- Output falls at sharpest rate since April 2020

- Substantial increases in both input and output price inflation

- Sentiment dips to nine-month low

March PMI data for Ghana pointed to a second successive deterioration in business conditions as new orders fell for the first time in seven months and output declined sharply. Once again, intense cost pressures led to weak demand in the domestic market while firms scaled back on purchasing activity amid cost-saving efforts. At the same time, however, staffing levels continued to grow while wages were raised at the quickest rate for eight months.

As for sentiment, steep cost pressures led some firms to reduce their output expectations with optimism at a nine-month low.

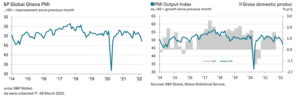

The S&P Global Ghana Purchasing Managers’ Index™ (PMI®) posted below the neutral value of 50.0 for the second month in succession, indicating a deterioration in business conditions. At 47.2 in March, down from 49.6 in February, the rate of decline was solid and the steepest since May 2020.

A key driver of the latest decline was a renewed fall in new orders. The overall rate of contraction was modest, but the first in seven months. According to panel comments, price hikes discouraged sales at the end of first quarter.

Similarly, output levels contracted in March – indicating a third consecutive monthly reduction. The rate of decline was marked and among the steepest in the series history, surpassed only by that seen during the onset of COVID-19 in March and April 2020.

All five monitored sub-sectors registered a contraction in output levels during the month. Agriculture recorded the steepest fall, followed by services, wholesale & retail, manufacturing and construction, respectively.

With global price pressures exacerbated by geopolitical issues, companies in Ghana faced an accelerated rise in purchase costs. Higher fuel, transportation and raw material expenses were often reported, though there were also mentions of unfavourable exchange rate movements against the dollar.

Firms raised their staff wages amid higher living expenses and as part of efforts to motivate workforces. Subsequently, overall input price inflation quickened to an 81-month high.

In line with rising cost burdens, firms raised their selling charges at the quickest rate for seven-and-a-half years.

Weak demand led Ghanaian companies to hold back on purchasing activity for the second month running. At the same time, cost-saving efforts led to another depletion of

inventories, which was the quickest for 15 months.

The intensification of inflationary pressures resulted in a moderation of sentiment, which eased to a nine-month low. Nevertheless, firms were on the whole optimistic that such

issues will have subsided in 12 months’ time.

On a more positive note, firms continued hiring activity in March. In turn, backlogs were reduced for the seventh time in eight months.

Meanwhile, vendor performance improved with firms reportedly placing orders in a timely manner. In fact, lead times shortened to the fourth-greatest extent in the series’ history.

Shreeya Patel, Economist at S&P Global said: “Ghana concluded the first quarter of 2022 with the steepest reduction in business conditions for almost two years. Output levels fell at the sharpest rate since onset of the pandemic, while a renewed decline in new orders suggests difficult trading conditions.

“The survey continued to highlight intense cost pressures, which was arguably the main driver of the latest deterioration. Firms indicated sales were curbed by severe price hikes which were only exacerbated by geopolitical tensions.

“Rising fuel, transportation and other input costs were key drivers of the quickest rate of overall input price inflation for almost seven years. Firms can only hope that dollar-cedi exchange rates move favourably, and policymakers continue to keep a close eye on inflation levels.”