Cocoa producers have emerged as the driving force behind cocoa market premiums as they continue to reap the benefits of a supply crunch, according to the latest International Cocoa Organisation (ICCO)cocoa market report released this month.

The ICCO’s report highlights significant differentials in cocoa prices, emphasising that producers are currently calling the shots regarding premiums due to the prevailing supply tightness. This shift in market dynamics has sent ripples through the global cocoa trade. A closer look at the numbers reveals a compelling narrative of growth and volatility.

“A look at country differentials – differences between the cost, insurance and freight (CIF) price of a specific origin and prevailing futures prices – points out that producers are currently calling the shots in terms of premiums as they benefit from the current state of supply tightness,” ICCO’s report read in part.

Ghana and Côte d’Ivoire are by far the two largest cocoa-growing countries, accounting for over 60 percent of global production.

Rising premiums

Compared to the start of the season, premiums for cocoa beans have surged significantly; particularly in the European and United States markets. In Côte d’Ivoire beans’ premiums escalated from £319 per tonne to £406 per tonne, marking a staggering 27 percent increase. Meanwhile, Ghanaian cocoa saw an 11 percent rise from £435 per tonne to £482 per tonne. When assessed against the United States market, Ivorian cocoa experienced a remarkable 36 percent surge from US$447 to US$608 per tonne, with Ghana’s beans rising by 24 percent and reaching US$725 per tonne from US$583 per tonne.

The month of August bore witness to these remarkable premium hikes, further confirming the producers’ newfound influence, ICCO said.

Cocoa futures soar

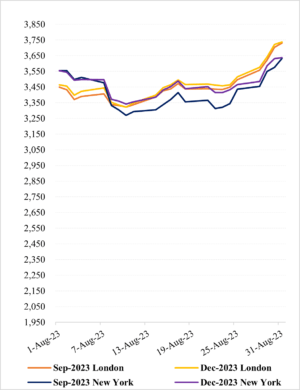

The report highlighted that in response to the impending global supply shortfall, cocoa futures contracts continued their upward trajectory throughout August, as the price movements of the first and second positions on the London and New York cocoa futures markets indicate – painting a vivid picture of this bullish trend. In London, prices averaged US$3,453 per tonne, fluctuating between US$3,323 and US$3,730 per tonne, while New York saw an average of US$3,416 per tonne ranging from US$3,269 to US$3,633 per tonne.

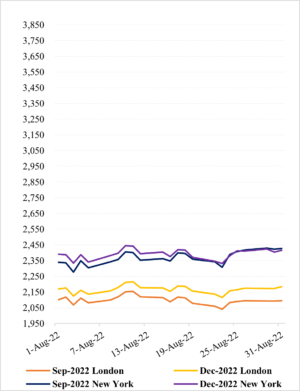

Comparing this to the previous year, the contrast is stark. A year ago, front-month prices averaged a mere US$2,041 per tonne in London, ranging from US$2,100 to US$2,154 per tonne; and in New York settling at an average US$2,369, with a range between US$2,278 and US$2,430 per tonne. As of August 31, 2023, cocoa prices remained relatively high, with London prices settling at US$3,730 per tonne and New York at US$3,633 per tonne, marking the highest nearby contract price for the 2022/23 season.

These price levels have been largely influenced by dwindling supplies and concerns for the forthcoming 2023/24 season, according to ICCO, making supply the primary driving factor behind these bullish prices.

Weather woes and supply shortfalls

Cocoa production, as a sector, is acutely sensitive to weather conditions. Unfavourable weather patterns in West Africa have led to outbreaks of the cocoa swollen shoot virus disease (CSSVD) and spread of Black Pod disease. These events, compounded by escalating input costs, have taken a toll on production volume in Côte d’Ivoire and Ghana – the world’s leading cocoa producers.

In Ghana supply fell short of expectations, triggering cross-border trading disruptions and contract fulfilment challenges; forcing government to conclude the 2022/23 season prematurely. The Ghanaian government subsequently launched the 2023/24 season on September 8, setting the producer price at GH¢20,943.84 (equivalent to US$1,821) per tonne – a substantial 64 percent increase from the previous season’s price of GH¢12,800 per tonne.

Earlier this year, Le Conseil Café et du Cacao halted forward export sales for the 2023/24 season due to supply concerns – further exacerbated by predictions of El Niño, which is expected to bring below-average rainfall and reduced soil moisture; heightening concerns about the 2023/24 crop size and potential price escalations.

Impact on chocolate manufacturers and retailers

The ICCO notes that the surging cocoa prices are raising concerns about profit margins for chocolate manufacturers. The soaring cost of cocoa, coupled with rising prices of other ingredients like sugar, may force manufacturers to make difficult decisions.

“Will we witness a resurgence of ‘chocolate shrinkflation’, whereby manufacturers reduce product sizes while maintaining prices? Or will these increased costs be passed on to consumers, potentially sparking conflicts between retailers and manufacturers?” the ICCO quizzed.

Given the current high cost of cocoa beans, consumers and retailers should not be surprised if chocolate bars either shrink in size or see price increases.

Data from Euromonitor reveals an interesting trend – retail growth in the chocolate confectionery market is rising faster in terms of value than volume. Between 2022 and 2023, the global retail chocolate confectionery market was estimated to have increased in value by approximately 6 percent, while volume grew by only 1.4 percent.

This, according to the ICCO, suggests that consumers are willing to pay higher prices for their chocolate treats – even if the size of those treats may shrink.

US$ per tonne

US$ per tonne