Petroleum revenue contribution to the national budget over the last 10 years has been estimated at US$2.6billion, which is out of a total of US$6.55billion in petroleum receipts (equivalent to 9.97 percent of Ghana’s 2020 GDP) earned between 2011 and 2020 by the Ghana Group from its three producing fields.

The portion of oil money in the national budget, the Annual Budget Funding Amount (ABFA), has been a critical financing source for the national budget – receiving 40 percent of the country’s petroleum revenues over the period.

While the allocations, over the years, to the ABFA have been in line with the Petroleum Revenue Management Act (PRMA) as amended, a recent report commissioned by the Public Interest and Accountability Committee (PIAC) sighted some possible infractions with disbursements.

According to the report: “While total benchmark revenue allocations to ABFA amounted to GH¢9.41billion (US$2.61billion), actual allocations on the other hand amounted to GH¢8.51billion (US$2.28billion) – leaving the balance being swept into the Consolidated Fund under government’s Treasury Single Account (TSA) policy,” the PIAC report noted.

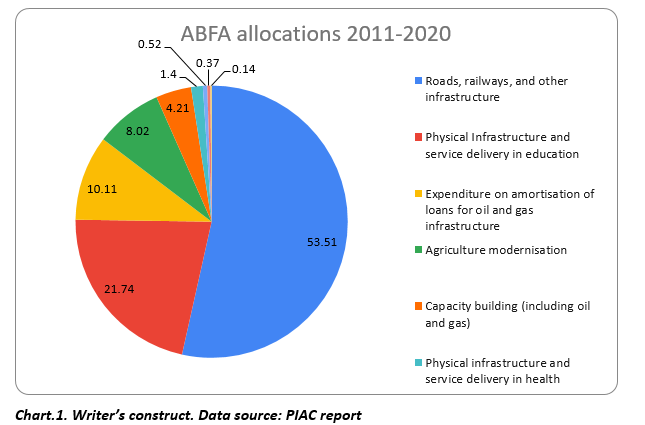

The report, on assessment of 10 years of petroleum revenue management in Ghana, shows that in terms of allocations the ABFA has been spent on seven out of the 12 priority areas specified under the PRMA. Accordingly, ABFA allocations have been on the following priority order (scale):

| ABFA spend (in priority order) | Percent |

| Roads, railways and other infrastructure | 53.51 |

| Physical Infrastructure and service delivery in education | 21.74 |

| Expenditure on amortisation of loans for oil and gas infrastructure | 10.11 |

| Agriculture modernisation | 8.02 |

| Capacity building (including oil and gas) | 4.21 |

| Physical infrastructure and service delivery in health | 1.4 |

| Ghana Infrastructure Investment Fund (GIIF) | 0.52 |

| Industrialisation | 0.37 |

| PIAC | 0.14 |

Table 1. Writer’s construct. Data source: PIAC report

In the case of Physical Infrastructure and service delivery in education which have so far been allocated 21.74 percent of ABFA, the report highlighted that t government’s flagship programmes such as the Free SHS policy account for most of the ABFA education spending.

“We find evidence of ABFA allocations being spread across the length and breadth of the country, thus partially satisfying the requirement under Section 21(2)(c) of the PRMA to undertake even and balanced development of the regions,” it was stated.

However, it maintained that the micro-level evidence base also indicates the selection of several ABFA-funded projects was not participatory; it was instead imposed top-down from Accra rather than bottom-up.

“Furthermore, it was disclosed that rules governing the selection of spending areas in the PRMA are not consistent with resource allocation structures under the budget; posing potential risks of non-compliance to efficient prioritisation as required under the PRMA.

“While the PRMA mandates ABFA project-selection to be guided by a medium-term expenditure framework (MTEF) aligned with a long-term national development plan, a review of most medium-term plans (MTPs) of beneficiary ministries indicates inadequate analysis and evidenced-based data to back the decisions in these documents.”

This development is believed to be highly symptomatic of Ghana’s underlying political settlements regime – whereby project selection in the national budget is very political, driven by political party manifestos rather than well-researched and cost medium-term plans (MTPs), or even a national development plan.

Furthermore, the checks show that there was no coordination and consensus between projects implemented across MDAs under the same ABFA spending area. Meanwhile, there is no mechanism to ensure that ABFA disbursements made across multiple sector MDAs under the selected priority areas are well-coordinated to generate optimum social returns.

“In essence, ABFA investments have yielded some successes; but its overall impacts have been minimal, delayed or negligible. Many stakeholders believe ABFA has not delivered their expectations in maximising the rate of economic development and enhancing their well-being. Many of the challenges affecting the effective and efficient utilisation of petroleum revenues, especially the ABFA, are macro-fiscal in form.”

At the back of these developments, the study called for official public criteria to guide the technical prioritisation of ABFA projects. “In other words, the Minister of Finance’s selection of ABFA priority areas should have an evidence-based justification and criteria to ensure the selection leads to the intended objectives of ABFA as specified in the law.”

It further noted that a more comprehensive and decentralised project preparation, planning and monitoring process is needed to ensure ABFA projects are strictly monitored and delivered on time.