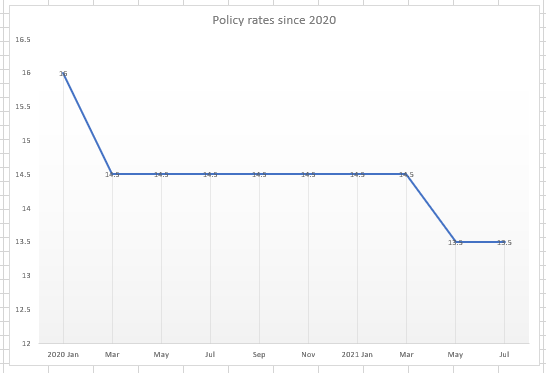

The Monetary Policy Committee (MPC) of the Bank of Ghana has, for the second time, maintained the policy rate at 13.5 percent, citing inflationary pressures, fiscal consolidation and debt concerns, and slow recovery of the economy as reasons.

Inflation in August inched up to 9.7 percent, taking it closer to the upper target band (10 percent) of the central bank, largely driven by food prices in the northern part of the country.

And despite rebound in activities in the services sector, the economy still recorded growth slower than the pre-pandemic levels, hitting 3.9 percent in the second quarter of the year. Again, fiscal consolidation and debt sustainability concerns continue to haunt the economy, as the public debt has further risen to 76.4 percent of GDP as of July.

These and other factors, the MPC noted, makes it necessary for further monitoring, hence, its decision to maintain the policy rate at 13.5 percent.

“The latest data suggests that fiscal consolidation efforts appear to be on track, but with some inherent risks associated with wage settlements and energy sector payments, amid low revenue mobilization. In addition, debt sustainability concerns remain, which warrants additional fiscal consolidation efforts, carefully balanced with sustainable growth strategies and efficient debt management strategies.

The expectation on fiscal policy implementation in the remaining months of the year will be shaped by revenue collection efforts and strict alignment of expenditures with revenue inflows to ensure attainment of the fiscal deficit target for the year.

Inflation has risen sharply over the last two readings, driven mainly by sustained food price increases. Although food inflation has pushed overall inflation close to the upper limit of the band, core inflation remains relatively subdued. In the view of the Committee, the increase in inflation is mainly due to food inflation which is expected to abate with the onset of the harvest season.

This notwithstanding, the latest forecast indicates that inflation will remain within the medium-term target band, but closer to the upper limit in the near-term, in the absence of further unexpected shocks. A close monitoring of the inflation situation is however warranted to respond swiftly to prevent potential second round effects on headline inflation from the rising food inflation.

The Committee stands ready to respond appropriately as needed if this particular risk materialises. Given these considerations, and the fairly balanced risks to inflation and growth in the outlook, the Committee decided to keep the policy rate at 13.5 percent,” the Committee stated.

The decision comes as no surprise though, as some analysts predicted ahead of the announcement that current economic conditions do not make it favourable for the rate to be cut.

Banking consultant Dr. Richmond Atuahene in an interview with the B&FT last week predicted the policy rate to remain unchanged given the weak fundamentals of the economy.

“For me, looking at the fundamentals – inflation is inching up; oil prices have gone up internationally; the cedi hasn’t been stable and competing treasury bills rate – I don’t think it will be conducive for Bank of Ghana to bring the policy rate down.

Especially with the global oil prices going up, inflation expectation will also go up. And Bank of Ghana will still want to keep inflation within the target band of 8±2, so I don’t think it will rush to reduce the rate. The probability for it to be maintained is very high,” he said.