Nigeria: Nigerian election tribunal upholds presidential election results.

Ghana: Ghana is ready for the 2nd tranche of IMF disbursement.

South Africa: South African rand under renewed pressure due to a spike in ‘load-shedding.’

Egypt: S&P Global’s PMI remains at 49.2 for the second consecutive month.

Kenya: The overall inflation rate decreases in August as shilling remains stable.

Uganda: Output activity in Uganda rises for the 13th consecutive month.

Tanzania: The shilling remains stable against the greenback amid rising fuel prices.

XOF Regions: Mobilized resources increase in the first half of 2023.

XAF Regions: Banana exports drop in Cameroon, and BRT project postponed until 2024.

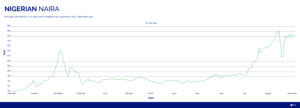

Nigerian Naira (₦)

Compiled by Ikenga Kalu

The naira continued its gradual depreciation, falling from USD/NGN 915 to USD/NGN 925 over the week as FX demand outstrips the available supply.

On Wednesday, September 6, 2023, the Nigerian election tribunal upheld the election result from earlier this year, rejecting the opposition’s petitions to overturn President Bola Tinubu’s victory. The opposition does have the option to appeal to the Supreme Court if they wish.

Meanwhile, the National Labour Congress has embarked on a two-day warning strike to call the government’s attention to the economic hardship triggered by the fuel subsidy removal.

We expect the naira to slide further against the U.S. dollar in the coming days in the absence of further directives from the central bank.

Further reading:

Reuters – Nigeria election tribunal upholds President Bola Tinubu’s victory

Punch — Subsidy pains: Labour vows to ground economy, begins strike

Ghanaian Cedi (GH¢)

Compiled by Sakina Seidu

The Ghanaian cedi has been slipping against the dollar since the start of September 2023, showing a current low of USD/GHS 11.60 this week.

Finance Minister Ken Ofori-Atta has expressed Ghana’s readiness for the second tranche of the IMF-approved loan of $3 billion. This flow of $600 million is expected to come in December after a successful review. As part of the IMF programme, Ghana is expecting to receive a specified amount every six months after the first installment in May, as follows: by the end of the year 2023, $1.2 billion; 2024 – $720 million; 2025 – $720 million and 2026 – $360 million.

With the U.S. dollar strengthening against major world currencies such as the euro and the British pound, the cedi is not immune as we already see a weakening in the cedi against the dollar. We expect this trend to continue unless an intervention is undertaken to push large volumes of dollars into the market.

Further reading:

Ghana web — Bureaus sell $1 at GH¢11.65, GH¢11.02 on BoG interbank as of September 5, 2023

Modern Ghana — IMF bailout: Ghana on track to receive 2nd tranche in December – Ken Ofori-Atta

Action Forex — GBP/USD and EUR/GBP Show Signs of Weakness

South African Rand (R)

Compiled by Alex BarmutaThe South African rand started the new week trading at USD/ZAR 18.79. As of Wednesday, it has moved back above 19 and is trading around 19.25.

The move is driven by both local and international factors. From the local aspect, an increase in rotational power cuts sparked a rand selloff as investors’ sentiment toward the rand soured. An increased demand for the U.S. dollar adds extra pressure to the rand.

Looking ahead, we can expect the rand to keep trading above 19. Some support can be found around 19.10. On the upside, 19.30 could offer some resistance.

Further reading:

Reuters — South African rand and stocks slip as power cuts bite

Egyptian Pound (EGP)

Compiled by Mitchell Diedrick

The Egyptian pound traded in a range of USD/EGP 30.84 to 30.93 since Friday’s close.

Business confidence is on the rise, and the S&P Global Egypt Purchasing Managers’ Index (PMI) stayed at 49.2 for the second consecutive month. While this is still below the 50 mark, which would signal expansionary territory, many are viewing this as a positive sign toward improved economic growth.

According to data from the Central Bank of Egypt, net foreign assets (NFA) increased to 1,475 billion pounds in July 2023 from 1,438 billion pounds in June 2023. Egypt’s NFA deficit also contracted by 24.92 billion pounds (circa. $807 million) in July 2023.

In the week ahead, we do not expect any major depreciation in the pound however, it is worth keeping an eye on the International Monetary Fund’s review of its loan agreement with Egypt.

Further reading:

Egypt Independent – IMF to review Egypt’s reform program twice in September

Egypt today – Egypt maintains PMI recorded at 49.2 in August, shows signs of recovering market

Kenyan Shilling (KSh)

Compiled by Terry Karanja

The Kenyan shilling has traded at stable levels against the dollar and is currently trading between USD/KES 144.95 and 146.10. The economy is recovering slowly as the political tension eases and also food prices lower. According to a report by Stanbic Bank’s Purchasing Managers Index, the PMI rose to 50.6 from 45.5, which shows economic recovery. The survey showed that although the exchange rate had weakened, the market expects economic conditions and the business climate to rise in the short to medium term. The overall inflation rate decreased to 6.73% in August 2023 from 7.3% in July and was mainly supported by easing food prices. Food inflation declined to 7.5% from 8.6% in July. We expect the shilling to remain stable in the coming days with support from investors such as the Africa Development Bank (AfDB), which has committed Sh 145.5 billion ($1 billion) to support youth startups in Africa. The first African Climate Summit was launched on Monday in Kenya, and the African leaders are determined to have more global influence and bring in more financing and support in dealing with the climate crisis.

