Nigeria: Inflation levels steepen as manufacturers manage higher fuel costs.

Ghana: Ghana experienced a rating downgrade and delayed commodity purchases due to the debt situation.

South Africa: Producer inflation cools in the latest data released.

Egypt: Egypt’s pound is predicted to weaken further.

Kenya: Kenya’s president calls for the revival of the interbank market as interest payments pile on further pressure on the shilling

Uganda: Uganda’s undisbursed debt decreased slightly.

Tanzania: Tanzanian shilling weakens as the market turns to other currencies.

XOF Region: Togo has raised XOF 46 billion in partnership with the European Union.

XAF Region: The Republic of Congo has established liquefied natural gas production units.

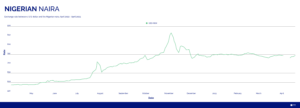

Nigerian Naira (₦)

Compiled by Ikenga Kalu

Week to date, the Nigerian naira appreciated against the U.S. dollar, climbing from $/NGN 745 to $/NGN 740. According to the national statistics bureau, Nigeria’s inflation rate spiked to 22.04% in March from 21.91% recorded in February. Inflation is now at its highest recorded level since 2009 despite efforts adopted by the central bank. One reason for the upward trend is the cost of diesel, which has increased from NGN 539.32 per liter to NGN 836.81 per liter recorded in March year-on-year. This strains manufacturers that depend on diesel for power generation, with costs passed to the consumer. We expect FX demand for the naira to remain stable in the coming days.

Further reading:

Reuters – Nigeria inflation quickens to 22.04 percent in March

ThisDay – Manufacturers groan as diesel price jumps

Ghanaian Cedi (GH¢)

Compiled by Murega Mungai

The Ghanaian cedi depreciated from $/GHS 11.75 to $/GHS 11.84 last week after strengthening to sub-12 levels. Due to missed payments on bonds issued before the Domestic Debt Exchange Program, The credit rating agency, Fitch, has downgraded the Long-Term Local-Currency (LTLC) Issuer Default Rating (IDR) to restricted default (RD). The rating agency also noted that uncertainty remains about the government’s payment schedule and deadline of April 28, 2023. Ghana’s Precious Minerals Marketing Company (PMMC) has not yet purchased nearly $100 million of gold exports from miners countrywide, putting them at risk of losing the export level for April. The PMMC is the only authorized importer and exporter of gold in the country, meaning that gold exports heavily rely on the company’s pace of purchase, which is heavily influenced by the economic situation. The upcoming tranche of World Bank funds due to be released has supported the cedi. We expect these positive sentiments to stabilize the cedi in the coming weeks.

Further reading:

Fitch ratings – Fitch Downgrades Ghana’s LTLC IDR to ‘RD’

Myjoy online – Ghana may lose $100m from gold exports by end of April 2023

South African Rand (R)

Compiled by Alex Barmuta

The South African rand opened the new week trading at 18.0686 against the U.S. dollar, on the lower side of the 17.99-18.33 range seen last week.

PPI data released on Wednesday, 26 April, showed that producer inflation figures have cooled – slowing to 10.6% year-on-year in March 2023 compared to 12.2% in February 2023. Despite this, the rand remains under pressure as the central bank has advised that inflation remains an economic concern.

Looking ahead, we can expect the rand to continue trading above 18 against the U.S. dollar, despite a subdued U.S. dollar strength. We can expect the USD/ZAR exchange rate to test the 18.50 resistance level, while support should remain around the 18.25 and 18.00 levels.

Further reading:

Reuters – South Africa’s producer inflation slows to 10.6% y/y in March

Egyptian Pound (EGP)

Compiled by Mitchell Diedrick

The Egyptian pound remained relatively stable against the U.S. dollar this week, trading around the 30.90 USD/EGP level on April 26, 2023, despite a less-than-favorable outlook from S&P Global Ratings.

The rating agency maintains that the Egyptian pound is likely to depreciate further before the end of June 2023. They also see economic growth averaging 4% for 2023 and the following two years.

The news was not well received in the international bond market, as yields on Egyptian bonds rose and performed poorly early in the week.

On a more upbeat note, the tourism sector is expected to recover to pre-pandemic levels. There has reportedly been an increase in reservations by European tourists of 34% for April 2023 compared with a year prior, according to an advisor to the World Tourism Organization. Additional GDP flows are welcomed in light of current debt obligations.

