“Your most unhappy customers are your greatest source of learning” ~ Bill Gates

The bank and customer relationship or the contract terminates by closure of the account at the request of either party. This can be by mutual agreement, or after a customer has transferred the balance on the account.

However, by law, an account can be terminated due to three reasons: Death, insanity/Lunacy or bankruptcy of the customer. In some limited circumstances, however, a bank can close an account without giving any notice, especially where warning letters have already been sent to the troublesome account holder. In summary, the determination of the banker-customer relationship can be for positive or negative reasons.

Customer Service in a Digital World- The New Paradigm

A customer service revolution is occurring in financial services. It is dynamic and being driven by consumers who are embracing digital and mobile channels as never before. The digital age is changing the way consumers research, shop and buy products and services and how they share their experiences after each purchase. Exiting a bank these days is very easy, thanks to digital banking.

Now we realize that customers do not even have to bother to enter the branch and issue a big cheque to make a teller suspicious to ask the reasons. They can just gradually transfer their funds into their own account held in another bank, or through their mobile banking funds if they do not want the bank to know. Eventually, they empty their account and leave the original bank’s account with a few cedis, which gradually dries up after charges, and end up with overdrawn balances!

Why are my Customers Leaving?

- Customers may leave for positive reasons – for example they might have outgrown the size of the loans that the bank can offer and be graduating to be a bigger corporate customer in a bigger bank.

- They may also leave for negative reasons, such as business failure or a bad experience with the bank. Furthermore, some customers who leave may decide to return at some stage in the future. Customer exits can affect the bottom line and the success of a bank. A rising exit rate may indicate major problems for a bank and even threaten its survival.

- Some may be unhappy with terms and conditions, or relations with staff.

- They may be switching to competitors.

- Perhaps the demand may be falling due to a change in the economic climate.

Therefore, if you do not research and address exit rates, this can have a serious effect on your bank’s financial performance. I always describe the banker-customer relationship as a financial marriage. When one party’s loyalty wanes, there is a likelihood of termination, which can sometimes be painful. Loyalty is a key requirement in the survival of the banker-customer relationship.

According to Hirschman in his famous book, “Exit, Voice and Loyalty: Responses to Decline in Firms, Organisations and States” in 1970, he argued that people have two different ways of responding to disappointment. They can vote with their feet (exit) or stay put and complain (voice). A customer’s complaint behaviour is determined by Psychographic variables. These are attributes relating to the customer’s personality, values, attitudes, interests, or lifestyles.

Customer Complaints Behaviour in Banks

This can be influenced by three Psychographic Variables: Exit, Voice and Loyalty. When customers perceive a decrease in service quality, they can exit (withdraw from the relationship); or, they can voice (attempt to repair or improve the relationship through communication of the complaint, grievance or proposal for change). However, the interplay of loyalty can affect the cost-benefit analysis of whether to use exit or voice.

While both exit and voice can be used to measure a decline in an organization, voice is by nature more informative in that it also provides reasons for the decline. Exit alone, only provides the warning sign of decline. Exit and voice combine to provide better opportunity for feedback and criticism, exit can be reduced. The general principle, therefore, is that the greater the availability of exit, the less likely voice will be used.

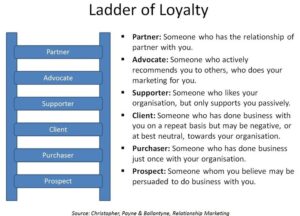

Customer Loyalty Ladder is a systematic way of classifying customers of an organization into five different categories depending upon the business level engagement of customers with the organization. It takes at least 30 times as much marketing budget to attract a new customer via traditional forms of advertising as to re-attract a repeat customer. Most business owners spend less than 5% of their marketing budget on their existing customers but they spend 95% of their marketing budget trying to find new customers.

Know your Customers’ Ladder of Loyalty

The error that some banks make is that they invest more in attracting new customers in the first stage, rather than keeping the already existing customer satisfied and happy. A good marketing company should invest at least 30% of their marketing budget in keeping the customers and clients happy.

The study of the customer loyalty ladder concept is to help banks to invest in developing satisfied customers. Banks should identify and analyze which customers belong to which stage of the customer loyalty ladder. The best customer is the most recent satisfied one, as well as, the best word of mouth advertising comes from the same source (the most satisfied customer).

Banks have to acquire the skills which allow them to act in a way that moves people up the ladder.

When you examine the diagram on the ladder of loyalty, you will realize that it seems a lot goes into making a prospect become a partner. Seems like a tall ladder, but in reality, it is not. There are some customers who become partners for life depending on their level of sophistication, expectation, trust and loyalty. There is a limit to what a customer can withstand or tolerate. However, with the barriers to account opening becoming so low and determined by market demand and aided by technology, the competition has become very fierce, and banks are leaving no stone unturned to stay afloat.

The Covid 19 pandemic era comes with challenges as well as opportunities. This is the best time to do a self-audit of your service. Customers going through business decline will obviously show decline in their turnovers but without asking, there comes a communication block. This is where Relationship Managers come in. Customers rely on their emotional experiences with salespeople more than any of the traditional factors, according to research by the Peppers & Rogers Group. It showed that:

- 60% of all customers stop dealing with a company because of what they perceive as indifference on the part of salespeople

- 70% of customers leave a company because of poor service, which is usually attributed to a salesperson

- 80% of defecting customers describe themselves as “satisfied” or “very satisfied” just before they leave, and

- Customers who feel their salespeople are exceptional are 10 to 15 times more likely to remain loyal.

Attitude and Emotion

These statistics show the important role that attitude and emotion play in determining whether customers leave or stay. It is critical for salespeople to understand customer attitudes and regularly collect feedback. The research further explained that “Most salespeople can answer the “who, what, when, where and how” of a business relationship. The missing element is “why.” Why do your customers do business with you? Is it because they feel valued, protected or informed? These “why” factors have a definitive impact on customer loyalty.”

Bank Self Audit

A bank’s self-audit will answer the question about customer exits even though it is always inevitable in the long run. No bank can retain a customer forever. Poorer customers may not be protected against crises or shocks. Richer customers may choose to leave a bank whose products and policies are not appropriate for them. However, as this worsens and remains unchecked or investigated, high levels of customer exits can seriously affect both the financial and the social performance of a bank.

Some exits are actually good riddance, while some can be painful. Next week, I will examine some basic self-audit topics that can give insights into how banks can avoid more painful customer exits. Banking is becoming a survival of the fittest but the fittest may not necessarily be from having the latest technology and clout. It comes in various ways, and mostly known by the customers!

TO BE CONTINUED

For more insights into banking, please book a copy of my new book, “THE MODERN BRANCH MANAGER’S COMPANION” which involves the adoption of a multi-disciplinary approach in the practice of today’s branch management. It also shares invaluable insights on the mindset needed to navigate and make a difference in the changing dynamics of the banking industry. Call 0244333051 for your doorstep delivery.

ABOUT THE AUTHOR

Alberta Quarcoopome is a Fellow of the Institute of Bankers, and CEO of ALKAN Business Consult Ltd. She is the Author of Three books: “The 21st Century Bank Teller: A Strategic Partner” and “My Front Desk Experience: A Young Banker’s Story” and “The Modern Branch Manager’s Companion”. She uses her experience and practical case studies, training young bankers in operational risk management, sales, customer service, banking operations and fraud.

CONTACT

Website www.alkanbiz.com

Email:alberta@alkanbiz.com or [email protected]

Tel: +233-0244333051/+233-0244611343