Further reading:

Aljazeera — Climate summit opens in Kenya as Africa demands more say and financing

Business Insider — Kenya records a timid economic recovery for the first time in six months – PMI

Ugandan Shilling (USh)

USD/UGX traded at 3,723 on Wednesday, September 6, 2023, up 0.22% from last Friday. Looking ahead, we expect USD/UGX to fall due to higher output for the 13th month in a row, aided by improved demand. Construction and services activity increased, while agriculture, industry, and wholesale and retail activity decreased. Additionally, new orders increased as new customers contributed to higher order volumes. Companies increased employment and purchasing activity, respectively, extending their expansion to five and 10 months. Finally, firms remain optimistic that activity will expand further in the coming year.

Compiled by Yadhav Panday

Further reading:

Stanbic Bank — Stanbic bank Uganda PMI

Tanzanian Shilling (TSh)

Compiled by Kristin Van Helsdingen

The Tanzanian shilling stabilized at a new level against the U.S. dollar, moving marginally between USD/TZS 2,504 and 2,505 this past week, indicating that the Bank of Tanzania has finally managed to gain control over the value of the shilling. USD/TZS is currently trading at 2,505.

This week, locals witnessed petrol prices rise from 3,199 shillings per liter up to 3,213. Diesel had the highest leap in price for fuels, rising by 324 shillings per liter, with its current price at 3,259 shillings. Price increases have been felt globally and continue to put pressure on rising inflation.

We can expect the Tanzanian shilling to move with the U.S. dollar as officials continue to keep control over the value of the shilling using various measures. Officials have continued to raise U.S. dollar reserves through increasing exports. USD/TZS is expected to move between 2,499 and 2,508.

Further reading:

THE CITIZEN – More pain at the pump as fuel prices rise to new levels in Tanzania

THE CITIZEN – Boost exports to tackle dollar scarcity, CTI told

| Final graph/chart image from Infogram here (pulls from this data). |

West African CFA Franc Region (XOF)

Compiled by Yashveer Singh.

In Senegal, the Economic Studies Forecasting Directorate (DPEE) of the Ministry of the Economy has released its report for the first half of 2023. During this period, budget management showed a positive trend with an 11.6% year-on-year increase in budget revenues, totaling 1,834.8 billion FCFA (2.8 billion dollars) by the end of June 2023. Public spending also increased but by a smaller margin, rising 1.4% to 2,449.2 billion FCFA. This led to a budget deficit of 614.5 billion FCFA at the end of June 2023, compared to 771.4 billion FCFA in the previous year.

Tax revenues played a crucial role in this financial performance, reaching an estimated 1,652.4 billion FCFA. This boost was attributed to the strong performance of various tax categories, including direct taxes, indirect taxes, customs duties, and, to a lesser extent, registration fees.

Direct taxes saw remarkable growth, primarily driven by a 36.7% increase in corporate tax collections, amounting to 303.2 billion FCFA by June 2023, compared to 221.8 billion FCFA the previous year. This increase was particularly notable in the secondary sector (96% growth) and the tertiary sector (31.8% growth).

Further reading:

Sikafinance — Senegal: Mobilized resources increase by 11.6% to 1,834.8 billion FCFA in the first half of 2023

Central African CFA Franc Region (XAF)

Compiled by Yashveer Singh

In August 2023, Cameroon’s banana exports experienced a significant decline of 12.2% compared to the same month in the previous year, as reported by the National Sector Association (Assobacam). Plantations du Haut Penja (PHP), the leading company in the market, experienced a significant decline in banana shipments in August 2023, with only 9,996 tons compared to 12,899 tons in August 2022, marking their third-worst performance of the year. This decline follows 9,761 tons in May and 8,714 tons in July 2023. Boh Plantations also saw a decrease in exports, with 1,024 tons in the same period, down 16.7% from 1,229 tons in August 2022.

The Douala Bus Rapid Transit (BRT) project, originally scheduled to begin in 2022, has been postponed until 2024. This delay is primarily due to the need to finalize compensation payments for individuals directly affected by the project. The Cameroonian government has allocated approximately CFA 12 billion for compensation payments and has conducted all necessary studies for the project. The project’s financing plan includes CFA260.8 billion from the World Bank (77.8% of the total cost) and CFA 62.1 billion from public-private partnerships. The remainder will come from the Cameroonian government for compensating affected populations.

Further reading:

Business in Cameroon — Douala’s Bus Rapid Transit Project rescheduled for early 2024

| Final graph/chart image from Infogram here (pulls from this data). |

LinkedIn post for review by Rachel Pipan

(I’m using the guidance of sites that call for shorter as better. Let me know if I need to change my way of thinking.)

If you plan on doing business in any nation on the African continent, you had better know what is happening with regard to the politics, resources, currency markets, and the overall strength of the various economies. We cover that every week with our FX Insights newsletter.

This week, we have a disputed presidency in Nigeria; Kenyan leaders looking for greater influence in the fight against global climate change; Ghana eager for its next loan payment from the IMF; and Tanzanians continuing to face higher petrol prices at the pump. Click to read about these issues and so much more.