Reinsurance is basically an insurance protection for insurance companies after they have taking up risks from the insured (individuals, corporation and government). Reinsurance is a specialized form of insurance transacted between professionals.

A legal definition of reinsurance was given by Lord Mansfield in the case of Delver v. Barnes (1807) that reinsurance “consists of a new assurance, effected by a new policy, on the same risk which was before insured in order to indemnify the underwriters from their previous subscription; and both policies are in existence at the same time”.

History of reinsurance

The first ever reinsurance contract on records took place in 1370, when an underwriter by name Guiliano Grillo, contracted with others by name Goffredo Benaira and Martino Sacco to reinsure a cover on a ship just part of the voyage from Genoa to Bruges. While Grillo covered the ship through the Mediterranean Sea, he passed the risk to Benaira and Sacco from Cadiz to Bruges. In this instance, Grillo was the reinsured while Benaira and Sacco were the reinsurers.

The Kölnische Rückversicherungs-Gesellschaft (Cologne Reinsurance Company) happens to be the first reinsurance company which was founded in Germany in 1843 after a great fire in Hamburg. After this, several reinsurance companies was also formed in Germany in the second half of 1800s. Most of these companies failed to operate because of high competition.

The Schweizerische Rückversicherungsgesellschaft (Swiss Reinsurance Company) was established in 1863 after the great fire of Glarus. This soon led to the exchange of businesses among reinsurers and insurance companies in Europe. Much of this business was of a reciprocal nature, where the insurance company in one country would exchange business from the insurance company in another country.

While professional reinsurers did not have original insurance business as such, they often created pools of business which could be used for reciprocal purposes. Another well-known reinsurance company is the Münchener Rückversicherungs-Gesellschaft (Munich Reinsurance Company) which was created in 1880.

Reinsurance in Africa

Both insurance and reinsurance were introduced to Africa as our colonial masters swept through the continent of Africa which led to the establishment of local branches. Egypt Re, which has since merged with Misr Insurance company (2008) was the first local reinsurer in Africa (1957) followed by Société Centrale de Réassurance, Morocco (1960).

The second group of national companies were set up mainly between 1972 and 1990: Ghana Re (1972), CCR Algeria (1973). Kenya Re (1973), National Re Sudan (1974), Tunis Re (1981), Sen Re (1988), Namib Re (1998) and Tan Re (2001).

In recent years, some countries have set up or are in the process of setting up their own national carriers such Gabon (SCG Re), Uganda (Uganda Re), Ethiopia (Ethiopia Re), Angola (Ango Re) and Seychelles (Sey Re).

Apart from national reinsurers, regional reinsurers were also set up starting with Africa Re, a clear market leader in Africa, which was established in 1976 by 36 member states of the Organization of the African Unity (OAU) and the AfDB with the aim of reducing the outflow of foreign exchange from the continent and assisting in fostering the development of insurance and reinsurance activities within the African continent. The other regional reinsurers are Cica Re (1982), Zep Re (1990) and Waica Re (2011).

After the wave of state reinsurance companies from 1957 up to 1984, privately owned local reinsurance companies commenced operations starting with Best Re in 1985 in Tunisia, which moved to Malaysia in 2011. Since then, over a dozen private companies have been set up in the continent including Continental Re (Nigeria) in 1987, Mainstream Re (Ghana) in 1995, East Africa Re (Kenya) in 1995, FBC Re (Zimbabwe) in 1995 and FM Re (Zimbabwe).

Reinsurance regulation in Ghana

Insurance and reinsurance operations in Ghana are regulated by the National Insurance Commission (NIC). The activities of all reinsurance companies and contact offices operating in Ghana must comply with the Insurance Act 2021 (Act 1061). This new insurance Act replaces the old insurance Act 2006 (Act 724). The enactment of the new Act is to ensure that insurance regulation in Ghana is in conformity with international regulation and supervisory standards. Conformity to these international standard will increase the competitiveness of Ghana insurance industry on the international market.

The new Act affirms the National Insurance Commission (NIC) as the regulator of insurance and reinsurance activities in Ghana. The regulator is tasked with a responsibility of ensuring efficient and stable insurance market for both insurance and reinsurance operations. The current minimum capital required to set up a reinsurance company in Ghana is GH¢125 million.

