As the domestic banking industry continues to navigate the complexities of a rapidly evolving landscape, coupled with recent public health and geopolitical developments, there is much to be pleased about over the industry’s performance in the 2021 financial year, with noticeable growth across key areas such as total assets, deposits, profitability, and loan books.

During the period under consideration, the industry’s deposits also recorded a double-digit growth of 16.6 percent of GH¢121.1billion; this was, however, lower than the 24.4 percent growth recorded in 2020.

Banks extended credit to households and businesses to the tune of GH¢53.8billion, underscoring the cautionary lending stance adopted by a number of commercial banks across the board. Industry total revenue was also on the ascendancy, reaching GH¢17.4billion for the year, a 14.6 percent year-on-year growth with total expense following the same trajectory.

Top of the table

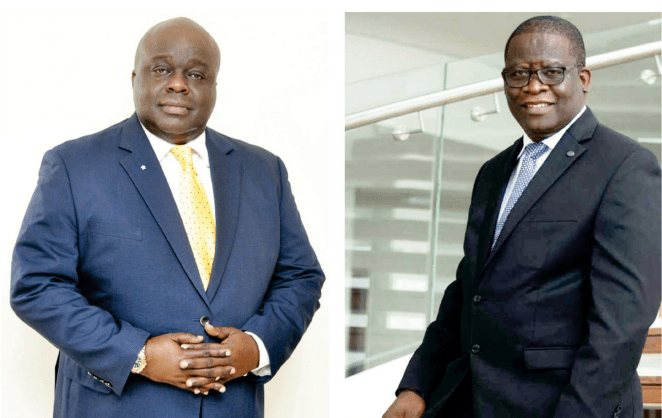

A look at the audited financials of 21 banks (GH¢171.9billion) indicates that the value of total assets of the industry is 37 percent of the 2021 Gross Domestic Product estimate of GH¢459.1billion. Cumulatively, industry assets grew to 20.4 percent versus 15.8 percent in 2020 to GH¢179.9billion from GH¢149.3billion. As expected, at the top of the food chain was the partly state-owned GCB Bank and publicly listed private juggernaut Ecobank leading the pack.

The rest of the top five is made up of Absa, Stanbic, and the wholly indigenous and privately-owned Fidelity Bank, with Consolidated Bank Ghana (CGB) – which at its introduction, was poised to become the third-largest in the country, at least by total assets on account of its nationwide reach – and crucially indigenous state ownership – just falling outside the group.

Two horse race?

Despite its modest beginnings in 1990, Ecobank’s agility in the adoption of forward-thinking strategies, particularly in the adoption of technology, ensured rapid growth. This was also propelled by being the spawn of the Pan-African banking group and benefitting from a transfer of know-how, etc.

Its acquisition of 100 percent shares of the erstwhile Trust Bank Ltd. (TTB) in 2013 in a US$135million deal positioned Ecobank as the largest bank by assets, with over 70 branches and 150 automated teller machines (ATMs). It remained at the top of the pile, leading in many categories; but it began to feel the heat from some of its rapidly upward-mobile peers.

Amid the sweeping industry reforms, Ecobank was toppled by GCB Bank in 2017 as the market leader from an asset value standpoint, owing to its acquisition of the good assets of the defunct UT and Capital Banks. Since then, both have been in a two-horse race to see who emerges first across the GH¢20billion-in-asset line.

National pride: GCB in 2021

A poster boy for the turnaround story, the Ghana Stock Exchange-listed GCB Bank closed the year with 48.75 percent of its shares being held by “various institutions and individuals,” with 29.89 percent owned by the Social Security and National Insurance Trust (SSNIT), and the remaining 21.36 percent by the Government of Ghana.

The bank recorded a 36.2 percent growth in pre-tax profit, from GH¢610.8million in 2020 to GH¢831.9million in the year under review. It also recorded a post-tax profit totaling GH¢557million for full-year 2021, a 26.7 percent growth from the GH¢439million recorded in the previous fiscal period and marginally beating analysts’ expectations.

Total assets, on a similar tangent, rose 19.16 percent to close the period at GH¢18.3billion. The performance was driven largely by growth in Cash and Cash Equivalents (46.84 percent); Non-pledged trading assets (115.8 percent); Loans and Advances (19.21 percent) as well as Deferred Tax (51.11 percent) on a year-on-year (YoY) basis. This ensured the bank ended the financial year with 10.6 percent of the industry’s total assets.

Digging deeper, the financial services provider held GH¢9.71billion of its assets in investment securities. A perusal of the numbers shows that GH¢5.07billion was in 5-year, fixed-rate Treasury notes, with another GH¢3.98billion and GH¢601million – totalling GH¢4.58billion – in stocks and Treasury bills, respectively.

On the flip side, the bank’s liabilities were driven primarily by a 16.2 percent rise in customer deposits to GH¢13.9billion. With all said and done, GCB topped the industry in Total Assets, Deposits, Total Operating Income, and Net Interest Income. It, however, placed 16th and 18th, respectively for sustainability metrics – Non-Performing Loans and Capital Adequacy Ratio.

1Q22: Meeting the mark

In the first quarter of 2022, the bank published a healthy set of results, with a higher-than-expected performance in some key segments. It comes, then, with little wonder that GCB Bank crossed the aspirational GH¢20billion threshold for total assets, closing the period at GH¢20.2billion, a 24.4 percent rise from the GH¢16.2billion recorded during a similar period last year.

Unsurprisingly, a look at the composition of the bank’s total assets indicates that Investments in Securities continue to be responsible for a princely share of the balance sheet at GH¢10.31billion (51 percent of the segment). Coming in at a distant second was Loans and Advances amounting to GH¢4.88billion, or 24.2 percent.

