…earmarks GH¢790,000 for CSR

The Fiaseman Rural Bank Limited at Bogoso in the Prestea Huni-Valley district of the Western Region has posted growth in all financial indicators for the 2020 year under review.

Operational Performance

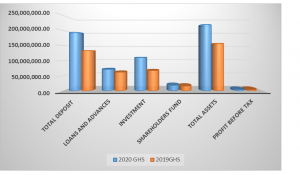

Despite the disrupted external business environment in the year under review, Fiaseman Rural Bank posted a pre- tax profit of a little over GH¢4.5million – an absolute growth of GH¢107,447.00 compared to the approximately GH¢4.4million recorded in 2019, representing a marginal growth of 2%.

The bank recorded total deposits of a little over GH¢193.6miilion, representing a percentage increase of 45.36% from approximately GH¢133.2million in 2019; with total assets of the bank hitting approximately GH¢219.7million compared to the previous year at about GH¢157million. The bank’s Total Assets increased absolutely by GH¢6.25million, which represented a percentage growth of 39.80%.

The board as well as management of the bank are confident about the year 2021 because other opportunities for sustainable growth are being explored and the team’s commitment to be innovative and distinguished in service delivery cannot be overemphasised; and the pandemic recovery is also expected to propel public confidence.

The Chairman of the Board of Directors, Lawyer Kojo Appiah-Annin, announced these and more at the bank’s 32nd Annual General Meeting held last Saturday at Bogoso.

Operational Environment

According to him, the bank operated in a very challenging macro-economic environment during the reviewed year.

Ghana’s economy in the year 2020 was not spared the adverse impacts from the COVID-19 pandemic experienced across the globe. The COVID-19 pandemic significantly curtailed the momentum of economic growth, with real GDP growth decelerating to 1.7% compared to the previous year’s growth of 6.5%.

The slow-down in economic activity due to the slump in oil prices and weakened global economic activity contributed to revenue shortfalls with high public debt, as government’s needed to finance unplanned COVID-19-related expenditure without adequate matching revenues.

The economy witnessed a steady decline in interest rates: the 91-day Treasury bill reduced by 14 basis points to 14.09% at the end of 2020. The Bank of Ghana reduced the Monetary Policy Rate from 16% in 2019 by 1.5% to 14.5%, which remained unchanged throughout the year.

Despite all the macro-economic and competitive challenges, coupled with adverse effects of the COVID-19 pandemic, the bank was able to put up a significant operational performance with all the performance indicators appreciating at an average of 21%, as shown in the chart.

Corporate Social Responsibility

The bank continues to support communities, individuals and institutions within its catchment areas. A total amount of GH¢85,763 was spent on donations and Corporate Social Responsibility in the areas of Agriculture, Education, Health, Security and Recreation. To deepen the bank’s commitment to societal responsibility, the board will appropriate GH¢790,899 of the profit for community support and development.

Future Outlook

The Board Chairman mentioned that the bank’s robust capacity to withstand sudden shocks from the COVID -19 pandemic and increased confidence of customers, coupled with strategic directions initiated by the Board and management, give firm assurance of great success in 2021.

He added that the comprehensive clean-up and recapitalisation reforms initiated by the Bank of Ghana have prepared and positioned the banking sector to weather the storm of COVID-19 pandemic, and increased public confidence in the industry.

According to him, with the introduction of vaccination and strict adherence of COVID-19 protocols, the Board and management have taken the measures needed to contain the situation in order to drive the bank’s strategic objectives.

“Our commitment to exceeding customer’s expectation through the introduction of tailored services and innovative products will be deepened to retain and increase the bank’s market share,” he stressed.

The Board has outlined some strategic plans to explore opportunities in other markets for branch expansion.

Some of the strategies include leveraging Agency Banking modules as means of market penetration; growing and increasing shareholders’ wealth by at least 40%; and growing and expanding beneficiaries of the bank’s cocoa programme by 30% over the previous year’s target.

Other strategies the bank wants to explore include to revive and grow the microfinance product by at least 30%; open the share register to the public to increase the shareholders’ funds; and then to embark on aggressive loan recoveries to promote a healthy advances portfolio.

Source: www.thebftonline.com