Similarities between insurance and reinsurance

| Contract | Contract agreement exists in both insurance and reinsurance market. |

| Transfer of risk | Both insurance and reinsurance involve transfer of risks from one party to the other. In insurance, the insured or policy holder transfers risk to the insurer or insurance company. In a reinsurance contract, the insurer or the insurance company / reinsured transfers risk to the reinsurer or the reinsurance company. |

| Underwriting | Underwriting refers to the assessment and selection of risk by underwriters. Both insurers and reinsurers are involved in risks assessment and selection. |

| Premium payment | Premium refers to the cost or price of an insurance product. Both insurance and reinsurance contract involve the payment of premium. In an insurance contract, the insured pays premium to the insurance company while in a reinsurance contract, the insurance company pays premium to the reinsurance company. |

| Technical skills | Both insurance and reinsurance contract require technical skills by employees in analyzing, selecting and charging appropriate premium for all risks accepted. |

| Regulation | Both insurance and reinsurance companies are regulated by the National Insurance Commission (NIC). |

Differences between insurance and reinsurance

| INSURANCE | REINSURANCE | |

| Buyers knowledge | Insurance buyers or policy holders are assumed to be less knowledgeable than the sellers (insurance companies). | Reinsurance buyers / reinsured /insurance companies are assumed to have the same level of knowledge as the reinsurance companies. |

| Jurisdiction | Insurance companies mostly operate on the local level. | Reinsurance companies operate on the international level. |

| Services provided | Insurance companies provide financial protection to the insured. | Reinsurance companies provide capacity to insurance companies to take up more risks. |

| premium | Premiums are paid by the insured to an insurance company to provide protection to an individual or an object / property. | Premiums under reinsurance contracts are divided among insurance companies and reinsurance companies based on agreed ratios. |

| Cover | Cover under insurance contract is provided to protect an individual, company or an object/property. | Cover is provided to insurance companies to enable them indemnify the insured in the event of a loss. |

Players in the reinsurance market

The three major players in the reinsurance market are insurance companies, reinsurance companies and reinsurance brokers.

- Insurance companies

The prime buyers of reinsurance are insurance companies. Insurance companies can either be non -life or life insurance company. Insurance companies often combines several reinsurance agreements to meet its particular needs. Each reinsurance agreement is tailored to the specific needs of the insurer and the reinsurer. Many insurance companies have a department devoted to placing reinsurance businesses. When the insurance company decides to spread its risks by way of reinsurance, it will reinsure a part of these risks with a reinsurer. Thus, a reinsurance contract is between an insurance company and a reinsurer. Ghana has 22 life insurance companies and 28 general insurance companies.

- Reinsurance companies

Reinsurers or reinsurance companies are insurance companies’ insurers. Professional reinsurers devote their resources to providing capacity for insurance companies to take up more risk from the insurance public. Reinsurers are not competitors to insurance companies and they are free to offer capacity to a number of insurance companies within a given market. Reinsurers have more extended knowledge in the insurance market. Reinsurance companies in Ghana are GN Reinsurance Corporation, Ghana Reinsurance Corporation and Mainstream Reinsurance Corporation. The largest reinsurance company in Africa is Africa Reinsurance Corporation with its head office located in Nigeria.

- Reinsurance brokers

Reinsurance brokers are independent intermediaries who find and place businesses with reinsurance companies on behalf of various insurance companies. They are the connection between insurance companies and reinsurance companies. Buying the right reinsurance protection for an insurance company’s portfolios of risk can be a challenge, and many insurance companies will use the services of an intermediary to help them structure and place their reinsurance needs. The five main reinsurance brokers in the Ghana insurance market are Afro-Asian Reinsurance Brokers Ghana Limited, KEK Reinsurance Brokers(Africa) Limited, Global Reinsurance Brokers Limited, Visal Reinsurance Brokers and IRisk Reinsurance Brokers Limited

Legal principles of reinsurance

The legal principles applicable to insurance contract are also applicable to reinsurance contract.

- Utmost good faith – This is a duty upon the proposer (insurance company) to reveal all material facts about the proposed risk to the reinsurance company. A material fact is one which would influence the mind of a prudent underwriter (Reinsurance Company) in deciding whether to accept a risk and on what terms and conditions.

- Insurable interest – The insurance company must stand in some legally recognized relationship to the subject matter of insurance whereby he benefits from its safekeeping or is prejudiced by its loss.

- Indemnity – The idea of indemnity is that, after an insurance company have indemnified the insured under the insurance contract, the insurance company should be indemnified by the reinsurance company under the reinsurance contract.

