…Assessing KOA’s definition of sustainability and the treatment of their partner farmers

My concluding thoughts

During my Master’s Thesis in 2019, I reflected on almost all the known initiatives the Ghana Government and industry stakeholders announced to have implemented to address the livelihood changes of smallholder farmers. I concluded that:

“It is not real for smallholder farmers to sustainably gain sufficient income to solve their income-driven challenges if they attempt to enhance their value capture from within the cocoa-chocolate value chain. This is due to the high level of power relations, firm network entrenchments, technology and infrastructure setbacks, and operational and competitive risks that disadvantage the smallholder farmer. However, enhanced value capture is only real when the strategy to capture does not interfere with the power relations, firm network entrenchment, and the operational and competitive landscape of the established stakeholders within the cocoa-chocolate value chain. At this point, they can gain the moral support of the lead firms and generate sustainable incomes to solve their livelihood challenges driven by income constraints.”

This conclusion wasn’t supposed to absolve these influential stakeholders, including Ghana Cocoa Board, from a fierce fight from smallholder farmers; but to equip farmers with the financial capacity to fight fiercely without holding back. For example, if the farmer can earn income from the by-product processing, they can think of hoarding as a strategy to demand better prices for their dried beans and decide to delay supply so long as they don’t go hungry.

I was excited when I heard of KOA’s operations in Ghana, which focused on value addition to cocoa pulp. But one thing many people ask is, was the Ghanaian investor, government or the cocoa farmers unaware of the economic value of cocoa pulp to have exploited it, and have had to wait all these years for KOA to pioneer its commercialisation in Ghana? In Ghana, an enabling environment has been created for companies that produce for the export market. In addition, when the exporter or investor is from Europe or the USA, where most of these sweet tooth markets are domiciled, the tariff and non-tariff market access advantages sit essentially with investments their citizens lead. Also, access to cheaper business support services and financing are opportunities limited to the local Ghanaian investor. Lastly, the legacy of a century-long wrong and generalistic way of portraying Africa and Africans as a place and a people who can’t be trusted, or do not have the environment to produce food products worthy of consumption by our ever ‘healthy’ westerners.

How have these reasons facilitated KOA’s ability to explore these blue ocean business opportunities within Ghana’s cocoa sector as a Foreign Direct Investor?

I would argue that KOA’s pioneering move into cocoa pulp processing in Ghana is fixated on many conducive business incentives they have as an export-focused and European-owned company, which indigenous Ghanaian investors who want to produce for local consumption do not have access to. Therefore, advice like “Producing countries should encourage the local consumption of cocoa products” and “buy made in Ghana or Africa products” is just rhetorical, with no policy backing. Value addition in Africa seems to be only acceptable to the west when it’s fronted by one of their own. Ghana and Ivory Coast produce over 60 percent of the world’s cocoa beans, yet the entire continent consumes less than 0.5 percent of the world’s chocolate. It is an indicator that regardless of how we develop our local markets for chocolate, unfortunately, we cannot ignore the need to access these financially resourced and sweet tooth markets for any value addition agenda we embark on. After all, the reason cocoa was termed as a ‘Cash’ crop in the agricultural textbooks in Ghana was due to its foreign exchange earning abilities to resource our industrialisation drive.

Below are details of some of the incentives KOA has as an export-focused European Direct Investment in Ghana:

- Incentives as members of the Ghana Freezones Authority.

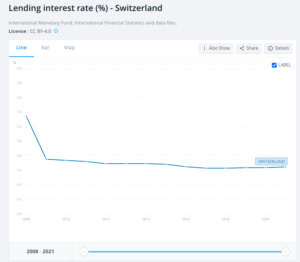

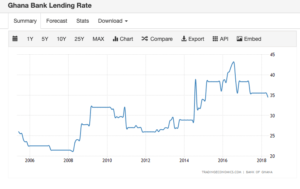

- Access to cheaper loans in Switzerland as opposed to the over 20 percent annual lending rates in Ghana, as shown in graphs 1 & 2. With Ghana’s continued currency depreciation, it’s much cheaper for KOA to operate in Ghana as a business that buys cocoa pulp in Ghana cedi and sells its final products in US dollars, Euros or Swiss Francs. This makes it more affordable for them to service their Swiss loans and make more profits while they await competition in the space.

Graph 1 – Average Lending Rate (%) – Switzerland

Graph 2 – Average Lending Rate (%) – Ghana

- Easy access to a sweet tooth market, i.e., European markets. KOA Switzerland, which focuses on marketing and distribution of their products in the west, with the owner being European, has much leverage in capturing the western market as opposed to a Ghanaian-owned manufacturer seeking markets in Europe. The most straightforward argument will be: “Why don’t Ghanaians develop an African demand for such products to gain the African advantage” too? Compared to the Western market, Africa’s low income and development status doesn’t incentivise the development of a large, sweet tooth market for luxury products like ‘well-packaged cocoa pulp juice or concentrate’. With Africa being a low-income continent, the products need to be cheaper before a substantial market can be developed. Financiers require the justification of the existence of a sweet tooth market before loans can be awarded.

To read the full article and support my research work, kindly make a paid subscription to my newsletter via https://cocoadiaries.substack.com/subscribe.