African Export-Import Bank (Afreximbank), has been singled out for applause by the Ministry of Finance (MoF), Bank of Ghana (BoG), and Ministry of Trade and Industry (MoTI) for its comprehensive cocktail of financial facilities for businesses and infrastructure development projects in Ghana and on the continent.

According to the state institutions, the bank’s liquidity support for trade and project-related finance activities across the continent is pivotal for boosting industrialization under the African Continental Free Trade Area (AfCFTA).

Some outstanding financial support projects of the bank over the years include a syndicated loan to Cocobod in the early 1990s’ when the bank just started, the introduction of an adjustment facility fund to give AfCFTA trading a significant boost worth US$10 billion & committing US$1 billion to same, and a facility of about US$7 billion for central banks and small and medium-sized enterprises, to reduce the effects of the Coronavirus.

Others include a recent US$4m Ukraine Crisis Adjustment Trade Finance Programme for Africa (UKAFPA) to help contain the short-term impacts of the crisis, a commitment of some US$1 billion to support the development of the automotive sector on the continent, and a multi-billion-dollar energy fund aimed at scaling-up private sector investment in African oil and gas projects, among others.

These supports among others accumulated to the whopping US$35 billion mobilized for the development of the continent, in the last five years, in addition to the bank’s aim to pump US$20 billion to support intra-African trade in the next five years, as indicated by the president of the bank in the 2022 Annual General Meeting of the institution.

The successful launch of the Pan African Payments and Settlements System (PAPSS), to connect African banks, payment service providers, and other financial market intermediaries, for instant and secure payments between African countries, was also mentioned as a further manifestation of the bank’s resolve to bridge Africa’s trade and investment gaps.

The deputy Trade Minister, Herbert Krapa, in what he described as the hard truth emphasized that the continent cannot develop and achieve inclusive economic growth without industrialization, hence, the need to commend the critical role of Afreximbank in this direction.

“Businesses in Ghana are the drivers for our participation in the 1.3 billion people market presented by the AfCFTA. Like many of their counterparts across the continent, access to financial services and risk mitigation strategies remain a perennial challenge. Innovative trade financing options have, therefore, become crucial to offer flexible solutions for accelerated cash flow while reducing exposures to trade risks.

To this end, Afreximbank’s leading role in providing a comprehensive cocktail of trade finance facilities for boosting intra-Africa trade is to be singled out for applause,” he said.

Governor, Bank of Ghana, Dr. Ernest Addison, in his remarks indicated that African integration and development are anchored on financial sector development and access to finance and investment. But unfortunately, in addition to the fragmented markets, inadequate payment systems infrastructure has been identified as a major constraint to intra-African trade.

“Payments within Africa are mostly done through correspondent banks before reaching the recipient African neighbour. This comes with high transaction fees, compliance costs, applied foreign exchange conversion rates, and liquidity costs.

Thankfully, Afreximbank’s MANSA platform is intended to provide secure and trustworthy means for proper verification of counterparties and due diligence, one of the main challenges facing intra-African trade today. The PAPSS platform will also give businesses in Ghana access to the entire African continent and enable them to engage in financial transactions in local currencies,” he said.

Finance Minister, Ken Ofori Atta, on his part, said: “For Ghana, in terms of our relationship with Afreximbank, the numbers speak for themselves. As far back as 1994, Cocobod secured a transaction and that syndication has gone on over the years on a more global sense of literally US$1b to US$1.5b annually. So, the catalytic effect of pushing things to start is evident and that comes down to leadership,” he said.

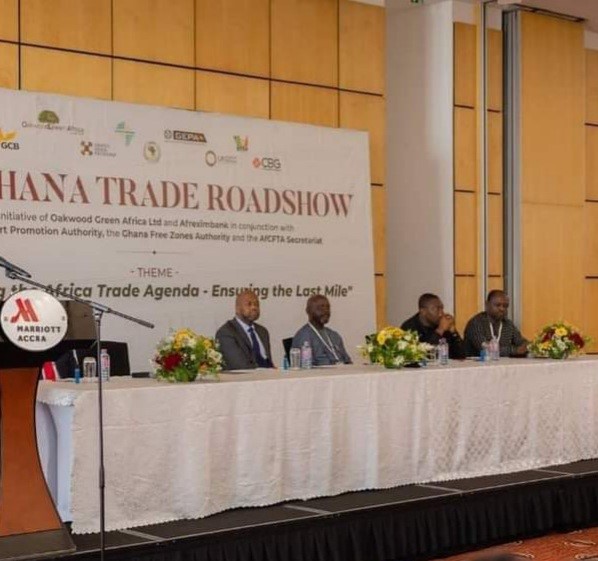

These remarks were made on the theme ‘Supporting the Africa Trade Agenda- Ensuring the last mile’ at the three-day Ghana Trade Roadshow (GTRS) organised by Afreximbank in partnership with the Oakwood Green Africa Limited, the Ghana Free Zones Authority (GFZA), Ghana Export Promotion Authority (GEPA) and the AfCFTA secretariat.