in purchases for the Christmas festivities.

The African Union has passed a resolution to establish a self-funded regional rating agency in 2024. This is expected to tackle the perceived biases that arise from global rating agencies on African states and economies.

With prices in goods and services falling, we expect the GHS to stabilize and minimum movement in exchange rates for the coming week.

Further reading:

Ghana web — Cedi sells at GH¢11.65 to $1, GH¢11.06 on BoG interbank as of September 13

Myjoyonline — Inflation for August 2023 drops to 40.1%

Myjoyonline — Cedi to end 2023 at ¢11.40 to a dollar – Fitch Solutions

Ghana web — African Union to establish regional rating agency in 2024 to address bias assessments

South African Rand (R)

Compiled by Alex Barmuta

The South African rand had a good start to the week, opening at USD/ZAR 19.0449, before gaining some ground against the dollar. As of Wednesday afternoon, the rand was trading around 18.80.

Locally, an increase in rotational power cuts initially caused some rand weakness. However, this did not last long, as the rand found some strength on the back of a new round of stimulus optimism coming from China, as well as an increase in new Yuan loans announced by the People’s Bank of China.

Looking ahead, we can expect the rand to trade in the USD/ZAR 18.75–19.00 range. A move back above 19.00 is possible if there is a shift in sentiment due to the aforementioned increase in power cuts.

Further reading:

Mybroadband — Eskom warns of increased load-shedding — as South Africans suffer through Stage 6

Egyptian Pound (EGP)

Compiled by Mitchell Diedrick

The Egyptian pound remained fairly stable this week at USD/EGP 30.89 in midweek trading and depreciated marginally from USD/EGP 30.835 observed in the latter part of last week.

Annual urban inflation reached a record 37.4% in the month of August, while annual core inflation continued to breach the 40% mark. Some positive news from the data release by the Central Bank of Egypt showed that month-on-month price increases of goods had slowed which could be an indication of inflation slowing.

Continued increases in money supply and rising food prices have exacerbated the problem.

In the week ahead, we do not anticipate any significant depreciation in the pound.

Further reading:

ZAWYA – Egypt’s August headline inflation jumps to a record 37.4%

Kenyan Shilling (KSh)

Compiled by Terry Karanja

The Kenyan shilling is currently trading at USD/KES 146.35 to 146.70, which is slightly weaker from last week’s levels of 144.95. This depreciation is driven by high demand from manufacturers and their cost to access hard currency. The depreciation has led to the significant erosion of central bank foreign reserves. Their foreign exchange reserves on September 7, 2023, stood at USD 7,051 million, which is 3.81 months of import cover, a drop from USD 7,080 million the week earlier.

Kenya and China are working to deepen their relations as they look to bridge the existing trade imbalance and attract more foreign direct investment. To boost trade, there is an International Industrial Expo slated for September 21-23, 2023. The government has also signed several memoranda of understanding (MoU’s) with different Chinese firms to attract more companies that are willing to invest in the country.

We expect the shilling to weaken in the coming days due to the continued pressure as demand for dollars from the energy and manufacturing sectors outweighs the inflows from agricultural exports and tea exports.

Further reading:

The Star — Kenya and China bank on expo to boost trade

Ugandan Shilling (USh)

USD/UGX was trading at 3,714 on Wednesday, September 13, 2023, down 0.03% from last Friday. Looking ahead, we expect USD/UGX to fall as the Bank of Uganda finally granted a license to the first financial institution engaged in Islamic banking after more than 20 years of waiting. Ugandans will now operate a hybrid banking system that will provide clients with access to both traditional and Islamic banking products as a result of the decision.

Compiled by Yadhav Panday

Further reading:

Africa Businessinsider — After a 20-year wait, Uganda has finally licensed its first Islamic Bank

Tanzanian Shilling (TSh)

Compiled by Kristin Van Helsdingen

Last week, the Tanzanian shilling reached its strongest level against the U.S. dollar on Thursday, September 7, 2023, reaching USD/TZS 2,500. Barring Thursday, the shilling has traded within a narrow range against the U.S. dollar, moving between USD/TZS 2,503 and 2,505. The shilling is currently trading at USD/TZS 2,505.

Tanzania published on September 1, 2023, that amendments were made to the Foreign Exchange Regulation, where restrictions on locals holding foreign currency had been loosened. Meanwhile, President Samia Suluhu Hassan has put the country’s constitution reform on hold despite opposition groups arguing for change. On Monday, she stated that the focus should be on upcoming elections in 2025 while initiating campaigns aimed to educate locals about the constitution.

The Tanzanian shilling is expected to continue moving with the U.S. dollar and is expected to remain within USD/TZS 2,500 and 2,507 in the week ahead as the Bank of Tanzania continues to control its movements.

Further reading:

BOWMANS – TANZANIA: AMENDMENT TO THE FOREIGN EXCHANGE REGULATIONS

THE EAST AFRICAN – Tanzania President Samia stalls constitutional review, for now

West African CFA Franc Region (XOF)

Compiled by Yashveer Singh

The International Finance Corporation (IFC) has significantly increased its investments in Senegal over the last four years, totaling $780 million or 478 billion FCFA. In 2022 alone, it set a record by investing more than $350 million (214 billion FCFA). These investments have primarily focused on the manufacturing sector, agribusiness, and services, amounting to over $432 million (264 billion FCFA). Additionally, the infrastructure sector received $354 million in investments, and the banking sector was financed with more than $201 million (123 billion FCFA).

Since 1966, the International Finance Corporation, a branch of the World Bank responsible for the private sector, has invested approximately a billion dollars in 67 projects in Senegal. Nouma Dione, the head of IFC in Senegal and Gambia, expressed a strong commitment to expanding its investment portfolio in Senegal and the surrounding region.

Notably, IFC played a pivotal role in bolstering Senegal’s electricity production capacity, contributing to the establishment of solar power plants like Cap des Biches, HFO in Tobène, Kahone, and Kael. This support helped Senegal increase its production capacity to 60 Megawatts.

Further reading:

Sikafinance — Senegal: $350 million invested by IFC in 2022

Central African CFA Franc Region (XAF)

Compiled by Yashveer Singh

Household consumption in Cameroon grew by 1.6% in the first quarter of 2023, making a positive contribution of 1.3 points to the gross domestic product. However, this growth follows a recent trend of declining consumption rates, with rates of 5% in Q2 2022, 3.6% in Q3 2022, and 1.8% in Q4 2022. The slight uptick in consumption can be attributed to reduced domestic demand, driven by an 8% increase in the consumer price index in Q1 2023.

This growth is primarily due to the private sector, which saw a 2.8% increase and contributed 2.1 percentage points to GDP growth in the same quarter. Conversely, consumption in the public sector declined by 0.7 points, mainly because of decreased demand for public administration services.

Further reading:

Business in Cameroon — Cameroon: Soaring prices slow consumption in Q1 2023

LinkedIn post for review by Rachel Pipan

Financial news is constantly flowing from Africa. Those who want to make the most of their move into these frontier markets need a source where they can find meaningful information. You can scour the web, set alert after alert, or subscribe to the FX Insights newsletter for a digest and links to follow for more information.

This week, in a historic move, the Bank of Uganda granted a license for Islamic banking. The new bank will provide Sharia law-based financial services which will offer a break from some of the high interest rates Ugandans face.

Other headlines include an upcoming trade expo between Kenya and China; Tanzania’s president puts constitutional reform on hold until after the 2024 national elections; South Africa’s power utility implements its highest level of load shedding; and inflation remains high in Ghana and Egypt. Click here for insights and information on these and other headlines from the continent.