In the quarter, revenue was up two percent on the previous accounting period (20 percent year-on-year) to reach GH¢824million. Accordingly, post-tax profit hit GH¢148million, a three percent annual growth and a 33 percent rise in lending. Its NPL ratio also improved marginally to 15.6 percent versus 16 percent.

GSE performance

In 2021, GCB Bank’s share price appreciated by 29.4 percent from GH¢4.05 to GH¢5.24, with a Price-to-Earnings (P/E) ratio of 3. In spite of its good performance in 2021, concerns about NPLs and wider market conditions have resulted in a decline in GCB Bank’s share price. At the close of the penultimate week in June 2022, its share price had steadily declined to GH¢5. The bank recently announced the payment of a final dividend of GH¢0.5 per share – which translates to GH¢132.5million – on its 265 million outstanding shares

The Pan-African bank

Consistent with its historical performance, as well as that of the wider industry in the year under consideration, Ecobank grew its operating profit by 14.6 percent, from GH¢773.7million in 2020 to GH¢886.3million in 2021. This was propelled largely by a 10.5 percent appreciation in net income to close the period at GH¢1.99billion.

It reported a 12.43 percent rise in its total assets to GH¢17.86billion, with GH¢5.63billion disbursed as loans and advances to customers. Deposits from customers also witnessed growth YoY, rising 13.1 percent from GH¢11.39billion in 2020 to GH¢12.88billion in 2021. The bank ended the year with Capital Adequacy, Non-Performing Loan, and Liquidity ratios of 20.24 percent, 12 percent and 69.84 percent, respectively.

1Q22 performance

Ecobank continued its good run of form with revenue growing 10.4 percent year-on-year to hit GH¢520million. Profit before and after tax were impacted by elevated operating expenses as personnel expense, depreciation and amortisation, as well as other components made a sizeable dent.

The bank, however, grew its total assets to GH¢19.1billion, up 20 percent from the corresponding period in 2021. A 35 percent loan book growth to GH¢6.3billion, as well as a 42 percent rise in the bank’s non-trading assets to hit GH¢7.3billion. Instructively, the latter is 38 percent of total assets. Deposits in the quarter grew by 23 percent year-on-year to reach GH¢14.4billion, as total liabilities closed the period at GH¢16.3billion.

GSE performance

At the close of the year, Ecobank’s shares were held predominately by Ecobank Transnational Incorporated (69.83 percent), SSNIT (16.21 percent) and others (14.86 percent). Ecobank closed the year with a share price of GH¢7.6 from GH¢7.2 at the beginning of the year. It has remained flat ever since, despite a P/E ratio of 4.

During its recently held Annual General Meeting, shareholders of Ecobank approved the payment of GH¢0.62 as dividend per share (DPS), bringing the total corporate payout for the 2021 financial year to GH¢199.98million. The sum represents approximately 35 percent of the financial services provider’s post-tax profit.

Despite being marginally behind GCB Bank in the total assets category, Ecobank exerted its dominance in others. In addition to leading the loan book category, Ecobank came top for Total Equity and Net Interest Income. The bank also had the highest cost of credit in the industry.

Notable mention

Lurking in third place for total assets was Absa Bank, which closed the year with GH¢16billion in assets. The former Barclays Bank, however, led the industry in profit – before and after tax, as well as return on equity. It also had the highest operating expenditure.

Observations

Of the two leading banks, in terms of total assets, there is a distinction in their asset mix. While GCB Bank heavily favours investing in Treasury securities, the two biggest components of Ecobank’s are its non-traded assets and loan book.

Furthermore, the tilt toward Treasury securities across the board is seen as Total Investments (46 percent of total assets) increased by 29 percent from GH¢64.2billion to GH¢82.9billion. Consequently, in excess of 70 of the Assets were held in Loans and Advances and Earning Assets.

Comments

As analyst Carl Odame-Gyenti puts it: “It was also observed that the Earning Assets (i.e., Investments in bills, securities and equity remained the largest component of total assets) increased by 30 percent year on year, while loan and advances to customers grew by only 13 percent year on year. It is, therefore, recommended that banks should make a conscious effort to open credit to the private sector to boost and stimulate the growth of the real economy.”

While the Ghanaian banking industry continues to be hailed for its resilience, and quite rightly so, at least relatively, some numbers expose how minuscule it is, again, comparatively.

The Industrial and Commercial Bank of China currently holds assets in excess of US$5trillion while America’s J.P Morgan Chase and U.K’s HSBC have assets of US$3.74trillion and US$2.95trillion, respectively.

By comparison, our very own GCB Bank’s assets are worth US$2.8billion, using the midpoint daily interbank FX rate for the third week in June. Admittedly, there are nuances such as the size of the economy, population and development of the financial sector. As important as they are, there is only so much banks can do. Until the nation is able to significantly grow its production base, we are bound to remain a hand-to-mouth economy with banks having limited wriggle room.

Inasmuch as we continue to urge our banks to further enhance innovation, diversify their asset mix, and seek additional ways to extend credit to the real sector, we must balance the calls with a healthy dose of caution, being cognisant of prevailing market risks and knowing fully well what failure in the banking system would result in for the wider economy.

In the meantime, we congratulate GCB Bank for attaining the feat, and expect that Ecobank will do the same before the current financial year closes. As we all work toward the expansion of the domestic financial ecosystem, we wonder who will be the first to the next milestone, with “30 billion for di ‘akant’”? GCB? Ecobank? Absa? Or just someone else.

References

- Audited Financial Statements of Ghanaian banks.

- Odame-Gyenti, Carl. (2022). Banking Sector Performance, a Review of 2021 Audited Financial Statements.