Benefits of reinsurance

- Providing capacity to insurance companies

One advantage of reinsurance is that it provides insurance companies with the capacity to accept liability exposures above its own existing capacity. In many countries, the premium that an insurer can write is a factor of the capital and free reserves the insurance company has available. Base on this, the company can only write insurance businesses up to this level. Reinsurance provides capacity to insurance companies to write businesses above this level.

- Enabling economies of scale

Economies of scale is defined as the cost saving advantage enjoyed by firms as they increase or expand their operations. Reinsurance provides capacity for insurance companies to take up more risk in the same geographical or technical area. This becomes a huge benefit for insurance companies who have strong marketing networks concentrated in a particular area. The concept of reinsurance allows these insurance companies to leverage their network to the maximum without worrying about not being able to fulfill their obligations in the future. This will in the long run lead to increase in underwriting and operational profit.

- Creating financial stability

Reinsurance arrangement provides financial stability to insurance companies in their operations. The more reinsurance cover, the lesser the risk of investors losing value for their investment. Controlling claim severity and frequency are the main issues of concern to insurance companies. Reinsurance arrangements are available for the most volatile portfolio of businesses. This makes it possible for insurance companies to effectively predict future flow of income and shareholders earnings with little or no surprises. The ability to create financial stability attract potential investors to the company.

- Enabling diffusion of risks

Reinsurance enables insurance companies to diffuse the risks that they insure to different part of the world. This prevents insurance companies from becoming bankrupt as a result of the occurrence of a disaster at a particular region or location. This is because insurance companies would have insured the risk with companies in different parts of the world. These diffusion of risks help insurance companies to withstand any shocks posed by natural disasters or calamities.

- Providing value added services

Reinsurance companies provide additional value added services in the form of training and capacity building for employees of insurance companies. This gives them the needed capacity to underwrite high profile businesses. Having a well-equipped and trained insurance underwriter is beneficial to both insurers and reinsurers in ensuring profit maximization.

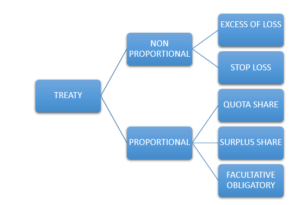

Forms of reinsurance

The two broad forms of reinsurance are Facultative or non- obligatory reinsurance and Obligatory or Treaty reinsurance

Facultative reinsurance

Facultative reinsurance is reinsurance for INDIVIDUAL RISKS on a case by case basis. The insurance company is free to choose which individual risks it wants to reinsure, and the reinsurer is also free to either accept or refuse any risks they are offered.

Advantages of facultative reinsurance

- It enables insurance companies to increase its capacity in individual instances where it is commercially necessary or profitable or both to do so.

- It enables insurance companies to make use of a reinsurer’s expertise in a particular class of business where the ceding company may have very little experience itself.

- It enables insurance companies to offer flexibility to important clients or may enable it to compete for important market accounts where a part of the business is unusual or outside its normal underwriting policy.

- As noted above, it can enable insurance companies to protect its automatic capacity where it needs or wants to write a particularly hazardous risk which could unbalance its automatic treaties.

Disadvantages of facultative reinsurance

- The time necessary to offer a risk to the reinsurance markets can delay the issue of a policy which create problems for intermediaries, agents and clients.

- Facultative reinsurance involves high administration and operational cost.

- Insurance companies may lose some of its freedom in fixing the price and terms of the insurance and even in certain cases the reinsurer may require the ceding company to refer to the reinsurer when settling losses.

- It may not be possible to amend the policy unless the reinsurer agrees.

- If the business is placed facultative with a competitor, it may provide the competitor with the information it needs to steal the client at the next renewal.

Treaty reinsurance/obligatory reinsurance

The Cambridge dictionary defines treaty as “an agreement between two or more countries, formally approved by their governments’’. Treaty is an agreement between parties to a contract. Treaty or obligatory reinsurance is a type of reinsurance for an entire portfolio on an automatic basis.

Under this agreement, the insurance company is obliged to cede a contractually agreed share of the risk to a reinsurance company and the reinsurance company is obliged to accept the risk. Most insurance companies use this agreement as a foundation for their reinsurance programs. This provides them with the certainty they need in order to develop underwriting guidelines and policies. The treaty arrangement can be done by through an insurance intermediary called a broker or the insurance company contacting the reinsurer directly.

Key features of treaty reinsurance

- It provides cover for a portfolio of business as opposed to individual risks.

- This type of reinsurance is cheaper to administer than facultative reinsurance.

