For the continent’s trade to be successful and enable businesses of all sizes to fully participate, there is a need for the secretariat to integrate a modernised and digitised barter trade system within the agreement’s framework in order to make it possible for companies without huge financial resources to move goods across the continent.

The African Continental Trade Area (AfCFTA) is working on introducing a payment platform dubbed the Pan-African Payment and Settlement System, which is to ensure transactions are carried out smoothly. But considering the complexities surrounding export trade and the finances needed to undertake it, only companies with huge financial muscle will have opportunity to participate in trade deals and use the payment platform.

It is against this background that Chairman of Africa Bartercard Exchange (ABX), Roger Kubi, is advocating for a modernised barter system that has been tried and tested in developed markets – with huge success rates – to be integrated in the AfCFTA payment platform and allow both large and small businesses move goods across the continent without having to worry about funding.

“With Africa agreeing to trade within itself without any barriers, currency plays a role in how trading activities and payments will apply – hence the need for a Pan-African Payment and Settlement System. If Bartercard is integrated with the Pan-African Payment System, it will also give opportunities to traders who might not have the cash to transact and may need each other’s products or services.

“There are a lot of products and services to be traded in Africa if we revisit bartering with technology. Once you are on the Bartercard platform, you will be able to trade with customers without having to pay cash for goods and services you need; but rather make exchanges with what goods or services you have in both Africa and other parts of the world where Bartercard is present,” he said in an interview with the B&FT.

The Bartercard platform has seen impressive success over the years in countries such as New Zealand and Australia, accumulating over 32,000 cardholders from diverse industries and businesses all around. The company is currently considering establishing an office in Accra, in order to introduce the system to SMEs which are interested in the continental trade deal but cannot match up with the huge financial demand.

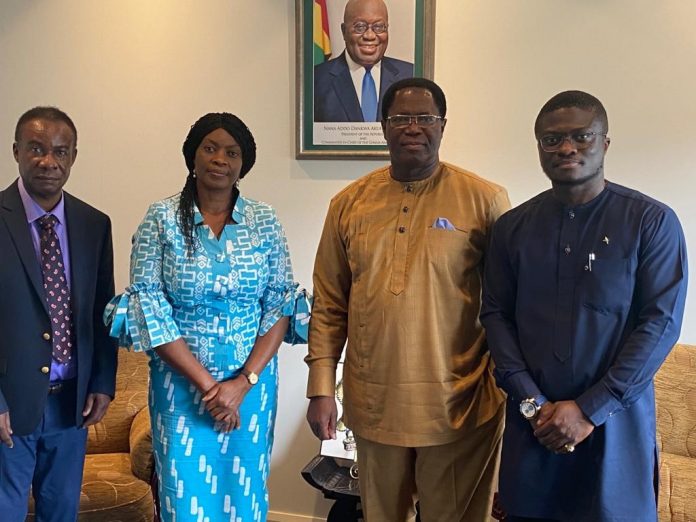

To start the process, Ghana’s High Commissioner to Australia, Dr. Joseph Agoe, has expressed keen interest in the move and promised to engage government to facilitate establishment of the company in the country, as it has the potential of becoming a game-changer on the continent through the free trade agreement. He took a tour of the offices at Bartercard in Gold Coast, Australia, to meet directors of the company and engage in deliberations about introducing the system into the country.

The talks centred on avenues of collaboration with the West African Business Community, using Ghana as the Gateway and taking advantage of the many opportunities which the AfCFTA presents.

During the meeting, Dr. Agoe said implementing Bartercard in Ghana and Africa will boost economic activity tremendously – adding that the system is in line with government’s digitisation agenda, and will contribute to job creation and employment in the country and the continent.

Bartercard has grown to operate the world’s largest trade exchange – achieving US$4.4billion in cash savings for businesses worldwide, equating to 21.9 million currency alternative transactions. The company’s extensive network of buyers and traders barter about US$600m every year. The platform assures safety, as every trader or business is individually and thoroughly investigated before being admitted to trade.