By Polo Leketa, Hannah Subayi Kamuanga, Winnie Mwangi, Lexi Novitske and Eleanor Kigen

In 2016, the Angel Fair Africa team introduced the “All Female Investors Panel” aka “Queens Panel” in response to the industry need to highlight the exceptional work of leading female investors who were breaking the glass ceiling. Over the year, many industry events have followed this example and brought diversity to their engagements. Gender lens investing has become mainstream on the continent with the Mastercard Foundation Africa Growth Africa and Kuramo Capital Management which are Fund of Funds employing a gender lens in their allocation of capital to fund managers.

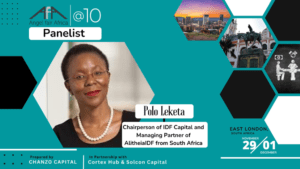

As the Queens of AFA@10, we are looking forward to sharing our diverse and multi-cultural backgrounds that form the foundation of our investing practice which collectively span three decades. We are the representation of leading women investors from Southern Africa, Polo Leketa, Chairperson of IDF Capital from South Africa, Central Africa, Hannah Subayi, Partner of Launch Africa Ventures from Democratic Republic of Congo, from East Africa, Winnie Mwangi, Investment Director of Bamboo Capital Partners from Kenya, from West Africa Lexi Novitske from the US, General Partner of Norrsken 22, moderated by Eleanor Kigen, Principal at Chanzo Capital from Kenya and currently residing in South Africa. Our backgrounds speak to the exciting conversation we are going to have at AFA@10.

Polo Leteka is a highly accomplished and experienced entrepreneur and private equity investor. She is the Chairman and Founder of IDF Captial – a South African based entrepreneurial financier and advisory firm. Through IDF Capital, Polo has contributed towards channeling investments into women owned SMEs across South Africa. In 2015, she co-founded AlitheiaIDF to continue investing in high growth businesses across Sub-Saharan Africa that are women owned and led. Polo is an accountant by training, and has varied experience in both the Public and Private sectors of South Africa which includes accounting and auditing, corporate finance, investment banking, public policy formulation, venture capital and private equity in the SME sector. At a fairly young age, Polo was tasked with leading the process of developing South Africa’s first ever Codes of Good Practice on Broad-Based Black Economic Empowerment which is a Government policy seeking to transform the South African economic landscape to be more reflective of its population demographics. As a result of this ground breaking work which has changed how Corporate South Africa interacts with the rest of the economy, she is considered a thought leader in areas of economic transformation and development.

Polo is a an accomplished public speaker, contributor to thought leadership articles on transformation and entrepreneurship. She was also part of South Africa’s version of the Dragons Den show and is also a co-Author of a book called “…..and for all these reasons, I’M IN…..”, which seeks to assist entrepreneurs to become investor ready.

Hannah Subayi Kamuanga is an experienced impact and early-stage investor in Africa, currently acting a Partner at Launch Africa Ventures, with a particular focus on frontier markets and female founders. Passionate about African investments, Hannah also advises and sits on the IC of few funds (including Aruwa Capital, the leading gender-lens fund in Nigeria) and has been recently re-appointed as a non-executive director of ABAN, the African Business Angel Network (ABAN) is a Pan-African non-profit association.

Previously, Hannah was acting as the Country Officer for the Republic Democratic of Congo (DRC) within Proparco – one of the largest DFIs in the world. Before joining Launch Africa Ventures and Proparco, Hannah was a portfolio manager in a 1bn$ African fund and an investment banker in London.

She graduated from HEC Paris Business School and from Paris I – La Sorbonne Law School in France with two Masters (in Finance and in Business Law). She is a Desmond Tutu Fellow 2023. She has been nominated as a 30 Top investor by BWAM in 2023, is a 2022 Alumni from the Boardroom Africa and a 2022 Fellow of Africa Venture Philanthropy Alliance.

Winnie Mwangi is currently the Investment Director and Fund Manager of BLOC Smart Africa Fund, a sub-fund of the Bamboo Capital Partners Group where she leads and drives investments in the technology space.

She is a venture capital investment professional with 16years experience in commercial venture capital, impact investing and M&A in Sub-Saharan Africa across several global funds and multination companies notably Bamboo Capital Partners, Lightrock and PwC.

She has led deals and cumulatively deployed USD 25m across Seed to Series B investments and across sectors such as logistics (last mile distribution), renewable energy, healthcare, retail and technology. Her geographical focus has cut across Francophone, Anglophone and Sub-Saharan Africa.

Winnie has and continues to hold board positions across the investees companies and have been part of the strategic and finance committees demonstrating value add contributions. She has a good understanding of the entrepreneurial space in Africa and is enthusiastic about driving positive change in the African continent through mentorship and thought leadership. She is also an angel investor and Jury President for Cartier Women’s Initiative.

Lexi Novitske is the General Partner of Norrsken22, based in Lagos Nigeria. Through Norrsken22’s Africa Technology Growth Fund it invests in the markets it operates in across Africa, leveraging its partners local expertise in scaling business and a board of founders of billion dollar+ companies to provide best in class value to its investee companies.

In 2012 Lexi Novitske moved to Nigeria, from The United States, believing the country held immense untapped potential, with an under-penetrated consumer population, expanding infrastructure and online access, and an active entrepreneur network. In 2014, Lexi launched Singularity Investments, a private capital-backed venture investment firm, and backed market champions in fintech and enterprise software including Paystack and Flutterwave. In 2019 Lexi acquired the firm’s portfolio and launched Acuity Venture Partners continuing Singularity’s mission to invest in technology companies driving trade and financial access across Africa. She continued to back another another 25+ companies build out the infrastructure for the Africa tech ecosystem including Brimore, Tribal Credit, Mono, and Sabi.

Lexi previously managed investments at African private equity firm Verod Capital Management.

Prior to joining Verod, she was focused on Africa investments at Small Enterprise Assistance funds and covered financial services at New York-based Sandler O’Neill Asset Management. Lexi is a board member at several technology companies and faculty member and mentor to several accelerators and start-up academies. Lexi is a CFA Charterholder and a Kauffman Fellow.

Eleanor Kigen is a highly talented and accomplished financial services professional with a background in investment analysis and appraisal of investment opportunities, building financial models, preparing forecasts, writing reports and monitoring performance of portfolio companies.

She is a CFA Charterholder, a Summa Cum Laude graduate in Business Administration and an Executive MBA graduate. In addition, she is a CFA Certified Ethics trainer with the CFA Institute and holds a French language diploma (Diplôme d’études en langue française (DELF B2)).

Her career began in the oil industry at Shell/BP before she delved into the finance and investments world as an investment analyst in Kenya and South Africa at African Alliance and Transcentury. She worked as a Head of Research at Faida Investment Bank before she became the President of the CFA Society East Africa. She was instrumental in getting the society registered and running. The society won many accolades including Most Outstanding Society during her tenure. She has also worked for Pesapal Limited as a Finance Consultant.