This is the continuation of our series on the Social Media Mix of Banks, first published in the Monday, 16th January, 2023 edition of this column. The key social media accounts we identified are Twitter, Instagram, LinkedIn, Facebook and YouTube, which we coined as TILFY. This second publication focuses on Instagram. Instagram is a photo and video-sharing social networking service owned by an American company, Meta Platforms. Meta Platforms is the parent company of Facebook, which acquired Instagram for about US$1billion in cash and stock in April 2012.

Instagram is advertising-friendly and has a dashboard interface which allows people and businesses to track impressions, the reach and frequency regarding the contents they share on the platform. Thus, Instagram has tabs for ‘Account Insights’ and ‘Ad Insights’ to inform its users of the impacts of contents they share on the platform. As part of its plan for 2023, Instagram is introducing a new feature – ‘Live Story Replay’, which will allow users to save their live stories and watch them again at a later time as well as share them with others.

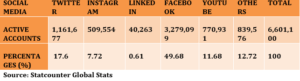

Monthly statistics on active social media accounts by Statcounter Global Stats as at the end of December, 2022 put active Instagram users to 509,554, representing 7.72 percent of the 6,601,100 active social media population in Ghana. The findings also reveal that an average of 6.3 percent of people are active on the Instagram platform every month.

In effect, the Instagram platform is largely active in Ghana for use to share relevant contents and achieve results in terms of building customer networks and advertising, getting customers’ feedback, and building loyalty with them. Concerning advertising as espoused by the famous Psychologist, Henderson Britt, “doing business without advertising is like winking at a girl in the dark. You know what you are doing, but nobody else does”. Thus, banks, among other businesses, will continue to advertise their products and services by making provisions for it in their yearly budgets. In 2022, in the estimation of Statista, traditional television adverting spending in Ghana by businesses was US$32million for digital terrestrial television (DTT) and US$8million for satellite. In the face of increasing cost of doing business, cost optimisation is very important to improve efficiency and enhance shareholder value. Therefore, social media platforms (TILFY) – in this case, Instagram – will help banks to optimise their advertising costs, hence, raise their bottom-line since it costs less or free to reach customers on Instagram and other social media platforms in the mix.

Active TILFY accounts in Ghana as @ Dec 2022

Text contents versus video/image contents

Psychologist Albert Mehrabian demonstrated that 93 percent of communication is non-verbal. The visual is the one that the audience reacts to first or more immediately and will likewise retain it. Also, findings of a research at 3M Corporation concluded that the human brain processes images 60,000 times faster than text, and 90 percent of information transmitted to the brain is visual. Further studies find that “pictures enhance or affect emotions and attitudes. They engage our imagination and heighten our creative thinking by stimulating other areas of our brain, which leads to a more profound and accurate comprehension. Emotions influence decision-making”.

Dr. Lynell Burmark of the Thornburg Center for Professional Development, who wrote a paper on visual literacy, said: “…unless our words, concepts, ideas are hooked onto an image, they will go in one ear, sail through the brain, and go out the other ear. Words are processed by our short-term memory, where we can only retain about 7 bits of information – plus or minus 2. This is why, by the way, we have 7-digit phone numbers. Images, on the other hand, go directly into long-term memory where they are indelibly etched”. Based on these facts, we can say that Instagram, as a photo and video-sharing social media platform, has a strong traction to influence customers and the public in their banking relationships when the banks optimise their value in their social media mix. Indeed, the banks are able to convey so clearly to their followers such promotional and product information through video contents and flyers.

The banks which have verified Instagram accounts as at 31st December, 2022 are the ABSA Bank, ADB, the Consolidated Bank Ghana (CBG), First National Bank (FNB), Guaranty Trust Bank (GT Bank), GCB Bank and the UBA(Ghana). In general, verified badges (blue ticks) confirm that an Instagram account is authentic. These help people more easily to find public figures and brands they want to follow and, therefore, eliminate the risk of impersonation. It is the case that people tend to trust and believe contents of verified accounts and identify with them more than unverified accounts.

It is our recommendation that banks which do not have their accounts verified should apply to Meta Platforms to have them verified as part of their brands (reputation) management. Our findings at J.S Morlu reveal the number of followers the banks on Instagram accounts have as a result of the contents they convey through the platform.

Ranking of followers of Banks in Ghana on Instagram as @ 31 Dec 2022

Among the lot, the Société Générale (Ghana) doesn’t have Instagram Account (Ghana) even though the parent company (group) has a verified Instagram account with over twenty-eight thousand, six hundred (28.6k) followers as at 31st December, 2022. For the period in focus, as shown in the table – Ranking of followers of banks in Ghana on Instagram as @ 31st December, 2022 – the First Atlantic Bank (Ghana) ranks number one (1), with the highest number of followers. It has one hundred and forty-seven thousand (147k) followers on the Instagram platform. Other banks follow in that order with the UBA (Ghana) placing second (2) with over one hundred and five(105k) followers, the Consolidated Bank Ghana (CBG) is third (3) with sixty-nine thousand three hundred (69.3k) followers. OMNI BSIC has seven hundred and eighty-eight (788) followers and placed twenty-second with regard to the ranking, and needs to do more to reach more people, especially the Generation Z, who are digital savvy within the social media space.

We do not by this publication impute that some banks are better managers of their Instagram accounts than others. Nonetheless, the intense competition among banks and the need for them to leverage on the TILFY spaces and unearth their full benefits motivate this publication.

BERNARD BEMPONG

Bernard is a Chartered Accountant with over 14 years of professional and industry experience in Financial Services Sector and Management Consultancy. He is the Managing Partner of J.S Morlu (Ghana), an international consulting firm providing Accounting, Tax, Auditing, IT Solutions and Business Advisory Services to both private businesses and government.

Our Office is located at Lagos Avenue, East Legon, Accra.

Contact: +233 302 528 977

+233 244 566 092

Website: www.jsmorlu.com.gh