The Public Interest and Accountability Committee (PIAC) has made a clarion call for the country to expedite processes to reverse declining crude oil production – warning that revenues from the sector will drop if nothing is done.

The PIAC, a public watchdog over use and management of petroleum revenue, also cautioned that multi-billions worth of hydrocarbon resources risk being stranded in the face of the global energy transition if efforts are not made to intensify exploration, appraisal and development of oil assets.

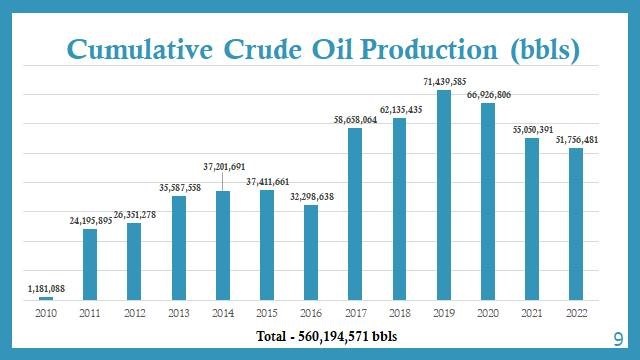

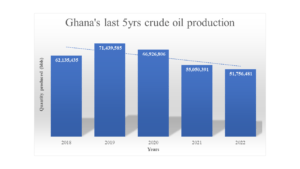

Having peaked at 71,439,585 bbls in 2019, crude oil production from the country’s three producing fields – Jubilee, Tweneboa, Enyenra, Ntomme (TEN) and the Sankofa Gye Nyame (SGN) – has been on the decline since reaching 51,756,481bbls in 2022.

Against this backdrop, the Committee believes that much more needs to be done in order to sustain production and ensure sustainability of oil-funded development projects like the Free Senior High School programme.

Cumulatively, the country has so far recorded an accumulated 560.2 million barrels (bbls) of crude oil since commercial quantities began in 2010.

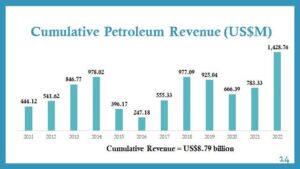

This, also translates to an estimated US$8.7billion accumulated revenue accrued to the state from 2011 to date.

However, PIAC’s data show a steady decline in the production of crude oil over the last three years.

For instance, during the year 2022 a total of 51.7 million bbls was produced from the three producing fields – about six percent lower than the 2021 figure of 55 million bbls. The 2022 actual output represents 87 percent of the 2022 Benchmark crude oil output of 59.51 million barrels. The relatively lower production volume in 2022 was due to reduced production in the TEN and SGN fields

PIAC said in its 2022 Annual Report that the Jubilee Field contributed about 60 percent of the total output, with production on the field increasing by 11.7 percent from the 2021 output of 27.3 million bbls to 30.5 million bbls in 2022. The increased production was due to the successful drilling and completion campaign of three wells.

The TEN Field’s production however declined by 28 percent from 11.9 million bbls in 2021 to 8.6 million bbls in 2022, due to technical challenges on the Enyenra reservoir.

Similarly, the SGN Field recorded a reduced output of 12.6 million bbls in 2022 compared to 15.7 million bbls in 2021, representing a reduction of 19.8 percent.

The 2022 production figure represents the third consecutive year of reduction in annual production volumes.

In 2019, Ghana witnessed its peak in crude oil production, recording a volume of 71,439,585 barrels. This declined to 66,926,806 barrels in 2020, representing a 6.32 percent drop.

Crude oil production further dropped to 55 million barrels in 2021 and then to 51.7 million barrels in 2022, representing 17.75 percent and 5.98 percent respectively.

Moreover, no new Petroleum Agreement (PA) was signed or ratified by parliament as of the end of December 2022. The total number of existing Petroleum Agreements remains at 14.

To reverse the decline, PIAC maintains that the country must speed up the sustainable development of its petroleum resources.

This call also comes amid the country’s pursuit of transformation through the exploitation of its natural resources while committing to a 2070 target for achieving net zero emissions.

For his part, Executive Director at the Africa Centre for Energy Policy (ACEP), Benjamin Boakye, noted that the regulatory environment needs to be ‘sanitised’ to attract new investments.

He noted Ghana has lost about 20 million bbls of oil on a year-to-year basis, implying a need to rethink the country’s strategy to make more from its oil resources.

Mr. Boakye was speaking in an interview at the back of a recent media engagement in Accra; he however observed the country made some gains in petroleum revenue despite the declining production – but current conditions will not likely allow a repeat of such fortune.

“Last year was an outlier; for this year the oil prices have been averaging US$75 per barrel, and if we are not lucky and production also dips, then it will be a double pain for the country,” he said.

The development, he noted, will have implications for the country’s budget – while indicating that the declining oil production has already led to some job-losses in the extractive sector.