- Any risk falling within this portfolio is automatically covered under this reinsurance arrangement

- It provides a good protection against both claims frequency and severity if properly managed

- One contract encompasses all risks

Proportional reinsurance

Proportional Reinsurance is a type of reinsurance were the insurance company passes or cedes a proportion of its liability on a number of risks to a reinsurer and pays the reinsurer the same proportion of the original premium for the risk or risks. In the event of a claim, the reinsurer in return will reimburse the insurer with the same proportion of the claim or claims.

Types of proportional reinsurance

- Quota share treaty

Under this type of proportional reinsurance, both the insurance company and the reinsurance company share a fixed percentage of insurance premium and losses resulting from the portfolio. The insurance company is obliged to cede a percentage of all risks (whether good or bad) that falls within the scope of the treaty to the reinsurance company. The reinsurance company on the other hand is also obliged to accept any risk ceded by the insurance company.

The following example illustrates an 80percent quota share treaty. This means that the insurance company retains only 20percent of every risk and cedes or passes 80percent to their reinsurers for all risks that falls within the scope of the treaty.

Risk Distribution

| Risk | A

GH¢ |

B

GH¢ |

C

GH¢ |

| Sum insured | 100,000.00 | 200,000.00 | 300,000.00 |

| Insurance company’s share | 20,000.00 | 40,000.00 | 60,000.00 |

| Reinsurance company’s share | 80,000.00 | 160,000.00 | 240,000.00 |

As shown in the above, for risk A with a sum insured of GH¢100,000.00, 80percent representing GH¢80,000.00 is passed on to a reinsurance company while 20percent representing GH¢20,000.00 is retained by the insurance company. Both premiums and claims are also distributed in the same proportion.

Claims distribution

The table below illustrates how claims within a year are distributed between the insurance company and the reinsurance company based on the 80percent quota share arrangement.

| Risk | A

GH¢ |

B

GH¢ |

C

GH¢ |

| Claims | 25,000.00 | 48,000.00 | 55,0000.00 |

| Insurance company’s share | 5,000.00 | 9,600.00 | 11,000.00 |

| Reinsurance company’s share | 20,000.00 | 38,400.00 | 44,000.00 |

- Surplus share treaty

Under the surplus treaty arrangement, the ceding or insurance company decides the limit of liability which it wishes to retain on any business or class of risks. The monetary amount is referred to as a line and it is stipulated in the agreement. When an underlying policy’s total amount exceeds the line, the reinsurance company assumes the surplus share of the amount of the insurance. The insurance company and the reinsurance company share the policy premium and losses proportionally.

Illustration

Assuming the insurance company’s maximum gross retention for its 2023 surplus treaty is GH¢2,000,000.00 on all fire insurances. The following will be the retention and amount ceded to reinsurers for various risks insured by the insurance company.

| Sum insured

GH¢ |

Retention

GH¢ |

Reinsurance

GH¢ |

| 1,000,000.00 | 1,000,000.00 | NIL |

| 2,000,000.00 | 2,000,000.00 | NIL |

| 3,000,000.00 | 2,000,000.00 (66.67%) | 1,000,000.00 (33.33%) |

| 3,500,000.00 | 2,000,000.00 (57%) | 1,500,000.00 (43%) |

The amount of risk ceded to a surplus treaty is normally expressed by the number of “lines”. Each line is equivalent to the insurance company’s gross retention. For example, if the insurance company’s gross retention is GH¢2,000,000.00 and operates a 10 line surplus treaty, the treaty capacity can absorb liability over and above the gross retention up to US$20,000,000.00 (GH¢2,000,000.00 * 10). To find the overall underwriting capacity, the gross retention is added to the treaty capacity GH¢22,000,000.000 (20,000,000.00+2,000,000.00).

If the insurance company insures risk of which the sum insured is above treaty capacity, the company can treat the extra amount in two major ways:

- Accept the excess amount for its own account (in addition to its existing gross retention) or

- Seek further reinsurance cover which could be on a facultative basis or by placing a further surplus treaty which would then be termed as the “second” surplus treaty. The first surplus would have priority for any sums insured over and above the insurance company’s gross retention, and risks would be allotted to it first. The second surplus would be involved in a risk where the original sum insured was larger than the amount of the insurance company’s gross retention plus the amount allotted to the first surplus treaty.

- Facultative obligatory

Facultative obligatory is a type of treaty which combines both facultative and treaty method of proportional reinsurance in seeking capacity. This makes it flexible for insurance companies to offer certain risks to the reinsurer which the reinsurer is obliged to accept under the terms of the reinsurance agreement.