In the week ahead, we forecast continued depreciation in the Egyptian pound to approach levels of 31.00 against the U.S. dollar.

Further reading:

Gulf Times – Egypt bonds slump after S&P cuts outlook on downbeat forecasts

Egypt Independent – Egypt saw 34 percent increase in tourist demand during April

Kenyan Shilling (KSh)

Compiled by Terry Karanja

The Kenyan shilling traded from 135.33 (at last week’s close) to a slightly weaker 135.81 this week. The interbank market opened up in the recent trading session as the president of Kenya, William Ruto, called for a revival to ease price distortion. Some prices in the market diverged by more than 10% from the official rates. Interest payments on debt service obligations have been one of the key drivers of pressure for the shilling among increased demand from the importers. With the sustained demand, we foresee sustained pressure in the coming days.

Further reading:

Business daily – Foreign loans interest up Sh19bn in eight months on shilling drop

Business daily – Dollar market distortion eases after President Ruto directive

Ugandan Shilling (USh)

Compiled by Yadhav Panday

This Wednesday, April 26, 2023, the U.S. dollar traded at 3,743.00 against the Ugandan shilling, up 0.08% from the previous trading session. In the previous four weeks, USD/UGX gained 0.64%. According to the Ministry of Finance, Uganda’s undisbursed debt decreased slightly in the second quarter of the fiscal year (FY) 2022/23, from $3.85 billion in September 2022 to $3.83 billion (about USh14 trillion) in December 2022. Furthermore, the Ministry of Finance reported an increase in disbursement from $0.12 billion at the end of September 2022 to $0.16 billion during Q2 2023.

Details in the ministry’s most recent quarterly debt statistical bulletin and public debt portfolio analysis indicate that the undisbursed debt from bilateral creditors decreased from $0.97 billion in September 2022 to $0.94 billion in December 2022. Looking ahead, we expect USD/UGX to trade at 3,773.10 by the end of this quarter and 3,889.63 in a year.

Further reading:

Monitor – Uganda’s undisbursed debt decreased to Shs14t in FY2022/23 quarter two – govt

Tanzanian Shilling (TSh)

Compiled by Kristin Van Helsdingen

This week, the Tanzanian shilling weakened further against the U.S. dollar, dropping to its new lowest level since March 2019 of USD/TZS 2,350. Over the past week, USD/TZS remained trading between 2,346 and 2,350. Bid and offer rates are currently at 2,346 and 2,355, respectively.

Tanzanian officials continue preparing for the 2023/24 budget speech as the minister of state in the office of the vice president, Selemani Jafo, has put together a TZS 54.1 billion budget proposal. The proposal is awaiting approval from the lawmakers.

While the government has been focusing on the upcoming budget speech, the Bank of Tanzania has recognized the improvements made to the country’s ports and is looking to increase imports and exports to boost economic growth.

With Tanzania’s rising economic growth rate, we expect the Tanzanian shilling to remain relatively stable. However, as concerns around a global recession increase, we expect demand for currencies such as the Tanzanian shilling to decrease. We expect USD/TZS to be trading around its upper limit of 2,350 in the week ahead.

Further reading:

Africa Press – Jafo tables 54bn/- budget estimates

Africa Press – BoT eyes ports forex push

The Citizen – Tanzania third fastest growing economy in Africa, says UN

West African CFA Franc Region (XOF)

Compiled by Jean Cédric Nando KOUA

Togo has raised XOF 46 billion in partnership with the European Union. To improve the conditions relating to agriculture, which is at the heart of the economy, this convention focuses on developing agro-industries and improving the management of natural resources. It also aims to support people’s access to basic social services and agriculture.

Further reading:

Sika finance – Togo: 46 billion FCFA from the European Union to support agriculture and social services

Central African CFA Franc Region (XAF)

Compiled by Jean Cédric Nando KOUA

The Republic of Congo has established liquefied natural gas production units. This project aims to cover local and international electricity production needs through exports. The first production unit should start operating in 2023, producing an estimated 0.6 million tons per year; the second will go live in 2025 with an estimated 2.4 million tons per year production. This project will have a significant economic impact and contribute to improving the central bank’s foreign exchange reserves.

Further reading:

Sika finance – Congo: Foundation stone laid for a liquefied natural gas plant