The primary function when placed in addition to a surplus treaty, is to give the insurance companies automatic reinsurance in excess of the capacity of its surplus treaty/treaties. Thus, it may be arranged simply for additional capacity to expand and develop existing accounts. It may also help the insurance company. It may be used to cover specific categories of risks which could be of interest to the reinsurance company.

Non proportional reinsurance

This type of reinsurance is not applicable to specific risk but on losses as compared to proportional treaties which is applicable to risks. It limits the amount of an insurance company’s loss as a result of any one’s claim. The ceding company does not cede risks, the reinsurance company accept to pay losses in excess or above a specific amount referred to as retention, deductible or priority.

Excess of loss

This is a type of non-proportional reinsurance which provides cover on per risk or per occurrence or event basis. The reinsurance company indemnifies the insurance company for any losses exceeding specific amount as stated in the agreement. It can also be a percentage of losses over the threshold which the reinsurance company is liable.

Per risk excess of loss

Under a “per risk” excess of loss treaty the reinsurers pay for losses on an individual basis. They pay for losses on an individual risk in excess of the insurance company’s retention. This ensures that the claims severity of the insurance company is reduced to a fixed amount. This treaty does not offer protection against claims frequency or accumulation of claims within a particular year.

Illustration

For example, if Beanna View has decided to have a net retention of GH¢200,000.00 on one of its portfolio. It protects its net retention with an excess of loss cover of GH¢150,000.00 in excess of GH¢50,000.00. This means that the reinsurance company pays up to GH¢150,000.00 after Beanna View has paid at least GH¢50,000.00 of any loss that occurs. If a loss of GH¢80,000.00 occurs, Beanna View will pay its share of GH¢50,000.00 and their reinsurance company will reimburse Beanna View the sum of GH¢30,000.00

Catastrophe Excess of Loss Treaty

The term “catastrophe” excess of loss is usually used to describe the “per event” or “per occurrence” cover. Such reinsurances are frequently arranged to protect property insurance accounts covering fire and natural perils, and marine portfolios where a particularly severe incidence of a catastrophic nature may affect a number of policyholders at the same time.

Illustration

Example of a catastrophe excess of loss A storm causes 1,000 losses of US$5,000 each on policies covering private residences that all fall within Beanna View’s net retention. If the ceding company has a non-proportional cover of US$4,000,000 excess of US$500,000 the above loss will be distributed in the following manner;

Total loss = GH¢5,000,000 (1000 x US$5,000)

Beanna View’s retention per event = GH¢500,000

Recovery from reinsurer = GH¢4,000,000

Additional un-reinsured amount payable by Beanna View = GH¢500,000

Stop loss

This is a type of excess of loss reinsurance where the reinsurance company is made liable for any loss incurred by an insurance company over a certain period of time that exceed a specified amount. This provides cover for a whole portfolio of risks or even the whole account of an insurance company. The role of the Stop Loss treaty is to protect the annual result of the ceding company in one class of business against negative volatility due to a marked increase in the size and number of losses in that class of business.

Illustration

Crop business can be a very volatile business, where large profits or large losses usually occur due to the nature of the business. The ceding company thus decides to protect the results of its crop account, by placing a cover of 30percent in excess of an annual loss ratio of 90percent. At the end of an accounting year, it is found that the loss experience is 120percent. The reinsurer is thus liable for the 30percent that exceeds the 90percent retention of the insurance company.

Conclusion

This article gives the reader the basic understanding of reinsurance, its importance and how it operates within the insurance industry. Reinsurance is an insurance policy purchased by insurance companies to protect them against larger losses in terms of severity and frequency. In Ghana, the National Insurance Commission (NIC) is the governing body responsible for regulating and monitoring activities of all players in the insurance industry. Reinsurance provide capacity, economies of scale, create financial stability, enables diffusion of risks, protecting solvency margin and providing added value services to insurance companies.

REFERENCE

- https://stratisrisk.com/facts/7-benefits-of-reinsurance/

- https://nicgh.org/

- Introduction to Resinsurance ©London School of Insurance 2016 v6.0 – 23032017

- Cambridge Dictioary

The Author

>>>The writer is a chartered insurance Practitioner and an Associate of the Chartered insurance institute of UK. He also holds a professional qualification in Risk Management (Associate in Risk Management -ARM) from the American Insurance Institute. He is currently pursuing his CPCU designation with the American Insurance Institute and MBA (Finance) program with University of Ghana Business School. He has over nine (9) years’ experience in insurance, reinsurance and risk management. He can be reached on +233249236939 and or [email protected] / [email protected]